NFT Staking: How to earn yield on your NFTs

Learn how NFT staking on Solana is becoming a popular way to earn passive income in the NFT space. Discover the basics, benefits, and top staking platforms available on the Solana blockchain. Mitigate risks and maximize rewards with NFT staking.

Introduction

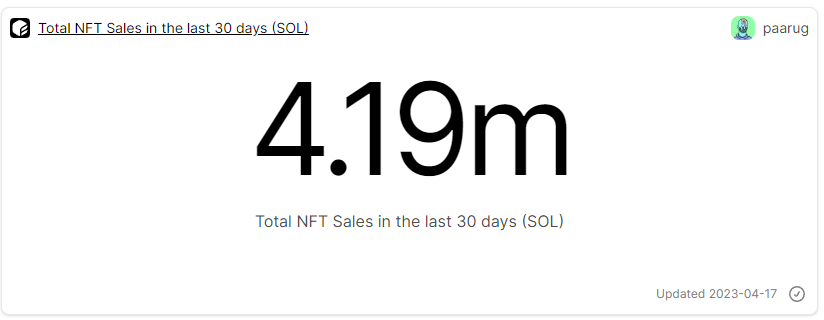

Solana has emerged as a top contender in the NFT market, with several high-profile projects such as Degenerate Ape Academy, DeGods, SMBs, and now MadLads launching. As of May 17, 2023, the past 30 Day Total NFT sales on Solana is over 4.19 Mil SOL (~equiv to 87 Mil USD), making it one of the fastest-growing NFT ecosystems. With such explosive growth, it's no wonder many investors and collectors are now focusing on Solana-based NFTs.

This blog post will delve into the world of NFT staking on Solana, exploring what it is, how it works, and why it's becoming an increasingly popular way to earn passive income in the NFT space. We'll cover the basics of Staking, the benefits of staking your NFTs, and some of the top staking platforms currently available on the Solana blockchain.

What is NFT Staking?

To start, let's understand what Staking means. Staking is when users lock their tokens in a smart contract to help secure the network and earn rewards.

You can learn about Staking in our blog here.

However, In the case of NFTs, users lock their NFTs to earn rewards in tokens or other NFTs. These rewards are distributed to stakers for their contribution to the network and can be earned as passive income.

NFT staking offers several benefits, including passive income and token rewards. By staking NFTs, investors can earn a steady income stream without actively trading or selling their NFTs. Additionally, stakers may receive token rewards that can be used to purchase other NFTs or sell for profit.

The amount of rewards earned through NFT staking depends on several factors, including the duration of the stake, the number of NFTs staked, and the overall demand for staking rewards. Some projects may offer additional benefits, such as early access to new NFT releases or exclusive content.

Risks Associated with NFT Staking

While NFT staking can sound like a nice opportunity to generate passive income, it's important to understand the potential risks involved. As with any investment, there's always the possibility of losing money.

- NFTs and the rewards received from staking them are also paid in cryptocurrencies. Both of them can be subject to volatility, just like any other asset. Thus their value can fluctuate based on market demand and other factors.

- Additionally, there is always the risk of hacking or technical issues that could compromise the security of your NFT staking. Choosing a reliable platform and taking the necessary steps to secure your assets is important.

To mitigate these risks, it's important to research and choose a reputable NFT collection and a rigid and secure platform for NFT staking.

Things to consider before staking your NFTs

Before staking your NFTs, there are several factors to consider.

- First, ensure that the NFT you want to stake is eligible for Staking. Not all NFTs can be staked, so do your research beforehand.

- Secondly, some NFT staking platforms have a lock-up period from days to years. Consider the length of the lock-up period before staking your NFTs.

- Third is the expected return on a staked NFT, the annualized percentage yield or APY. While some projects offer high APYs, be aware of their sustainability, as each protocol has a different way of calculating APY, and the rarity and price of the NFT can also impact the APY.

- Finally, Community participation is another consideration, as some NFT staking platforms distribute rewards in the form of native cryptocurrency tokens that can have additional utilities such as voting power on the platform.

Final Thoughts

In conclusion, NFT staking on Solana presents a compelling opportunity for investors and collectors looking to earn passive income from their NFT holdings. With the explosive growth of Solana-based NFTs and the increasing demand for staking rewards, it's no wonder that more and more people are turning to NFT staking to generate steady income streams.

However, as with any investment, there are risks associated with NFT staking, including volatility, potential hacking or technical issues, and the possibility of losing money. Doing your research and choosing a reputable platform for staking your NFTs to mitigate your risks is essential.

Factors to consider before staking your NFTs include eligibility, lock-up periods, APY, and community participation. By considering these factors and doing your due diligence, you can maximize your rewards while minimizing your risks and enjoy the benefits of NFT staking on the Solana blockchain.

Stay Tuned with #GooseAcademy

Website | Twitter | Telegram | Discord | Docs

Disclaimer: The statements, proposals, and details above are informational only, and subject to change. We are in early-stage development and may need to change dates, details, or the project as a whole based on the protocol, team, legal or regulatory needs, or due to developments of Solana/Serum. Nothing above should be construed as financial, legal, or investment advice.

Comments ()