What is Kamino Finance $KMNO

Discover Kamino Finance's suite of DeFi products, including lending/borrowing, automated liquidity vaults and more. Also, Understand how the $KMNO token is shaping up to power this ecosystem of products!

Introduction

Recently, the $KMNO token claim and launch happened which was a pretty big event that a major portion of Solana ecosystem was waiting for!

GMino Solana!

— GooseFX (@GooseFX1) April 30, 2024

As $KMNO Genesis claims approach, here's a swift thread from Intern to keep you prepped up and steer clear of any last-minute hiccups!

🧵 pic.twitter.com/DgSr870gmK

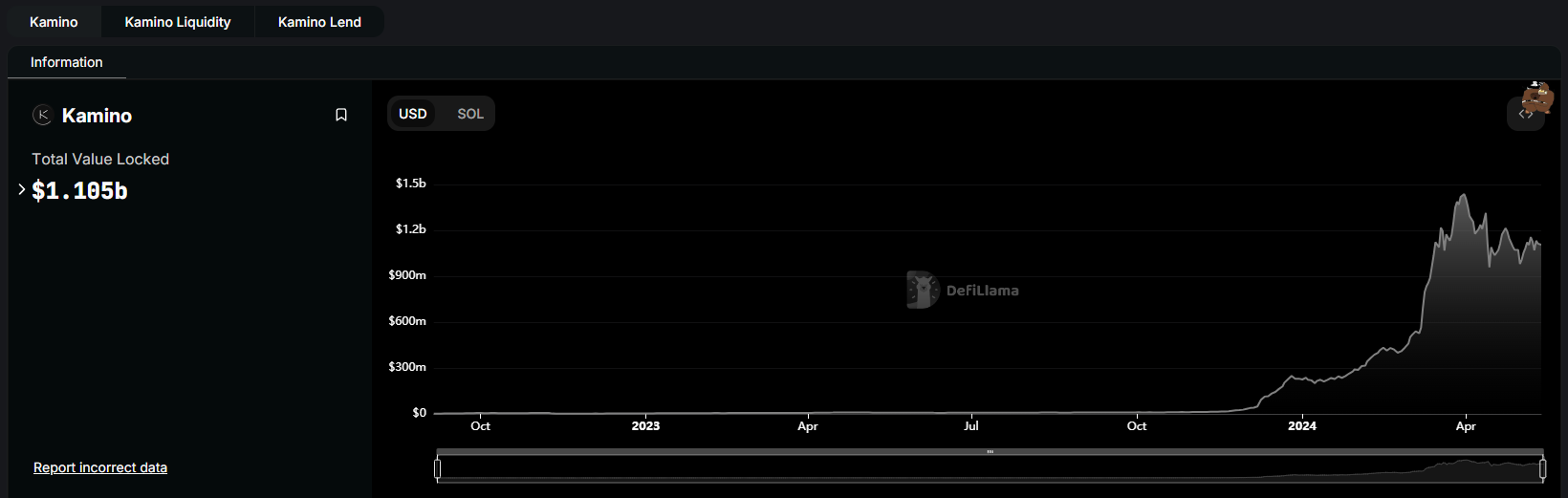

If you are living under a rock, Kamino Finance is a DeFi suite like GooseFX providing various offerings from lending/borrowing to yield farming opportunities. They've grinded throughout the bear market and have rightfully amassed over $1 Billion in TVL.

Well, in this blog, we'll be taking a closer look into their offerings, their recently launched points system and the $KMNO token and what lies ahead for you Kamino users.

So, without any further ado, let's begin!

Kamino Finance

Kamino Finance started off as a yield farming aggregator with the goal of providing the easiest way for users to farm yield on Solana. It then introduced it's one-click automate your LP positions which was a huge push for CLMM pools like Orca and Raydium and quickly became one of the most popular products in Solana DeFi.

Now, it has turned into a DeFi suite offering 4 major products which we'll be taking a look at in this section.

