What are Oracles in crypto?

Uncover the power of crypto's unsung heroes—Oracles! Understand how oracles bridge blockchain with the real world for smooth transactions and live price feeds.

Introduction

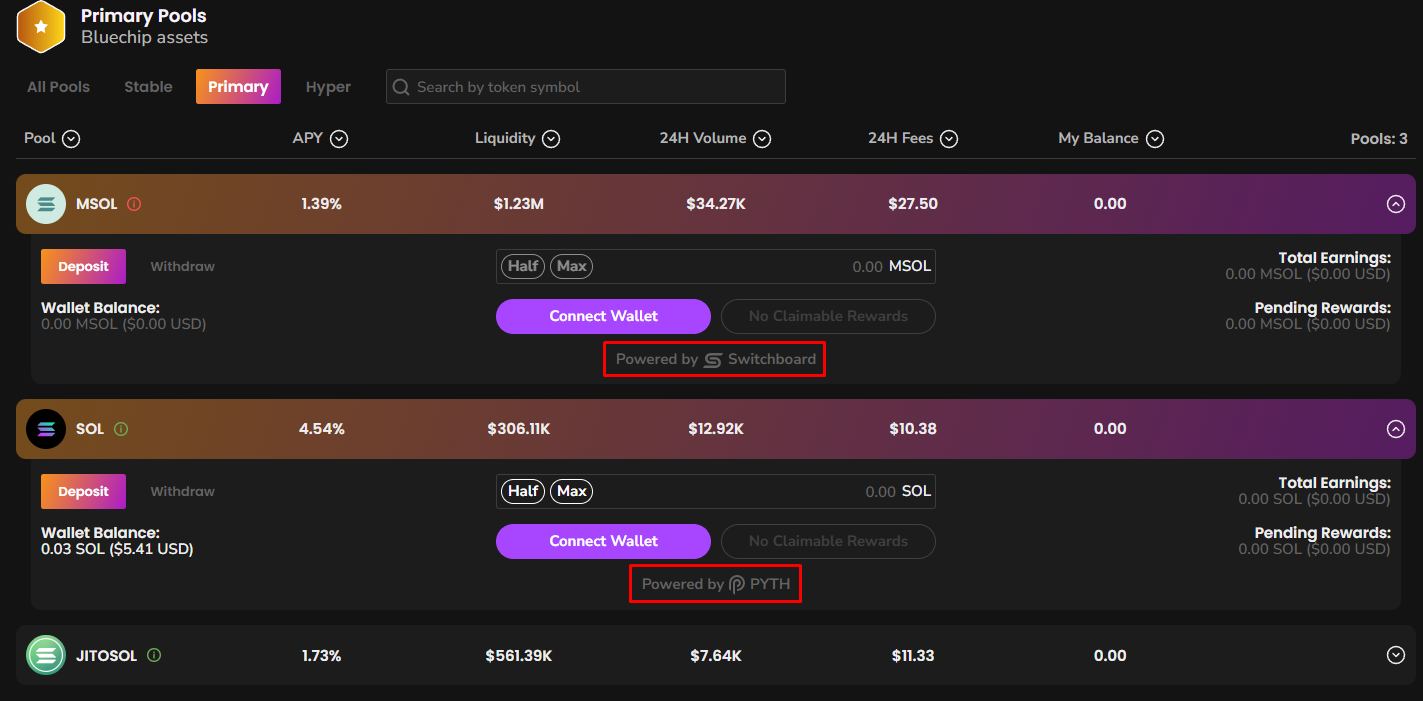

Imagine this. You go to your favorite DeFi destination - GooseFX. You deposit some asset into their SSL Pools, however when you open them, you see something like Powered by [X] and you stand there wondering what does that mean?

Well, those are Oracles. It won't be an exaggeration to say that they are one of the most vital component of any dApp. Simply think of them as protocols that relay the data to any protocol. In this case, since a novel AMM model powers the SSL pools, you need fast and reliable price feeds to ensure your model is quoting best prices and generating revenue for the LPs. This price feed is what we get from Pyth Network and Switchboard.

Why are they important?

