GooseFX receives PYTH as Part of the Pyth Network Retrospective Airdrop to dApps 🔮

Learn how Pyth Network, one of the leading oracles on Solana powers GooseFX - Your Solana DeFi destination

Introduction

Recently we published a short thread talking about Pyth Network's Retrospective Airdrop program: Phase 2 and a brief overview into how we'll be utilizing it. This blog is about diving into the finer details of it and what GooseFX and Pyth Network have built together!

At GooseFX, we take pride in ourselves on becoming your @solana DeFi destination & this wouldn't be possible without being #PoweredByPyth!

— GooseFX (@GooseFX1) February 11, 2024

As early users of the @PythNetwork, we’re proud to receive $PYTH tokens as part of their Retrospective Airdrop Program - Phase 2!

🧵👇 pic.twitter.com/4P6zZCo9S0

So, without further ado, let's get started!

GooseFX - Your Solana DeFi destination

First and foremost, if you're new here, you might be wondering what GooseFX is. We are a premier Solana DeFi suite offering a Perps DEX as well as our revolutionary Single Sided Liquidity or SSL pools. Our primary goal is to streamline your DeFi journey by allowing you to trade as well as earn yield on your assets, all at one place.

Our Perps DEX isn't just another exchange. It's a CLOB or Central Limit Order Book based DEX with a sleek UI and offering 10x leverage with competitive fees.

Keen on learning about the difference between CLOB vs AMMs exchanges? Check out our blog

Not only this, but you can also earn MM rebates via our Market Maker program as well as by staking GOFX tokens allows you to earn a portion of the fees generated across our platform.

In response to community feedback, we've introduced Trader Profiles! Now you can conveniently monitor your deposits, funding, and trade history—all from a single dashboard.

TL;DR on why you should trade on our Perps DEX

- 10x leverage with competitive fees!

- Earn rebates via Market Maker program!

- Earn a portion of fees generated on our platform by staking GOFX!

- Sleek UI!

Coming to our innovative Single Sided Liquidity pools, it enables participation in liquidity pools using a single token. Unlike traditional liquidity pools that require users to manage a 50/50 split of assets, our solution simplifies the process. Hence the term "Single sided". On the back end, we have a revolutionary in-house AMM model which also balances the pools internally, eliminating the need for active position management.

If you want to learn more about Automated Market Makers or AMMs, check our blog out!

TL;DR on why you should deposit your assets in SSL Pools

- Only need to deposit a single asset to earn yield!

- High APY! Our pools provide concentrated liquidity allowing for a higher capital efficiency and thus higher APY!

- Our SSL Pools feature advanced risk controls and price oracles for fair trades and risk mitigation.

- We cater to diverse preferences by supporting various assets in SSL Pools, including stablecoins like $USDC and $USDT, blue chips like $SOL and $mSOL, along with volatile tokens like $BONK.

Our #GooseGang community seems pretty excited about our upcoming SSL pools updates!

— GooseFX (@GooseFX1) February 4, 2024

Haven't joined our discord yet?https://t.co/HCDUyGYmCO pic.twitter.com/Eo4b0dIUIG

GooseFX and Pyth - A croc story!

To power our DeFi suite, requires a fast and reliable oracle. This is where Pyth Network comes in!

