Futures vs Options

Wondering what differentiates Futures from Options? Dive into this blog as we check these derivatives out and understand how they're different illustrated with an example of Odin Bonkson.

Introduction

In our previous blog, we took a look at Perpetual futures and understood what Futures actually are. In this blog, we'll be diving into not only what Futures are but how they are different from Options and some protocols that offer these across various chains.

So, without further ado, let's dive in!

Futures

As mentioned previously, Futures are derivative contracts built to facilitate a trade between two parties concerning an asset or security at a pre-determined price and date. They can either be settled in cash or in the native asset itself.

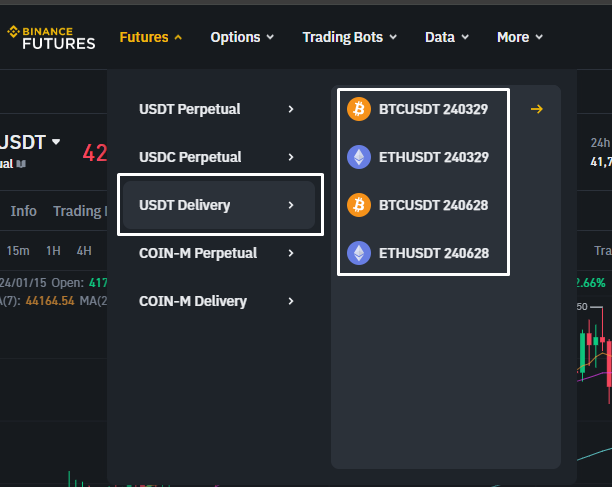

Such contracts can be found on most centralized exchanges. For example, Binance has two options depending on whether contracts are to be settled in cash or in native asset.

A common type of Future contract is called Perpetual Futures. Unlike normal future contract, these perpetual futures don't have any expiration date hence the term perpetual or never ending. Most exchanges offer Perpetual Futures or Perps for short such as SOL-Perp on GooseFX.

If you aren't trading perps with the lowest fees and fee rewards on GooseFX then why not?

