Types of Derivatives Contracts in Crypto

Learn about the various types of derivatives in the crypto market, including futures, options, and synthetic derivatives. Each has unique characteristics and uses. Discover the benefits and risks of trading each type, and gain insight into how they work in the volatile crypto market.

Table of Content

Int(r)o the Future

Derivatives are financial instruments that derive their value from an underlying asset. In cryptocurrency, derivatives have been gaining popularity as a way to speculate or hedge against the volatility of the crypto markets. This guide will delve into the different types of derivatives available in the crypto market and how they work.

This guide will focus on three main types of derivatives: futures, options, and synthetic derivatives. Each type has unique characteristics and uses; we will explore these in detail. We will also discuss the pros and cons of trading each type of derivative and the risks and benefits of trading derivatives in the crypto market.

We also recommend users check out our previous blog on Perpetual Futures and how you can trade those on a centralized or decentralized exchange.

Without further ado, let's dive right into the future (no pun intended!)

Futures

Futures contracts are financial agreements in which the buyer commits to purchase an asset, and the seller commits to sell an asset at a specific price and date.

A few types of Futures contracts that you can find in crypto are:

- Perpetual Futures: The most common and traded type of future contract is Perpetual Futures or perps. You can find these on any derivatives exchange, such as Binance, Bybit, Drift Protocol, Zeta Markets, DYDX etc.

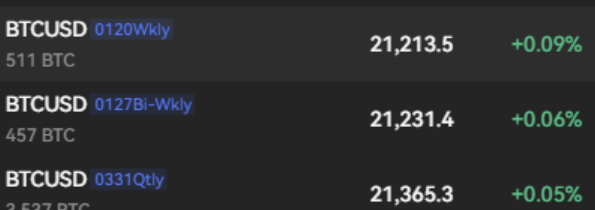

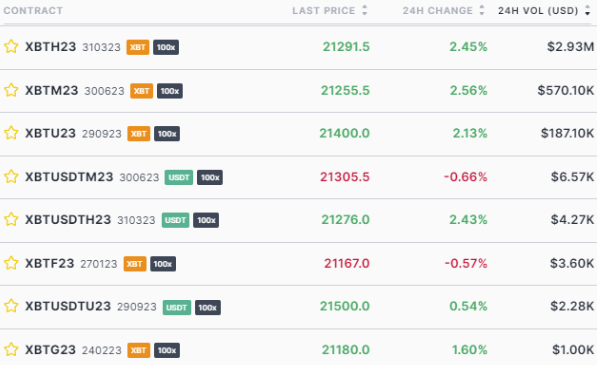

- Apart from that, we have Weekly, Bi-Weekly, Monthly and Quarterly Futures in crypto. Okex (OKX) provides a variety of futures contracts for both Bitcoin and Ethereum.

Every platform has its way of naming these contracts. For example, Binance has BTCUSDT Quarterly 0331, implying that its a Quarterly futures contract expires on 31/03 or 31st Mar, while BitMEX names its contracts such as XBTUSDTM23 300623, implying that this contract expires on 30/06/23 or 30th Jun.