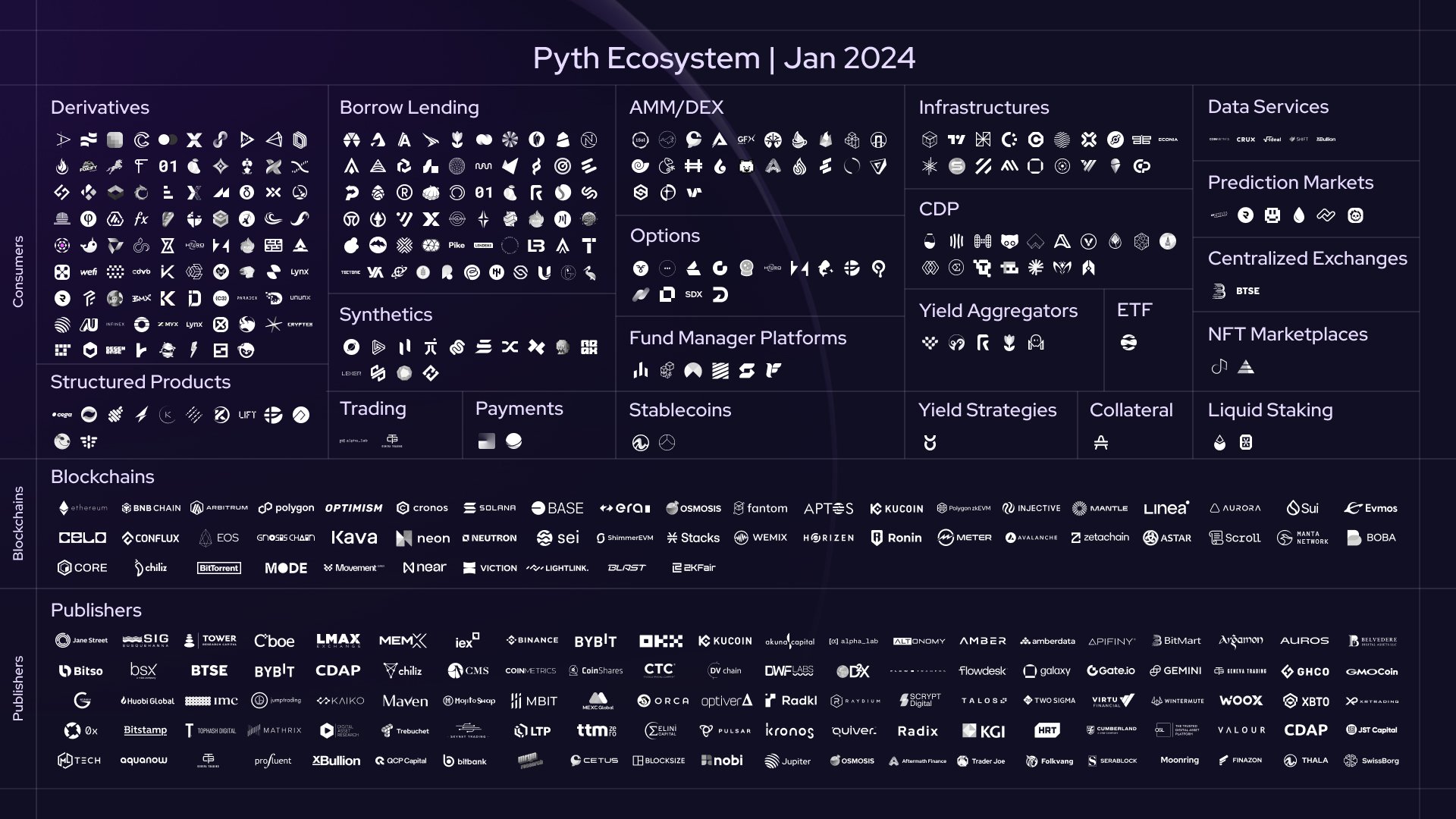

Pyth Network provides more than 450 price feeds to over 300 dApps across various chains! At GooseFX, we've carefully selected Pyth as our trusted provider for price feeds. It serves as the backbone for both our Perps Market Maker and our groundbreaking AMM model that drives our Single-Sided Liquidity pools. These price feeds are the lifeblood of our trading ecosystem, but you might be wondering, why PYTH?

- Latency and Frequency of Updates: Pyth offers lightning-fast updates with high frequency which is crucial for our AMM to be as effective as possible!

- Security Measures: Pyth prioritizes security with tight measures such as confidence intervals, providing added reliability and trustworthiness to the price data it delivers.

- Ease of Integration: Integrating Pyth into our platform was seamless and hassle-free, thanks to its user-friendly APIs and developer-friendly documentation.

- Competitive Platform Fees: Pyth's innovative Pull Oracle design enables us to enjoy competitive platform fees while maintaining the highest standards of accuracy and reliability.

- Wide Coverage of Assets: With Pyth, we have access to a vast array of assets, ensuring comprehensive coverage across various markets and instruments not only for our Perps DEX but also for our SSL Pools!

Token Allocation

At GooseFX, we view the PYTH as more than just a financial injection; it symbolizes a vote of confidence in our mission - To build a community centric DEX.

This allocation serves as a catalyst, pushing us forward on our journey to create a your ideal DeFi destination. With this support, we are empowered to accelerate the development of our DeFi suite, ensuring that our users have a seamless experience.

You can provide us feedback for our DEX and stand a chance to win $GOFX

The PYTH allocation enables us to actively engage in Pyth's governance, collaborating with other leading teams leveraging Pyth Network. But our ambitions don't stop there.

We're utilising the power of the PYTH allocation to realize our vision keeping our users as our primary focus. We aim to benefit our community members in various ways.

Stay tuned for further details!

Ending Thoughts

As we wrap up this blog, we'd like to thank you, our users for all the support you've shown. You've been with us through thick and thin and we can't wait to showcase what all we have in the store for you in future!

Till then, sit back, relax and help us build Solana's top DEX!

Intern out.

Stay Tuned with #GooseAcademy

Website | Twitter | Telegram | Discord | Docs

Disclaimer: The statements, proposals, and details above are informational only, and subject to change. We are in early-stage development and may need to change dates, details, or the project as a whole based on the protocol, team, legal or regulatory needs, or due to developments of Solana/Serum. Nothing above should be construed as financial, legal, or investment advice.

Comments ()