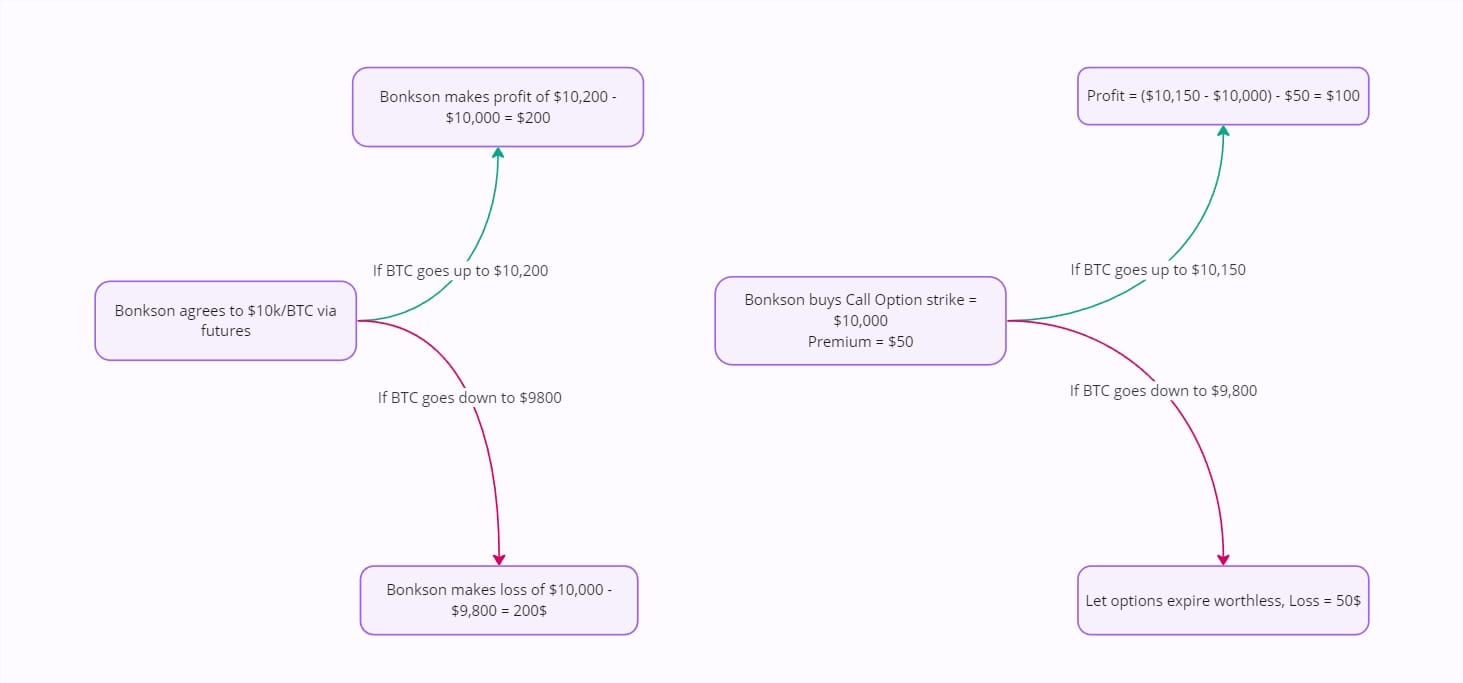

Let's understand this with a simple example based on a real life incident of Odin Bonkson. Odin Bonkson agreed to buy at a price of $10,000 via a BTC futures contract. If price moves in favor of Odin to $10,200 and stays there at the time of expiration, he would make $10,200 - 10,000 = $200 per BTC. On the other hand, Seller has to sell it at a worse price than current market price thus losing out on a better deal.

Options

Options on the other hand are derivative contracts that give the user right but not the obligation to buy or sell the underlying asset at a pre-determined price also known as Strike price and before its expiration or maturity date.