Lending/Borrowing

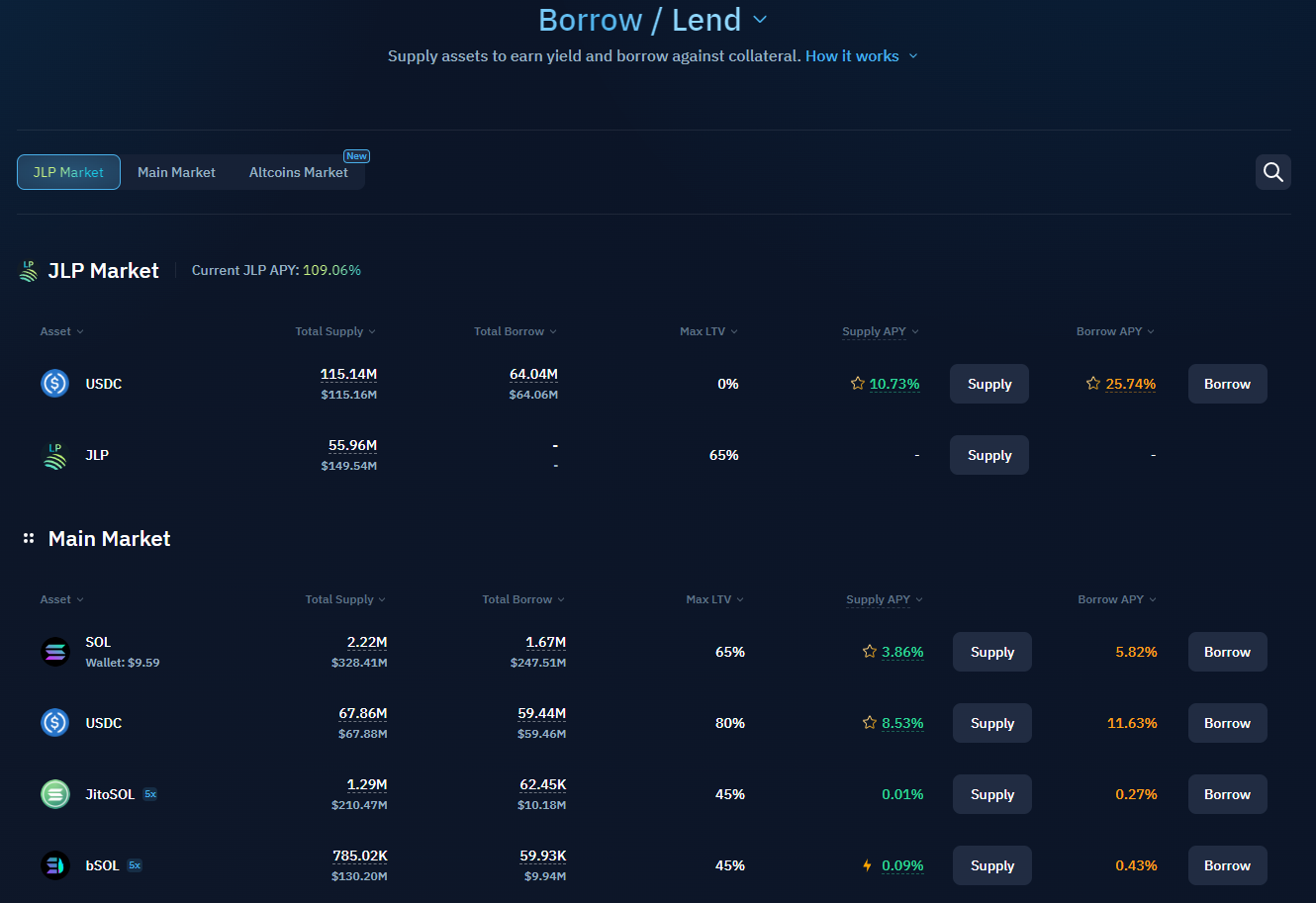

Moving into the new segment of lending/borrowing, Kamino Finance quickly became one of the top avenues across Solana amidst the top dApps like Solend, MarginFi etc.

With over, $940 Million in TVL across its lending and borrowing platform, Kamino Lend became the showstopper and it did for the right reasons. It currently at the time of writing provides one of the highest APYs for stablecoin lenders on Solana as well as offers unique benefits over the other lending platforms.

