Delta Neutral Maxi: Capitalizing NFTs and Perps to earn yield

Discover the powerful strategy of delta neutral trading with NFT lending/borrowing and perpetuals. Learn how to eliminate directional risk, while leveraging the value of NFT assets and earn efficient yields with this innovative approach.

Introduction

Welcome to our blog where we’ll be covering a strategy involving NFT lending/borrowing, and perpetuals on GooseFX. The vital aspect of this strategy is that it is delta neutral in nature which is a type of strategy where a user aims to eliminate the directional risk of their portfolio by balancing positive and negative deltas i.e. staying hedged, resulting in a position that is less sensitive to market or asset movements.

Understanding these innovative strategies can provide a significant advantage in your trading endeavors.

What are Delta Neutral strategies?

As discussed, Delta neutral strategies aim to eliminate the directional risk associated with holding positions in the underlying asset by carefully balancing long and short positions. By maintaining a delta-neutral position, traders can potentially profit from changes in other factors, such as volatility or time decay or in the case of Perpetual Futures, earn from funding rates.

One of the use cases of a delta neutral strategy is Arbitraging. Arbitrage opportunities arise when there are variations in prices or valuations of the same asset across different markets. Delta neutral strategies enable traders to take advantage of these discrepancies by simultaneously buying and selling related assets, profiting from the price differentials.

We recently covered an exciting arbitrage opportunity utilizing Funding Rates in one of our threads which you can check out here!

With that out of the way, let’s understand each part of this strategy.

Understanding NFT Lending and Borrowing

Before we even dive into the strategy itself, let’s understand what NFT lending and borrowing is and how it is actually helpful to you.

NFT lending and borrowing have emerged as innovative ways to capitalize the value of NFTs. NFT lending, similar to any other asset backed loan, involves the process of providing your NFT assets as collateral in exchange for a loan. The NFT is held in a smart contract, which ensures transparency, security, and automated execution of the lending agreement. Borrowers can access capital without selling their valuable NFTs, while lenders earn interest on their lent assets.

Smart contracts play a crucial role in NFT lending and borrowing. These self-executing contracts facilitate the borrowing process, including collateral lock-up, loan duration, interest rates, and repayment terms.

Engaging in NFT lending and borrowing offers several benefits. Firstly, it allows NFT holders to unlock liquidity from their assets without the need for immediate sales. By using their NFTs as collateral, holders can access capital for various purposes, such as investment opportunities or personal expenses, while retaining ownership of their prized assets.

Furthermore, participants in NFT lending and borrowing can earn interest on their lent assets. Lenders receive a return on their investment, creating a passive income stream in itself. This aspect attracts individuals who want to generate additional income by capitalizing the value of their NFT holdings.

However, it is essential to consider the potential risks associated with NFT lending and borrowing. Like any other activity, there are inherent risks involved, such as default on loan repayments or the devaluation of NFT collateral. Participants should carefully evaluate the risks and conduct due diligence on borrowers or lending platforms to mitigate potential losses.

Defaulting on loan repayments means failing to pay back the borrowed money as agreed while Devaluation of NFT collateral means that the NFT used as the asset for the loan has decreased in value, potentially causing complications in loan repayment or asset seizure.

Using Perpetual Futures via GooseFX

Perpetual futures contracts are derivative instruments that enable traders to speculate on the price movements of an underlying asset without an expiration date. Unlike traditional futures contracts that have set maturity dates, perpetuals can be held indefinitely, offering flexibility and continuous trading opportunities.

Refer to our blog here if you want to learn more about Perpetual Futures

For this strategy to work, we’ll also have to understand what Longing or Shorting an Asset is. Longing perpetuals refers to the act of buying perpetual futures contracts with the expectation of profiting from an increase in the underlying asset's price. Shorting perpetuals, on the other hand, involves selling or opening positions in perpetual futures contracts with the anticipation of making a profit from a decrease in the underlying asset's price.

Now that we know the basics of both parts of this strategy, let’s understand how the strategy works.

How does the strategy work?