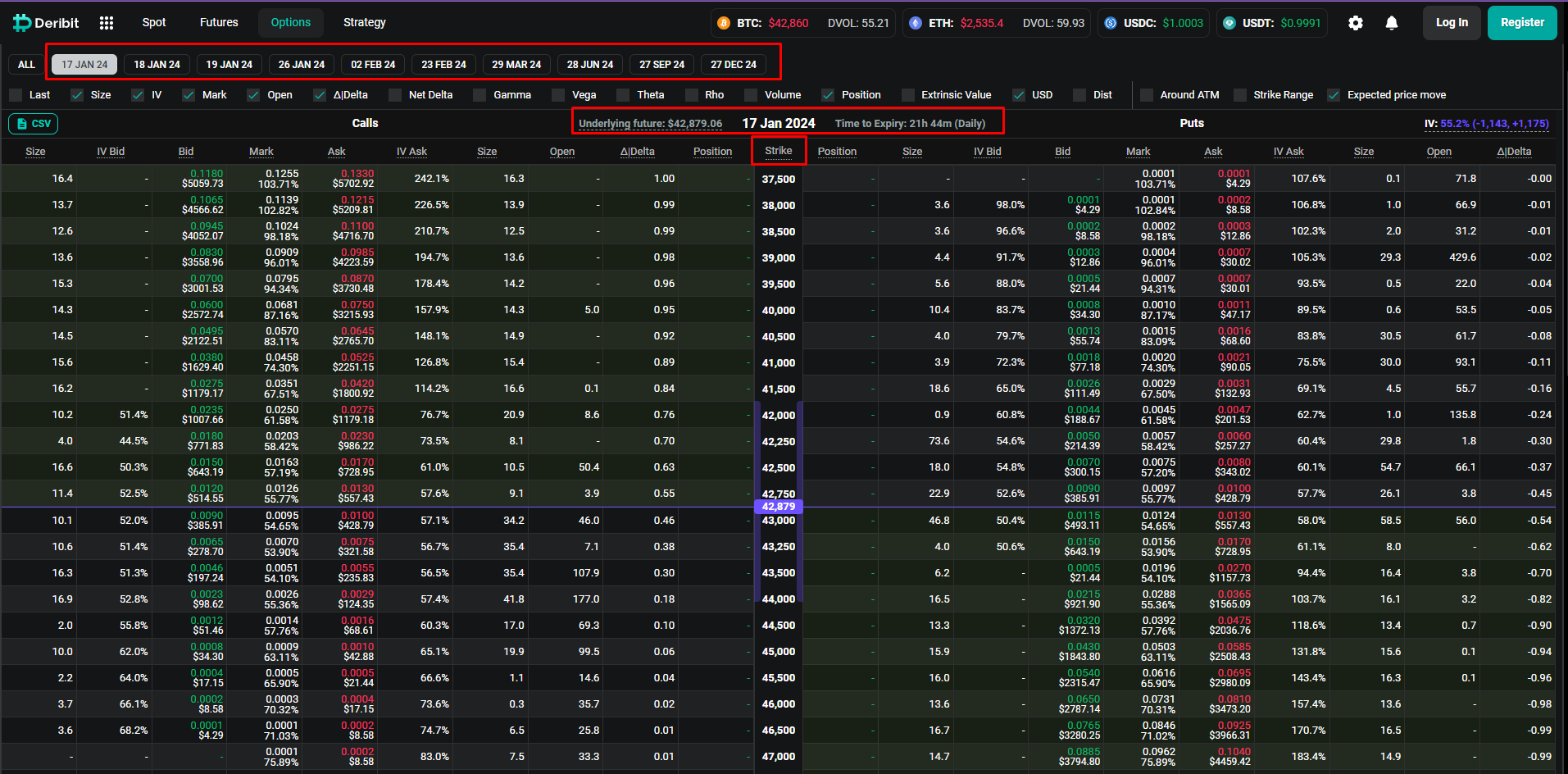

There are two types of Option contracts; namely Call and Put option. Call options allow users to buy the underlying asset at the strike price before maturity date meanwhile Put options allow users to sell the underlying asset at a particular strike price before maturity date expires. One of the biggest Options exchanges is Deribit

We also have two sub-types of Options known as American Options and European options however we won't be diving into those in this blog.