Kamino lending is based on two primary features. First is the K-Lend system. The K-Lend system is utilised not just as a standalone but also in Kamino's other offerings like Multiply Vaults and Long/Short. The K-Lend system boasts a very complex risk engine designed to protect the users' assets and its interests and ensure a silky smooth DeFi experience.

Second are its Automated Liquidity Vaults. These vaults, which were introduced by Kamino in August 2022 and helped Kamino to come to light are another unique feature of the lending platform. Why, you might ask? Well, Kamino Lend is the first lending protocol that can take CLMM LP positions as collateral.

Think of it this way, let's say a user Y2Dappa which is definitely a made up name deposits liquidity into the jitoSOL-SOL vault. Doing so, will give him kjitoSOL-SOL kToken. Now, what Y2Dappa can do is use these kTokens as collateral and borrow from a wide variety of assets during times of need. This helps keep his vault holdings liquid while still earning him yield on that making it all the more powerful.

Apart from these 2 major features, Kamino Lend also hosts other unique features like Poly-linear Interest curve dictating the rates based on how well the asset is being utilized, auto-deleveraging, real-time simulators and much more!

For more info on all of these features, check out the Kamino Lend litepaper

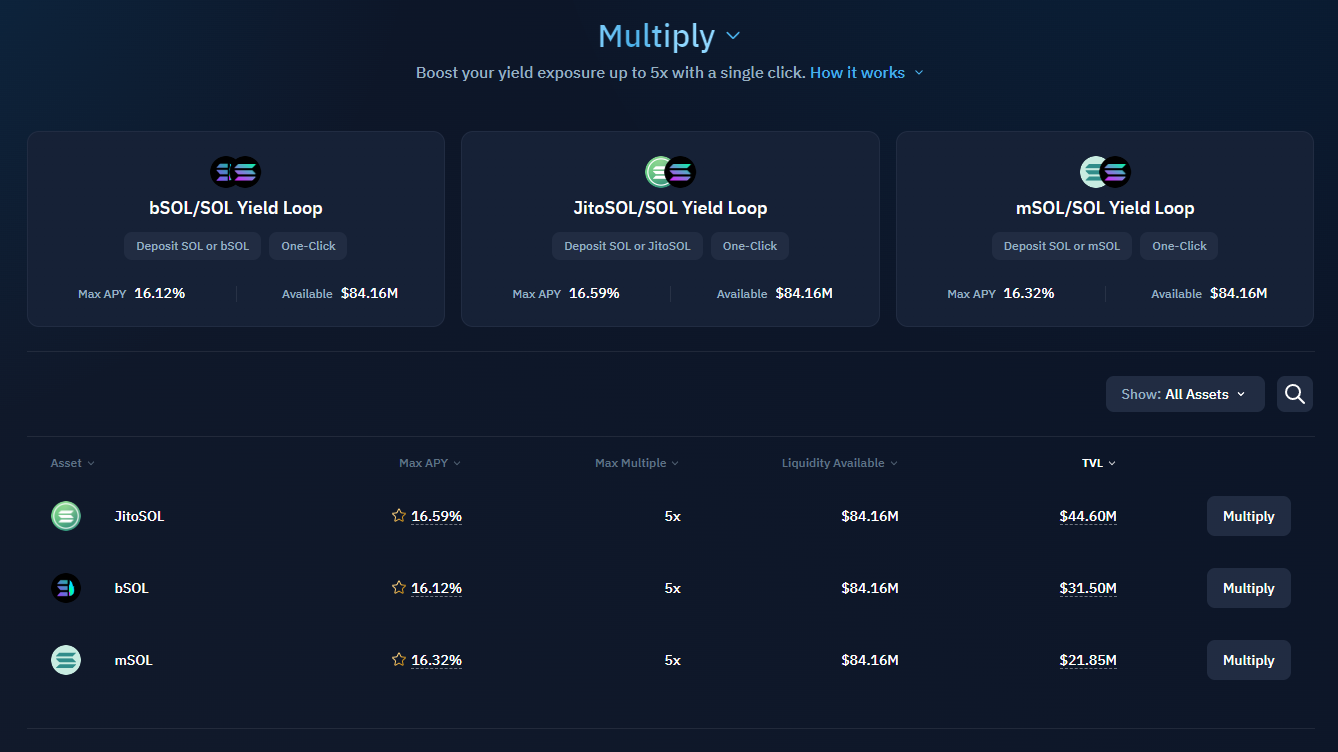

Multiply Vaults

Utilising the K-Lend mechanism, up next are the Multiply Vaults by Kamino Finance. These are one-click vaults allowing you to leverage your exposure to yield-bearing assets while minimising the risks involved. Underlying these vaults are two primary features of the K-Lend mechanism and those are, eMode and Flash loans.

eMode which stands for Elevation Mode is a K-Lend feature enabling increased loan-to-value ratios aka higher leverage for assets pegged in price such as LSTs.

How does it work? Let's assume you're using the mSOL/SOL yield loop. So first, pick your leverage and deposit your SOL or mSOL. Then, Kamino swaps those tokens into mSOL and uses a flash loan to borrow more SOL. After that, the borrowed SOL is swapped for more mSOL, which is added to K-Lend. Finally, the borrowed SOL is repaid, and your new position starts earning rewards. This leads to higher and better yield than your normal lending APY due to the leveraged nature.

The risks however attached to it are pretty simple and you can get liquidated if the borrow rates either exceed staking rates or if of course the LSTs get exploited i.e a smart contract risk.

Long/Short

Utilising the same two primary mechanisms as Multiply vaults are the Long/Short vaults. The only difference lies in the fact that in Long/Short vaults, your deposits get borrowed for USDC rather than any LSTs like mSOL.

So, in these vaults, you first choose your leverage and deposit your token (e.g., SOL). Then, Kamino deposits it into K-Lend and borrows leverage tokens like USDC using a flash loan. After that, the borrowed tokens are swapped for more SOL, which is added to K-Lend. Finally, the borrowed tokens are repaid, and your position provides exposure at the chosen leverage.

