Funding Rates 101: A Comprehensive Guide on Funding Rate

A comprehensive guide on understanding funding rates in cryptocurrency. In this blog, we will explore funding rates, their mechanism, discuss the differences between positive and negative funding rates, and delve into the factors that influence them.

Introduction

Welcome to our comprehensive guide on understanding funding rates in cryptocurrency.

In the following sections, we will demystify funding rates, explore their mechanism, discuss the differences between positive and negative funding rates, and delve into the factors that influence them. We will also address frequently asked questions surrounding funding rates to provide you with a comprehensive understanding of this vital aspect of the crypto landscape.

For those new here, at GooseFX, we strive to provide our users with a seamless and all-encompassing DeFi experience. Our platform offers a wide range of unique decentralized peer-to-peer financial products, including a DEX powered by our Concentrated Liquidity Market Maker model (CLMM), a perpetual futures DEX based on a CLOB design, an NFT aggregator, single-sided liquidity pools & staking, and NestQuest, an on-chain NFT and platform tutorial.

So with all that out of the way, let's dive into this blog.

What are Funding rates?

Funding rates play a significant role in determining the costs associated with holding leveraged positions. Funding rates represent the periodic fees charged to traders in perpetual futures contracts.

Unlike traditional futures contracts, perpetual futures contracts do not have an expiry date, making them popular among cryptocurrency traders.

The funding rate mechanism involves a payment that occurs periodically between long (buy) and short (sell) traders. The payment aims to maintain balance and stability in the market by incentivizing traders to align their positions with the prevailing spot market prices.

The calculation of funding rates is based on the premium or discount of the perpetual futures contract price compared to the underlying spot price of the cryptocurrency.

We have covered the difference between Funding Rate and Predicted Funding Rate in the FAQ section

Funding rates serve as a crucial mechanism to prevent significant divergences between the perpetual futures and spot prices. The payment transfers between long and short traders help maintain market equilibrium and prevent the perpetual futures price from deviating too far from the underlying asset's actual value.

Several factors can influence funding rates in the crypto market, including market demand, liquidity, and the difference between long and short positions. We'll go each of these factors in a later section of the blog.

Understanding Funding Rate Mechanism

The prevailing market conditions and the position imbalances between long and short traders determine the funding rate. When the funding rate is positive, long traders pay a fee to short traders, while a negative funding rate means that short traders pay a fee to long traders. This payment mechanism ensures that the perpetual futures price remains aligned with the spot price.

The calculation of the funding rate typically includes two components: the premium index and the interest rate. The premium index reflects the gap between the perpetual futures contract price and the underlying spot price. If the perpetual futures price exceeds the spot price, the premium index is positive, and vice versa. The interest rate is added to the premium index to determine the overall funding rate.

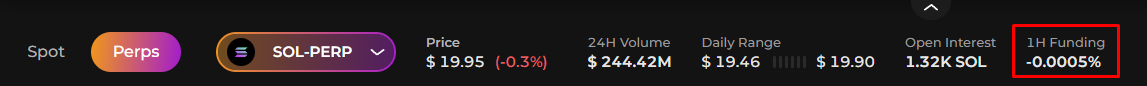

The funding rate is usually calculated periodically, with most exchanges using an eight-hour funding interval. However, it's important to note that different platforms may vary their calculation methods and funding intervals. Traders should consult the specific exchange's documentation or resources to understand the funding rate calculation process in detail.

By monitoring and understanding the funding rate mechanism, traders can gain insights into market sentiment and position imbalances. A high positive funding rate may indicate an overleveraged long market. They indicate a bullish sentiment in the market, as long traders are willing to pay a premium to maintain their positions.

Conversely, a high negative funding rate could suggest an overleveraged short market. They suggest a bearish sentiment, as short traders are willing to pay a premium to maintain their positions. It can attract more long traders looking to capitalize on the fee and potentially lead to an increase in long positions.

Factors Influencing Funding Rates

Various factors contributing to the equilibrium between long and short positions influence funding rates in the perpetual futures market. Understanding these factors is essential for traders to interpret funding rates accurately and make informed trading decisions. Let's explore the key factors that can influence funding rates.