Why are oracles so important in crypto, you ask? On its own, blockchains like Solana are more of a closed-loop systems that can't interact with the outside world. You can think of Oracles as the bridge between the crypto world and the real world out there. They unlock a whole bunch of cool possibilities for blockchain tech. With oracles, smart contracts can handle real-world transactions automatically, no human intervention needed.

Sure, you've probably heard of oracles mainly in the context of price feeds on decentralized exchanges like GooseFX. But trust the Intern, they have a lot more tricks up their sleeves that developers are only starting to explore. If you want to get let's say the price of apples you would require an Oracle that gets this data for you and then relays that data to you.

Oracles on Solana

First up on this list is Pyth Network. Pyth is a pull-based oracle as opposed to majority push-based oracles. The difference in the two lies in how they get their data. Pull Oracles are those oracles where anyone can update the on-chain price without needing permission while for Push oracles, the oracle operator pushes the data feed on-chain.

Here's a basic understanding of how Pyth works:

- First up, you've got the publishers. They're the ones responsible for putting the pricing info out there into the Pyth system. Pyth's got a bunch of these publishers for each product/data feed, which helps keep things super accurate and reliable.

- Then, Pyth's oracle program steps in. It takes all that data from the publishers, crunches it together, and spits out a single price along with a confidence interval. Think of it as a data aggregator.

- Last but not least, you've got the consumers. These are the folks who read the info generated by Pyth's oracle program. It's like having a reliable source for data right at your fingertips. Cool, right?

You can read all about how they do this in detail on Pyth Networks' documentation

Pyth Network also has it's own governance token called PYTH

Next up, we have Switchboard. Last year, Switchboard pushed their v3 utilizing something they call as TEE or Trusted Execution Environment. Most oracles typically use trusted nodes to gather and publish on-chain results. But this setup relies on most nodes playing fair, which means more fees and wait times for data sources. Plus, there's a big risk if something goes wrong with millions at stake.

Enter Switchboard v3! With its Trusted Execution Environments or TEEs, oracles become verifiable, offering speed, affordability, and most importantly, trustworthy compute services. In simple terms, when you ask the oracles to do something, they'll do it and prove it, all in a way that you can verify.

1/ Presenting Switchboard v3 — an oracle protocol using Trusted Execution Environments (TEEs).

— Switchboard 🔌 (@switchboardxyz) March 1, 2023

Read more here: pic.twitter.com/6VDaykyom9

Switchboard has also recently launched their points system known as Switchboard Orbs or Operation [X] and GooseFX is a proud partner protocol for this program. Simply, deposit your assets on our SSL Pools powered by Switchboard and start earning orbs right away!

Are you farming those @switchboardxyz Orbs anon or no?

— GooseFX (@GooseFX1) April 16, 2024

Simply, deposit asset into our SSL pools powered by @switchboardxyz and you're all set! 🔥https://t.co/TQcJedVVIy pic.twitter.com/NQxfYnYSet

Conclusion

To sum it up, oracles are those unsung heroes of crypto, bridging the gap between blockchain and the real world. Whether it's getting real-time price feeds to help build your Solana DeFi destination - GooseFX or enabling smart contracts to execute real-world transactions seamlessly, oracles play a crucial role.

Pyth Network and Switchboard are two powerhouses in this space, providing reliable and verifiable data feeds to drive decentralized finance. Both have their own pros with Pyth's pull-based oracle model allowing anyone to update on-chain prices, while Switchboard v3's Trusted Execution Environments or TEEs ensuring trust and efficiency in data computation.

So next time you interact with our SSL Pools powered by Pyth and Switchboard, remember, it's the oracles making it all happen behind the scenes.

Happy trading!

-Intern out

Stay Tuned with #GooseAcademy

Website | Twitter | Telegram | Discord | Docs

Disclaimer: The statements, proposals, and details above are informational only, and subject to change. We are in early-stage development and may need to change dates, details, or the project as a whole based on the protocol, team, legal or regulatory needs, or due to developments of Solana/Serum. Nothing above should be construed as financial, legal, or investment advice.

Comments ()