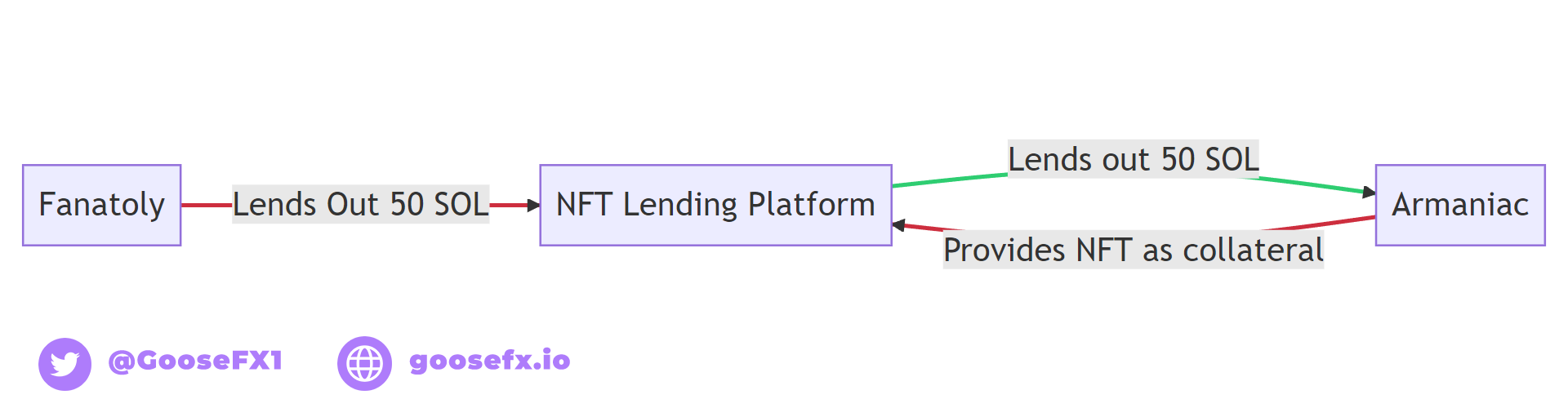

To begin, let us understand the two parties involved in an NFT Lending/Borrowing. The first party would be the Lender i.e. the one who provides SOL to the borrower. The second party is the Borrower who provides his NFT as the collateral and borrows SOL for a specific duration.

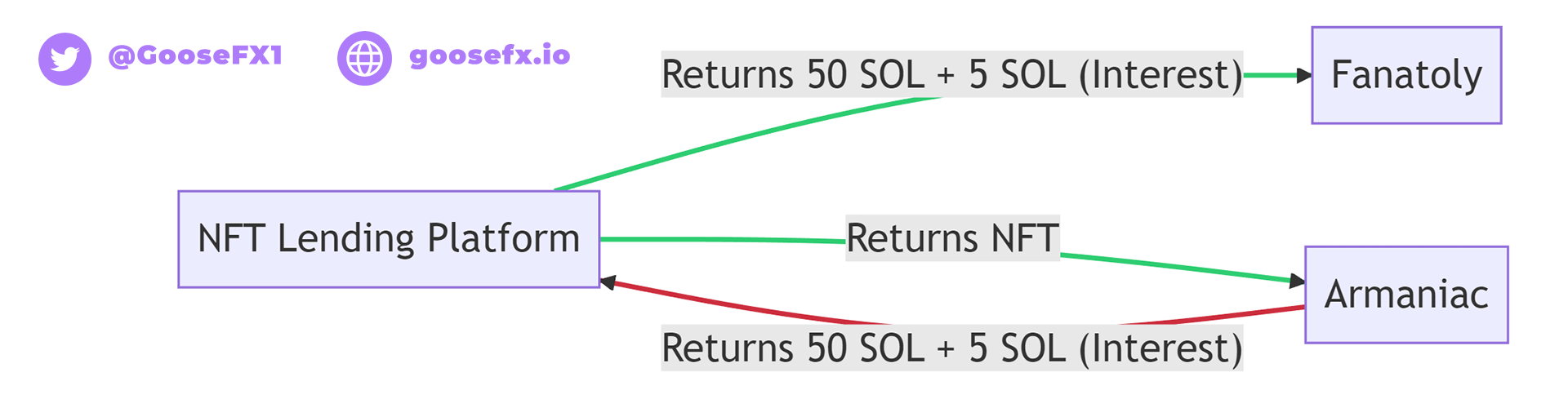

Upon maturity date i.e. when the loan duration ends, the Borrower will give back SOL + Interest on his position for his NFT.