Demand and Supply

The fundamental principle of supply and demand is crucial in funding rate fluctuations. When there is a higher demand for long positions than for short positions, the funding rate tends to become positive, incentivizing short traders to enter the market and restore balance. Conversely, if the demand for short positions surpasses that of long positions, the funding rate can turn negative, attracting long traders to rebalance the market.

Open Interest

Open interest, which represents the total number of active contracts in the market, can impact funding rates. A significant increase in open interest indicates growing market participation and can lead to higher funding rates. Conversely, a decline in open interest may result in lower funding rates as the market experiences reduced trading activity.

Market Volatility

Volatility is another crucial factor that can influence funding rates. During periods of high volatility, funding rates tend to increase as the risk and cost associated with maintaining positions rise. Conversely, funding rates may decrease in low-volatility environments as the market experiences relatively stable conditions.

Market Sentiment and Speculative Activity

Market sentiment and speculative activity can have a substantial impact on funding rates. When traders exhibit a bullish sentiment and engage in speculative buying, the demand for long positions may increase, leading to higher funding rates. Similarly, if market sentiment turns bearish and speculative selling intensifies, the demand for short positions can rise, resulting in higher negative funding rates.

Exchange-specific Factors

Different cryptocurrency exchanges may have mechanisms for calculating and adjusting funding rates. Factors such as exchange volume, liquidity, and trading fees can vary across platforms, potentially influencing funding rates differently. Traders should be aware of these exchange-specific factors and consider them when analyzing funding rates.

It is important to note that the specific influence of these factors on funding rates may vary over time and across different markets. Traders should continuously monitor and assess the interplay of these factors to gain insights into funding rate dynamics and adjust their strategies accordingly.

FAQ and Summary

Funding rates in the perpetual futures market can be complex, and traders often have questions regarding their meaning, implications, and determinants. Some frequently asked questions about funding rates are:

What is Funding Rate?

As explained, Funding rate is used in perpetual futures contracts to balance long and short positions. It represents the periodic fee exchanged between long and short traders. Positive funding rates imply that longs pay shorts, while negative funding rates mean shorts pay longs. The funding rate aims to incentivize traders to keep the perpetual futures price aligned with the underlying asset's spot price.

What Does a High Funding Rate Mean?

A high funding rate typically indicates an imbalance in the perpetual futures market, with a greater demand for longer than short positions (or vice versa). A sustained high funding rate can imply an overbought or oversold market condition, where the cost of holding a position in the prevailing direction becomes more expensive.

Traders should closely monitor high funding rates as they may influence market sentiment and trigger potential price adjustments.

What is the Funding Rate and Predicted Funding Rate?

The funding and predicted rates are closely related but serve different purposes. The funding rate is the actual rate charged periodically based on market conditions. On the other hand, the predicted funding rate is an estimated rate calculated before the funding timestamp. It gives traders an indication of the expected funding rate, helping them anticipate the potential cost of holding positions in the perpetual futures market.

To conclude, Funding rates are a critical aspect of perpetual futures trading that traders should understand to trade effectively.

You can also checkout another great article on Funding Rates and Open Interest written by twitter anon CryptoCred

Futures crash coursehttps://t.co/YuZ7C1Jqgc

— Cred (@CryptoCred) January 14, 2023

In this blog, we have explored the concept of funding rates, delved into their mechanism, and examined the differences between positive and negative rates. Traders must also recognize the factors that affect funding rates and the potential risks associated with funding rates and implement appropriate risk management strategies to safeguard their positions.

At GooseFX, we offer a comprehensive suite of decentralized financial products designed to empower traders in the crypto market. We strive to equip traders with the necessary tools and features to succeed in this dynamic market. Whether you want to leverage the benefits of funding rates, explore NFTs, or trade cryptocurrencies, GooseFX has you covered!

Embark on your trading journey with GooseFX today and unlock the potential of the perpetual futures market and Stay tuned to our blogs for more educational content and regular updates on the latest market trends.

Stay Tuned with #GooseAcademy

Website | Twitter | Telegram | Discord | Docs

Disclaimer: The statements, proposals, and details above are informational only, and subject to change. We are in early-stage development and may need to change dates, details, or the project as a whole based on the protocol, team, legal or regulatory needs, or due to developments of Solana/Serum. Nothing above should be construed as financial, legal, or investment advice.

Comments ()