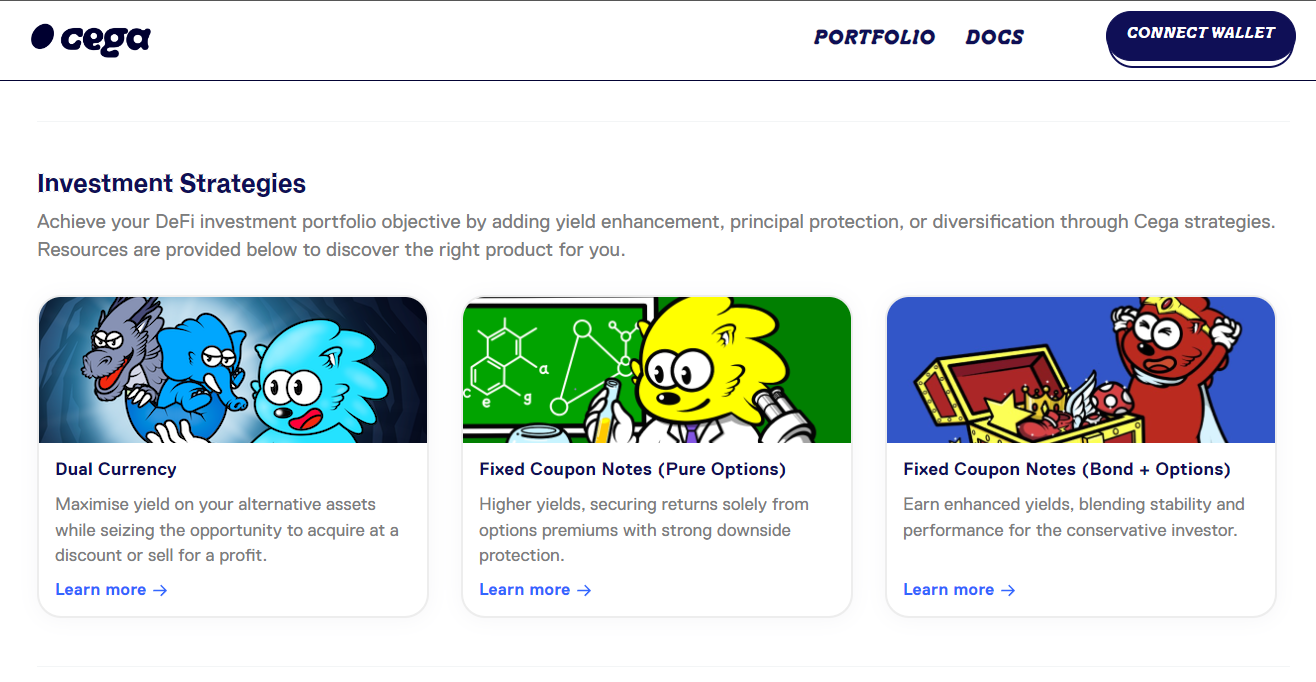

On Solana, you can trade Options on either SDX Market and PsyOptions. Other protocols that utilize Options to provide yield to users are Cega Finance and DualFinance.

Let's understand Options with a very simple example. Let's assume that BTC is currently trading at $10,000. Odin Bonkson buys a BTC call option at a strike price of $10,100 maturing in 3 months and pays a premium of $50. If BTC jumps to $10,200, Odin can excercise his call option and sell his BTC for $10,200 making him a net profit of $10,200-10,100-50 = $50. So he gained $50 by utilizing just $50.

Another possibility could be that BTC drops to $9,800. In that case, Odin can simply let these options expire worthless and thus he loses only $50 instead of losing $10,100+50-9800 = $350 had he excercised his option.

This showcases how Options have a limited downside which is the premium that you've paid to buy/sell those options.

Similarities b/w Futures and Options

There are two major similarities when it comes to Futures and Options.

First and foremost, both of them are Derivative contracts. Derivatives are special contracts that derive their value from an underlying asset. They provide a way to speculate on or hedge against price movements in these underlying assets.

Secondly, Futures and Options both allow users to leverage their positions i.e take up a large position with a relatively small amount of capital. While Futures more or less have a leverage option that you can set it at, the leverage in Options is dependent on the price you buy/sell that particular option contract relative to the price of the underlying asset.

Differences b/w Futures and Options

While these contracts have some similarities, they also have differences among them and in this section we'll take a look at those.