First Party (Lender)

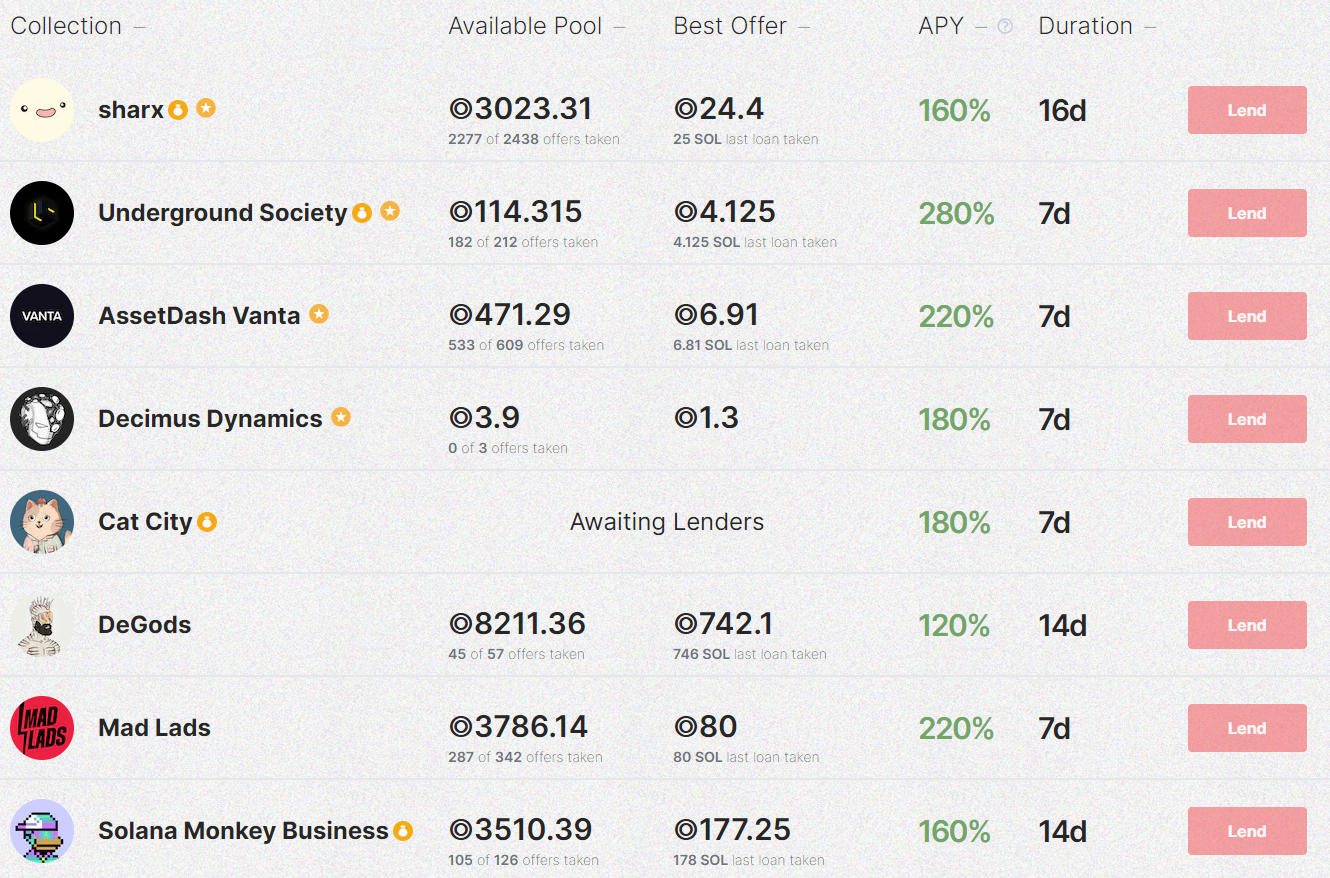

We’ll use an example to understand this strategy. Assume that a person named “Fanatoly” has 1500 USDC that he wishes to utilize to earn yield. He checks on SharkyFi , that another person whom we shall name for ease of explanation as “Armaniac” wants to borrow 50 SOL and the APY of this loan would be 120% and for a period of 30 Days.