Options

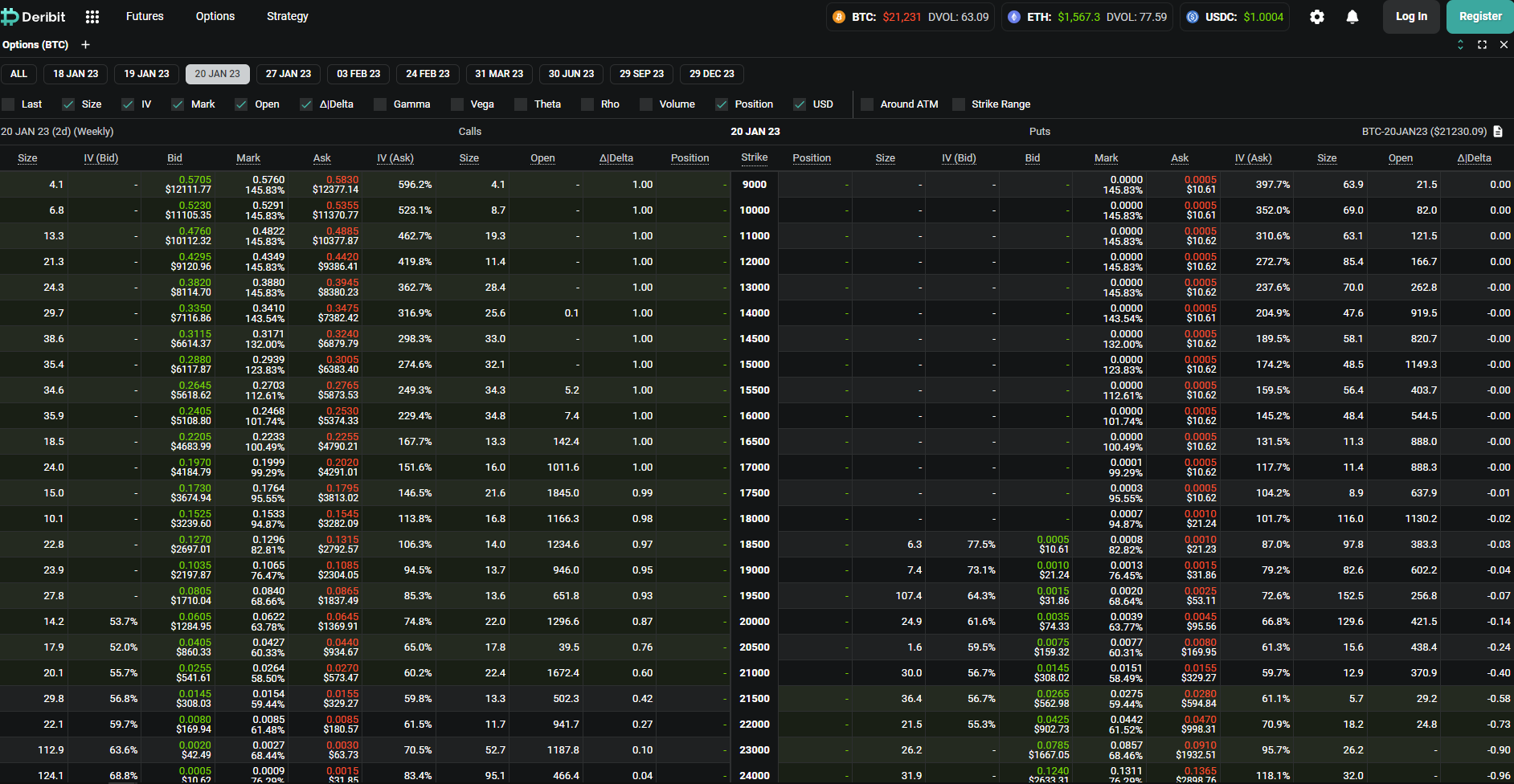

Options are financial derivatives that give the holder the right, but not the obligation, to buy or sell a specific cryptocurrency at a specific price on or before a specific date in the future.

There are two main types of options: call options, which give the holder the right to buy an underlying asset, and put options, which give the holder the right to sell an underlying asset.

Market participants can use these options to speculate on a cryptocurrency's future price or hedge against price risk.

There are multiple types of Options contracts, such as American Options, European Options and Exotic Options, which are more complex forms of options such as binary options etc.

- American and European Options: American options allow the holder to exercise before the expiration date, while the holder can only exercise European options on the expiration date. American options are more flexible, while European options could be more flexible. The choice of options contract depends on the trader's strategy and goals.

- Exotic Options: Exotic options are complex financial derivatives with flexible terms. They are used in specialized markets and can be used to create customized strategies for hedging and speculation. They are more complex than traditional options and can be harder to price and trade. We won't be diving deep into the different types of exotic options, but you can check out this blog by Cega Finance, teaching you all about it.

A few exchanges where you can trade Options are Deribit, Delta Exchange, Zeta Markets and Cega Finance etc.

Note: Zeta Markets have temporarily disabled Options and Futures and will be relaunching them in future.