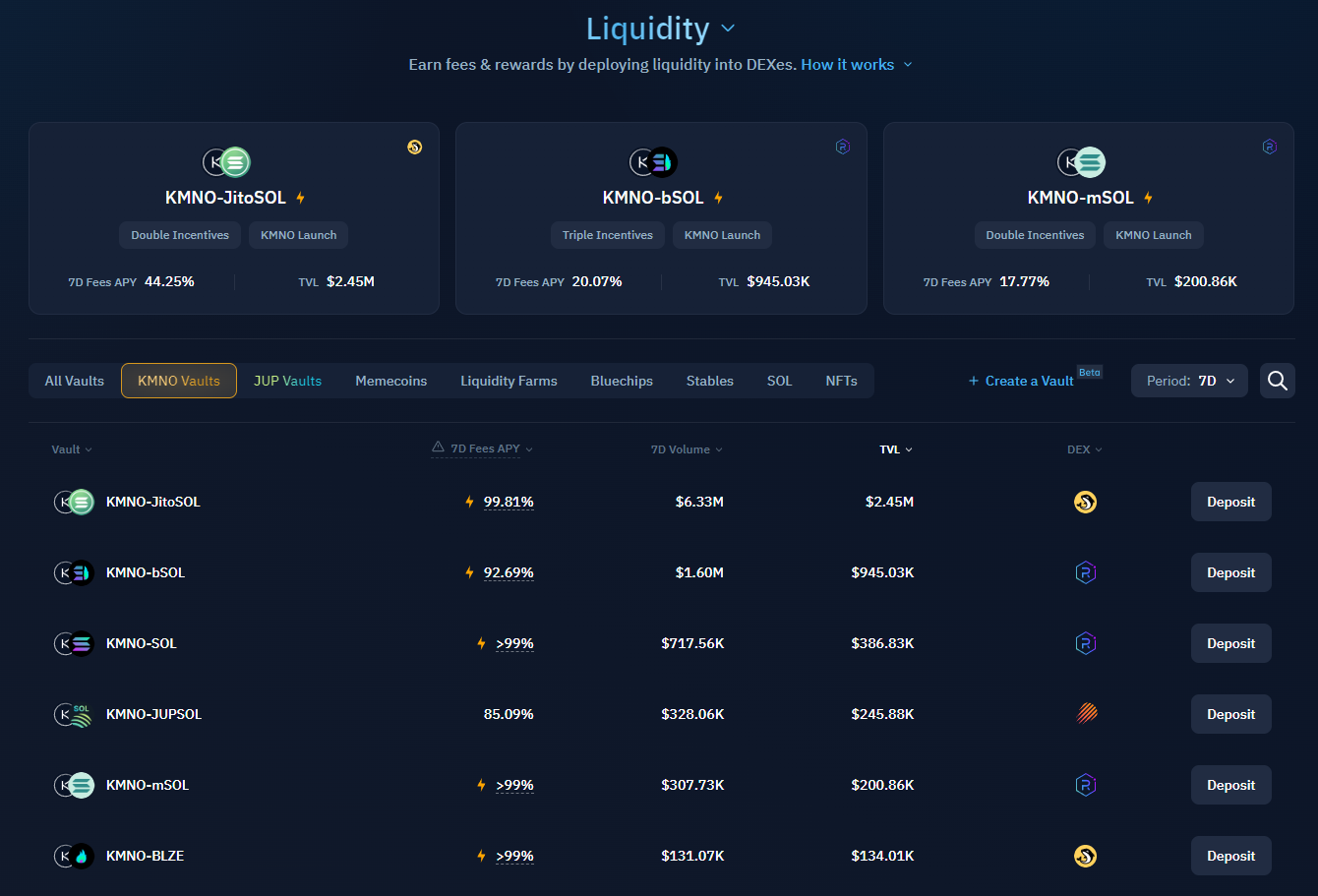

Liquidity Vaults

Finally, we have sort of the showstopper product of Kamino; their Liquidity Vaults and these vaults play a vital part in the underlying mechanisms of their other offerings. Let's understand why they are an integral part to the Solana DeFi ecosystem.

First, to understand these vaults, let's take a step back and understand a few things. If you've followed our World of DeFi series, you would know what AMMs are but for a brief understanding, AMMs or Automated Market Makers are the mechanism that run a DEX allowing for automated trading and liquidity provision.

We first saw these AMMs with Uniswap and Balancer with their Constant Product Market Makers or CPMMs based DEXs and then Uniswap in their v3 model came up with CLMMs or Concentrated Liquidity Market Makers.

Now, these CLMMs were an improved version of the previous models as it allowed for user to set a price range in which they would like to provide liquidity. However, with such settings, it obviously required a user to be active in changing the price range if needed and thus would be a bothersome task for most and here came Kamino Finance, to the rescue.

Kamino Finance's liquidity vaults have three core components; Auto- compound, Auto-rebalance and Auto-swapping. Auto-compounding as the name suggests isn't anything unique to Kamino's vaults and basically implies that your rewards are added into your LP position making your initial position bigger and thus the rewards, bigger.

Auto-rebalancing is the vital part which helps users with having to actively manage a CLMM position. Now, if you're rebalancing the price range that would imply that you're withdrawing your liquidity and then deposit it in a newly defined price range thus leading to you realising impermanent losses as well as any slippage loss due to swapping from one token to the other in that pair to keep a 50/50 ratio.

Thus to maximise the efficiency and minimise any losses due to IL or even slippage, Kamino identifies a few reference price points and maximum slippage thresholds and thus rebalances accordingly. The strategies can be divided into four subtypes depending upon the type of tokens in that specific LP

- Stablecoin strategies: These don't need much tweaking and should stay pretty steady. Example: USDC-USDT pool

- SOL-only strategies: These can drift a bit, especially when dealing with liquid staking SOL tokens. They might need a tune-up every now and then. Example: SOL-mSOL pool, SOL-jitoSOL pool etc.

- Mixed strategies with volatile assets: These can wander off track and need some adjustments to stay in the sweet spot. But watch out for potential losses during wild price swings. Example: SOL-BONK pool, SOL-KMNO pool etc.