Note: APY is yield calculated annually hence for 30 day period or 1 month, the user would get 120/12 = 10%

Upon seeing this, Fanatoly decides that he wants to lend out SOL to Armaniac and to do this, he has to convert his USDC to SOL. Assuming the SOL/USDC rate to be $20.00 , he would require 1000 USDC to get 50 SOL. Now, Fanatoly has lent out his 50 SOL to Armaniac. After 30 Days, he expects to get his 50 SOL back + 10% more SOL as interest payment i.e 55 SOL in total. However, markets are volatile and prices can fluctuate.

Let’s assume that for the worse, the SOL/USDC price goes down to $15.00. Hence if Fanatoly gets his 55 SOL and converts that to USDC, he would get only 825 USDC resulting in a net loss of 1000-825 = 175 USDC.

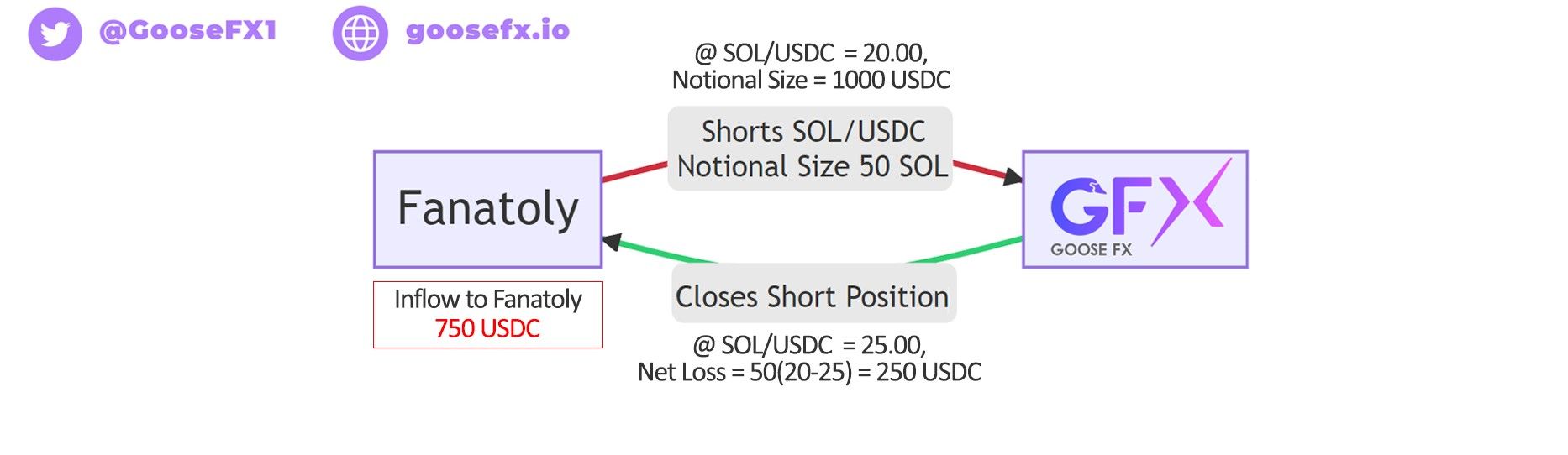

To hedge against the price fluctuations or volatility, he goes to GooseFX and uses his left over USDC to short SOL Perps at the same time as he lends and of the same notional size i.e 50 SOL such that Fanatoly stays risk averse irrespective of where the price is 30 Days from now.