Synthetic Derivatives and Assets

Synthetic derivatives are financial instruments created by combining other derivatives or assets to replicate the performance of a specific underlying asset.

For example, a synthetic derivative that tracks the price of Solana could be created by buying a combination of options and futures contracts of Solana. This synthetic derivative would allow an investor to gain exposure to the price of Solana without actually owning the underlying asset.

Examples of protocols offering such products are Friktion Labs, PsyFinance etc., which offer multiple vaults or trading strategies which are a mixture of Futures, Options and other derivatives contracts to maximize yield generation while trying to minimize risk.

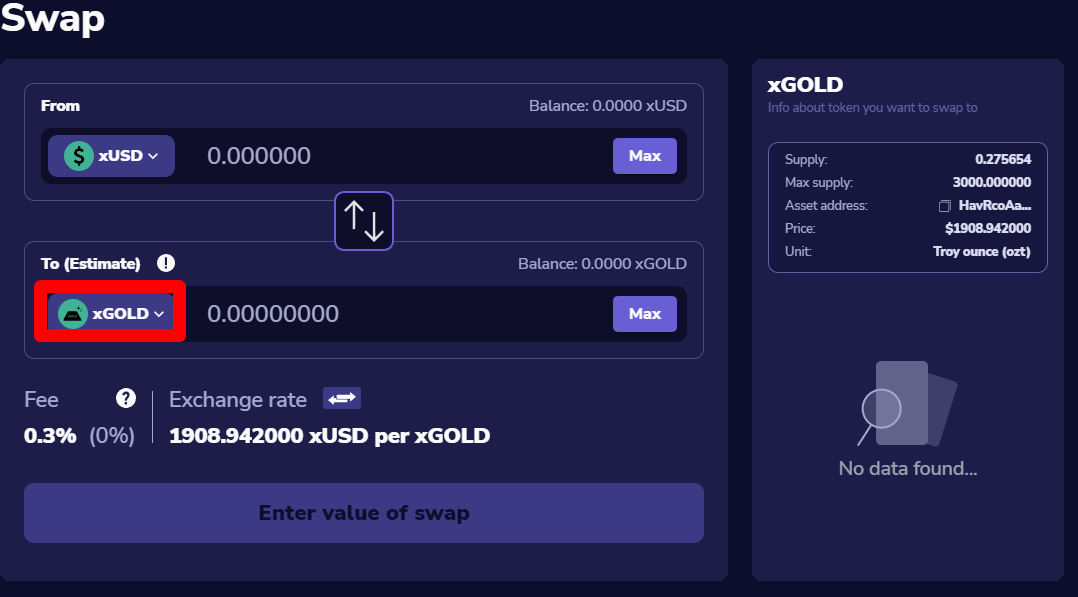

On the other hand, synthetic assets are digital tokens backed by collateral and can be traded on decentralized platforms like Synthetix, UniDex and Synthetify.

Users can buy these synthetic assets that replicate the behaviour of other assets, like gold, oil, or stocks, without actually owning them.

Note: Do note that synthetic derivatives can be complex and highly speculative, and it is crucial to fully understand the risks and mechanics of these instruments before deciding to trade them.

Conclusion

In conclusion, derivatives are a powerful tool for managing risk and maximizing returns in the crypto market. Market participants can use them to speculate on a cryptocurrency's future price or hedge against price risk.

The crypto market offers a wide variety of derivatives, each with its unique characteristics and uses. Futures, options, and synthetic derivatives are the three main types available in the crypto market. Each type has its pros and cons, and it is crucial to fully understand the risks and mechanics of each type of derivative before deciding to trade them.

As always, it is essential to carefully evaluate the platform or exchange you are planning to use and to consult a financial advisor before making any investment decisions.

Stay Tuned with #GooseAcademy

Website | Twitter | Telegram | Discord | Docs

Disclaimer: The statements, proposals, and details above are informational only, and subject to change. We are in early-stage development and may need to change dates, details, or the project as a whole based on the protocol, team, legal or regulatory needs, or due to developments of Solana/Serum. Nothing above should be construed as financial, legal, or investment advice.

Comments ()