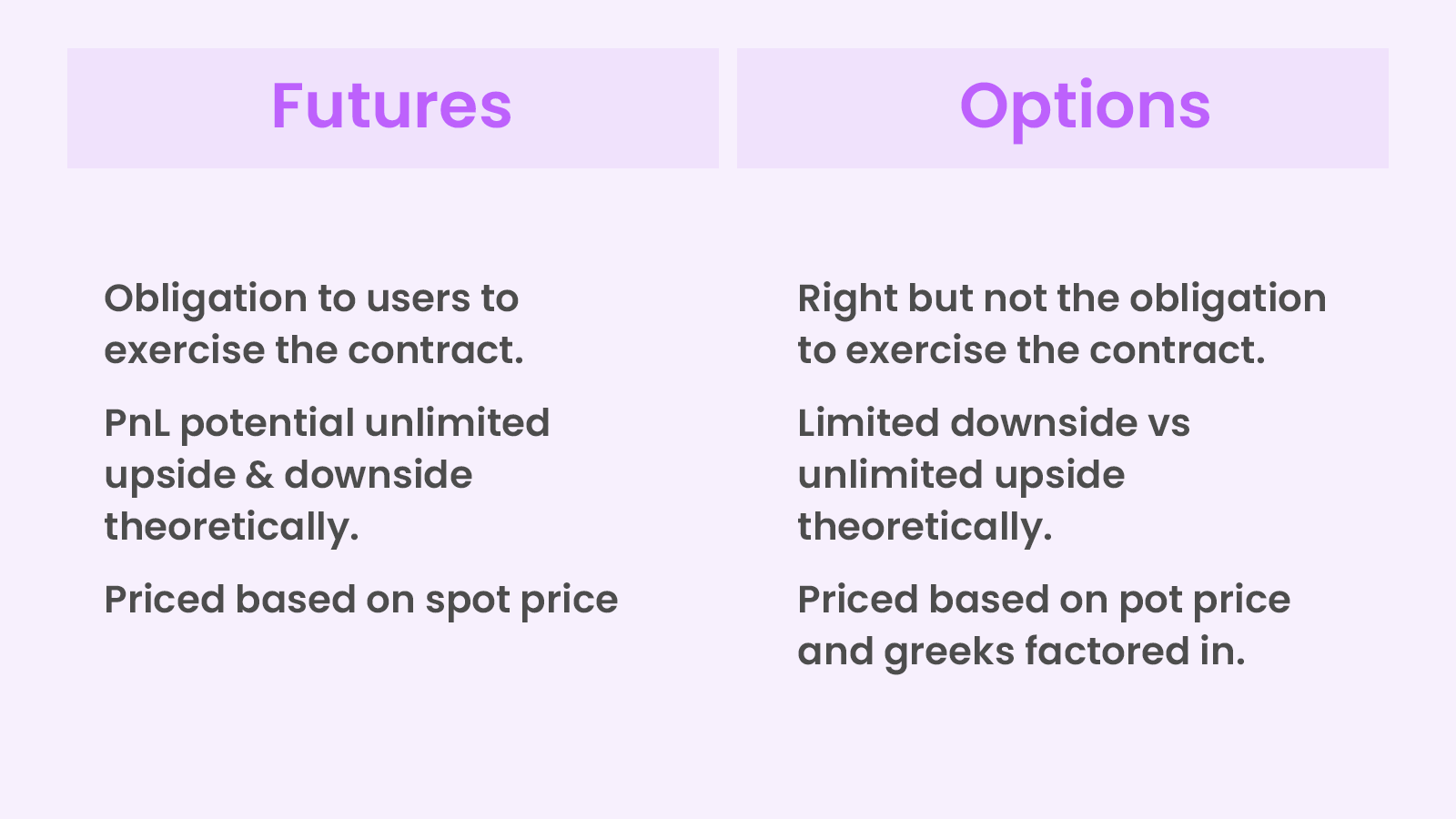

Firstly, Options gives the holder the right, but not the obligation, to buy or sell the underlying asset at a specific price before or on a predetermined date. However, Futures obligates both parties i.e the buyer and the seller, to buy or sell the underlying asset at a predetermined price on a specific date in the future. There's no choice i.e both parties are required to fulfil the contract's terms.

The second difference comes as the PnL potential of each of these derivatives. The profit potential for options is theoretically unlimited if it's a Call option and limited if it's a Put option. However, the maximum loss the holder can bear is the premium that he has paid for the contract thus limiting the downside. When it comes to Futures contracts, the profit and loss theoretically have unlimited potential based on whether it's a long or short position and if the price continues in their direction or against them.

Last but not the least, the third difference comes in the form of pricing. The pricing of Option is dependent on various factors that are called Greeks. These underpin the price of a particular option and thus the potential profit of your options. However, Futures are generally priced at a premium based on the spot price. This also highlights the complexity of Option contracts compared to Futures.

Ending Thoughts

To summarise, futures and options are distinct derivative contracts with options providing flexibility, offering the right but not the obligation to buy or sell assets at a set price limiting potential losses just to the premium paid. In contrast, Futures compel both parties to buy or sell assets at a predetermined price on a specified date, allowing for unlimited profit and loss theoretically.

While these contracts have some similarities with each other, they also have various differences. These differences range from how these derivatives are priced, PnL potential to Obligations vs Rights. It is vital to understand these differences to come to a conclusion over the type of derivatives you'd like to use. Ultimately, it is dependent on your risk tolerance and how good the liquidity is in the market that you're trading.

and if you're trying to trade perpetual futures, make sure to visit GooseFX and trade on the fastest Perps DEX on Solana along with competitive fees and huge fee rebates!

Stay Tuned with #GooseAcademy

Website | Twitter | Telegram | Discord | Docs

Disclaimer: The statements, proposals, and details above are informational only, and subject to change. We are in early-stage development and may need to change dates, details, or the project as a whole based on the protocol, team, legal or regulatory needs, or due to developments of Solana/Serum. Nothing above should be construed as financial, legal, or investment advice.

Comments ()