Assume that the SOL/USDC price goes up to 25.00 USDC, Fanatoly would close his Short Position at a loss of 250 USDC (50*20-50*15), but the SOL that he has lent out will offset this loss once he converts that 50 SOL into USDC. This is irrespective of what price he converts the Interest Payment (i.e. 5 SOL payment) at. Hence, Fanatoly has saved himself from Volatility or Price Fluctuation Risk.

Second Party (Borrower)

Let’s take a look at this from a borrower i.e. Armaniac’s perspective now. Armaniac borrows 50 SOL so that he can convert that into USDC and stake it in a liquidity pool offering 50% APY.

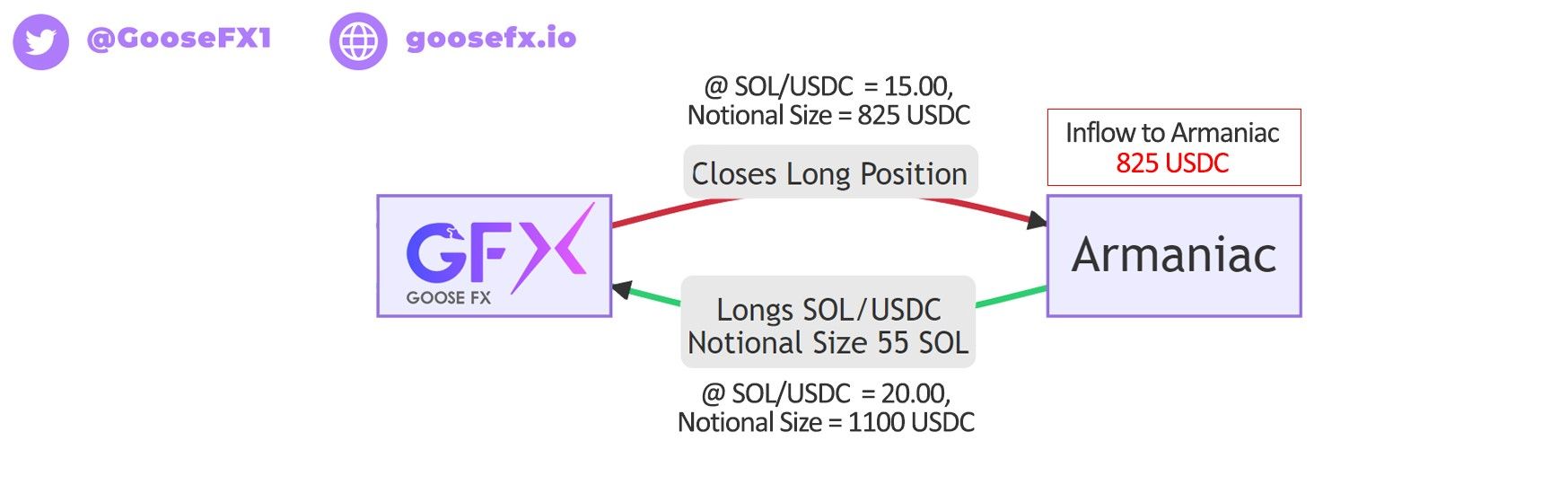

As he is borrowing 50 SOL and he has to pay 10% Interest on it, he would like to hedge his risk by Longing SOL Perps. This is because if price of SOL/USDC rises to 25.00 USDC , to pay the money back + 10% Interest i.e. 55 SOL (which was 55*20.00 USDC = 1100.00 USDC at the time of borrowing), suddenly now becomes 55*25.00 USDC = 1375 USDC resulting in a 275 USDC loss. Hence, to hedge against this, Armaniac would look to Long SOL perps on GooseFX of the same notional size i.e 55 SOL hence protecting himself in case the price goes up.

In case the SOL/USDC price goes down to 15.00 USDC , he would take out his 1100 USDC + his pool earnings and convert 825 USDC from it into SOL to get 55 SOL to be used to repay his loan hence making him 275 USDC through this process. However, this 275 USDC profit will be offsetted by his long position which will be closed at a loss of 275 (55*20 - 55*15) USDC. Thus his net profit is his pool earnings but Armaniac was able to protect himself from any further downside risk due to Volatility or Price Fluctuation i.e. Armaniac was Delta Neutral throughout this process.