- Mixed strategies with stable-coin tokens: Keep an eye on these to keep them in their optimal zones, similar to volatile-to-volatile setups. They might also see losses if the non-pegged asset's price bounces around. Adjustments are made to handle the ups and downs, but they'll rebalance if things get too crazy for too long. Example: SOL-USDC pool

Finally, we have the Auto-Swapping part. Auto-swapping is an interesting feature and what it does is it allows users to deposit only 1 asset as opposed to dual assets required in LPs and then swaps that into a 50/50 ratio for the specific pool in which the user is depositing. This feature can also be utilised while withdrawing from the LP and Kamino uses Jupiter to swap so you already know that you'll get the best swaps for all your tokens.

Check out their documentation on Auto-swapping for more info

$KMNO token and Points Season 1

$KMNO

— Kamino (@KaminoFinance) March 7, 2024

Kamino Points Season 1 snapshot will be taken on March 31st, and will culminate in the Genesis Distribution of $KMNO in April$KMNO Genesis is an important step in establishing the decentralized governance of Kamino Finance🧵 pic.twitter.com/m14UJLmihb

Kamino went live with their Points Season 1 as the pre-cursor to their $KMNO token launch in April. You could earn points by simply utilising their platform whether that's for lending/borrowing purposes or earning yield on your assets; the choice was yours.

Kamino Finance took a snapshot of the points on March 31st and planned to allocate tokens based on a linear system. In simple terms, if you had, say, 10% of the total points, you'd get 10% of the tokens allocated for initial community distribution. Easy-peasy, right!

Want to trade $KMNO? Head over to Birdeye now!

Here's a quick breakdown of the other details regarding the $KMNO token launch that you may not know 👇

- Ticker: $KMNO

- Total Supply: 10,000,000,000

- Estimated Day 1 Circulating Supply: 10%

- Initial Community Distribution: 7%

- Token Generation Event: April

The $KMNO holders will have a say in governing different aspects of Kamino. Over time, as the protocol moves towards full decentralisation, the range of governance responsibilities will expand.

For all $KMNO token related info, visit their docs.

Kamino Points Season 2

Kamino Finance launched their Points season 2 last month.

Season 2 of Kamino Points is now live

— Kamino (@KaminoFinance) March 26, 2024

More products, more boosts, and more rewards - Season 2 can become even bigger than Season 1

Season 2 will run for 90 days following the $KMNO launch

View the Points Hub: https://t.co/0xPz9DxtIx pic.twitter.com/G7hKpU8tzN

Some tweaks compared to previous season, in this season, all users who participated in their Season 1 would get a loyalty boost depending upon the duration of usage in Season 1. Not only that but also you can stake $KMNO or deposit into a few $KMNO LP pools as well to gain further points!

The main motives according to the team for Season 2 are:

- Increase usage across the Kamino product suite, including upcoming products. 👀

- Provide rewards for $KMNO holders.

- and finally, recognize and reward users who have been consistently using the protocol over time.

If you haven't participated till now, go ahead and join the Kamino Points Season 2

Ending Thoughts

With that, we've finally come to the end of the blog. What Kamino is doing is pretty amazing especially their automated liquidity vaults and it definitely shows in their TVL growth and it is a pleasure pushing the Solana DeFi ecosystem forward alongside these chads!

Like Kamino Finance, we also have our single sided liquidity pools which are a bit more complex and you should definitely check out!

Well, for them the future looks very bright. As they've mentioned they have a few more products in their suite that they'll be launching soon and the Intern is excited to see what they bring!

Till the time they do that, how about you give our blogs covering AMMs in crypto a read 👀

I hope you enjoy your day!

-Intern out

Stay Tuned with #GooseAcademy

Website | Twitter | Telegram | Discord | Docs

Disclaimer: The statements, proposals, and details above are informational only, and subject to change. We are in early-stage development and may need to change dates, details, or the project as a whole based on the protocol, team, legal or regulatory needs, or due to developments of Solana/Serum. Nothing above should be construed as financial, legal, or investment advice.

Comments ()