Note: Do note that Funding Rate is applied to any perps position on a periodic basis which can increase or decrease your profits over this period.

If during the time Fanatoly is short, the Funding rate on SOL Perps is positive, he would earn more profits on top of the interest earned by lending whereas if Funding Rate is negative, Fanatoly would lose some of his profits earned via lending

The opposite is applied to Armaniac and he would make more profit if Funding Rate is negative throughout the 30 Day duration while he would lose some profits if Funding Rate is positive.

To know more about what Funding Rates are and how they work, check out our blog here.

Frequently Asked Questions (FAQs)

As we delve deeper into the world of NFT lending, borrowing, and perpetual futures, it's essential to address some frequently asked questions to provide a comprehensive understanding of these concepts.

What is NFT Lending and Borrowing?

NFT lending and borrowing involve utilizing non-fungible tokens (NFTs) as collateral for loans or earning interest by lending NFT assets to borrowers. This practice enables liquidity provision, collateralization, and speculative opportunities within the decentralized finance ecosystem.

How does NFT lending and borrowing work?

In NFT lending, individuals can lock their NFT assets in smart contracts and lend them to borrowers, who provide collateral or pay interest in return. Borrowers can access NFTs without owning them outright, benefiting from the assets' utility or potential appreciation. NFT borrowing allows individuals to borrow NFTs for various purposes, such as showcasing in virtual worlds, using them in gaming applications, or participating in curated events.

How do you calculate the interest earned by NFT lending/borrowing?

The interest earned through NFT lending or borrowing is determined by various factors, including the duration of the loan, the interest rate set by the lending platform, and the value and rarity of the NFT asset used as collateral. Typically, interest is calculated based on the loan amount and the agreed-upon interest rate, and it accrues over the loan's duration. Platforms may employ different interest calculation methods, so it's important to understand the specific terms and mechanisms used by the lending platform.

You can also check out the respective Lending Platform's Documentation for more information on this.

What are the mechanisms to consider when trading perpetual futures contracts?

When trading perpetual futures contracts, there are several important mechanisms to consider. These include funding rates, which are periodic payments exchanged between long and short positions to maintain the contract's price close to the underlying asset's spot price. Additionally, the use of leverage amplifies both potential profits and losses, requiring careful risk management. Traders should also be mindful of liquidation levels and mark prices, which determine the conditions under which positions are liquidated to avoid significant losses or defaults.

How can arbitrage opportunities be identified and exploited using perpetuals?

Arbitrage opportunities in the perpetual futures market can arise from price discrepancies between different exchanges or trading venues. Traders can identify potential arbitrage opportunities by monitoring prices across platforms, analyzing market depth, and using automated trading bots. By executing trades strategically, traders can exploit these discrepancies, aiming to profit from the price differentials and bringing equilibrium to the market.

Conclusion

In conclusion, this strategy involving NFT lending/borrowing and perpetual futures on GooseFX provides traders a powerful tool to balance their portfolios and mitigate directional risk. By engaging in NFT lending and borrowing, traders can capitalize the value of their NFT assets while earning Interest or accessing capital without selling their prized possessions. On the other hand, perpetual trading allows traders to speculate on the price movements of SOL and hedge their borrowing exposure.

It's important to note that funding rates and hourly fluctuations can impact profits in this strategy. Positive funding rates can increase profits for lenders, while negative rates can reduce profits. Traders should also consider leverage, liquidation levels, and mark prices when trading perpetual futures contracts.

By understanding the intricacies of NFT lending, borrowing, and perpetual trading, traders can seize opportunities, optimize their portfolios, and generate efficient yields.

Stay Tuned with #GooseAcademy

Website | Twitter | Telegram | Discord | Docs

Disclaimer: The statements, proposals, and details above are informational only, and subject to change. We are in early-stage development and may need to change dates, details, or the project as a whole based on the protocol, team, legal or regulatory needs, or due to developments of Solana/Serum. Nothing above should be construed as financial, legal, or investment advice.

Comments ()