Top 5 Perps DEX on Solana

Top 5 Perp DEXs on Solana | Drift Protcol · GooseFX Perps · Zeta Markets · Mango Markets · Jupiter | upto 100x leverage trading across Solana

Table of content

- Introduction

- What is a Perps DEX?

- Advantages of Perps DEX?

- Basic concepts of Perpetuals

- Top 5 Perps DEX on Solana

- Conclusion

Introduction

Imagine Odin Bonkson, a crypto enthusiast keen on trading crypto assets like Bitcoin, Ethereum or Solana. Traditionally, they'd have to rely on centralized exchanges or CEXs, which often come with limitations such as high fees, KYC and the need for exchange acting as the intermediary. However now, the game has changed with Perpetual DEXs!

Perpetual Decentralized Exchanges or Perps DEXs for short, offer Odin Bonkson a dynamic and seamless trading experience, providing several advantages

- Decentralized: Unlike traditional exchanges, DEXs operate on decentralized networks like Solana, eliminating the need for intermediaries. This means that Odin Bonkson has full control over his assets, enhancing security and trust.

- Lower Trading Fees: Perpetual DEXs often boast lower trading fees compared to their centralized counterparts. This translates to cost savings for traders, which is always a plus.

- Non-Custodial: It implies that Odin Bonkson retains control of his funds throughout the trading process. With Perpetual DEXs, there's no need to trust a central entity with their assets, reducing the risk of hacks or theft.

What is a Perpetual / Perps DEX?

A Perpetual DEX allows for perpetual futures trading. Futures are simply contracts based on the underlying asset or security which in our case would be Bitcoin, Ethereum, Solana etc. Typically futures have a date of expiration or maturity date on each contract. However, later on perpetual futures were introduced which don't have any expiry date i.e is never ending which is what the traditional CEXs and DEXs utilize in the crypto space.

While traditional CEXs are generally CLOB or Orderbook based exchanges, DEXs can vary from CLOB based model to AMM based exchanges offering multitude of advantages.

We've done a deep dive into CLOBs vs AMMs which you can check out

Advantages of Perpetual DEXs

- Lower fees compared to traditional exchanges

- Non custodial control

- Privacy focused, no KYC

- AMMs also offer concentrated liquidity at all times irrespective of the asset

Basic keywords used in Perps Trading

Let's unravel some of the fundamental concepts you'll encounter on your Perpetual DEX journey

What is Leverage?

- Leverage is a key feature of perpetual futures, allowing traders to control larger positions with less capital, but it also comes with increased risk.

What is Spot Trading vs. Perpetual Trading?

- Spot trading involves buying and holding actual crypto assets, while perpetual trading lets you speculate on their price movements without ownership. Perpetuals offer more flexibility and leverage.

What are Long and Short Positions?

- Going long means speculating that an asset's price will rise, while going short is betting on a price drop. With perpetuals, you can do both, opening up opportunities in any market direction.

What are Liquidity Pools?

- Traders deposit assets into pools to facilitate trading, earning fees in return. These pools help maintain price stability.

Different Order Types (Limit, Market, Take Profit)

- Limit orders let you set a specific price to buy or sell.

- Market orders execute instantly at the current market price. Take Profit orders automatically sell when your target price is met

Learn all these terms and more in our Introduction to Perpetual Futures blog

Perpetual DEXs on Solana

Solana's rapid transaction speeds and low fees make on-chain orderbooks possible, addressing key challenges faced by traditional DEXs.

We will now explore the Top 5 Perpetual DEXs on Solana, guide you on how to trade on them, provide brief overviews of each platform, and highlight their unique features for a comprehensive understanding of the Solana Perpetual DEX landscape.

Drift Protocol V2

Drift Protocol is a decentralized exchange (DEX) built on Solana, providing users with the ability to engage in perpetual and spot trading with leverage of up to 10x.

Why Use Drift Protocol?

- Leverage: Trade perpetual swaps with up to 10x leverage.

- Borrow & Lend: Access variable rate yields by borrowing or lending.

- Efficient Order Execution: Benefit from Just-In-Time (JIT) liquidity and order matching.

- Stake & Provide Liquidity: Earn rewards by staking or providing liquidity.

- Efficient Order Execution: Benefit from Just-In-Time (JIT) liquidity and order matching.

- Competitive Pricing: Get competitive pricing for larger order sizes.

- Cross-Collateral Support: Cross-collateralize on perpetual futures and enhance margin trading efficiency on spot assets.

- Yield & Margin: Deposited tokens earn yield and provide margin for perpetual swaps.

- Safety Measures: Borrowers can only borrow in an over-collateralized fashion, ensuring safety.

Drift V2 Key Stats

- Cumulative Trading Volume: 3.78B

- Cumulative Users: 71,953

- Total Value Locked (TVL): $120 million

- Supported Markets: BTC, ETH, SOL, JTO, PYTH, BONK, RLB and more

- Collateral Assets Supported: USDC, USDT, SOL, bSOL, jitoSOL, mSOL, wBTC, wETH, PYTH and JTO

Drift Protocol V2 Stats Dune - https://dune.com/bigz/drift-protocol-v2

How to trade on Drift Perps?

- Visit Drift protocol https://app.drift.trade/

- Click connect wallet

- Choose your desired Solana Wallet

- Bonus tip: Make sure to have more than 0.2 SOL in your wallet

- Deposit your desired collateral asset like USDC

- Place a limit order / market order (menu at the left hand side)

- Click Long/Short to execute the trade

- Voila!

GooseFX Perps DEX

GooseFX Perps Dex a decentralized exchange specializing in perpetual futures trading with community first approach. What sets it apart is its innovative use of the Central Limit Order Book (CLOB) design, a pivotal component that enhances trading efficiency and liquidity for its users.

Why use GooseFX Perps DEX?

- CLOB-Based Design: Utilization of the Central Limit Order Book ensures a dynamic trading environment. It enables traders to place limit orders at specified prices, enhancing precision in execution and order matching.

- High Leverage: The platform offers traders the opportunity to euse up to 10x leverage.

- User-Friendly: GooseFX prioritizes straightforward order execution, ensuring that traders can efficiently enter and exit positions.

- Competitive Fee Structure: Users benefit from a competitive fee structure, helping them optimize their trading costs.

- Referral System: In partnership with Buddylink, GooseFX presents a referral system, allowing users to earn rewards by bringing in new participants.

- Staking for Reduced Fees: Staking GOFX tokens not only provides users with potential rewards but also grants access to lower trading fees.

- Customizable UI: Users can customize every element on the perps DEX as per their liking.

- Perps SDK: Users can use the GooseFX Perps SDK to integrate perps into their own software, make trading bots etc.

- Future Plans: Multiple asset as collateral, advance order types and new markets.

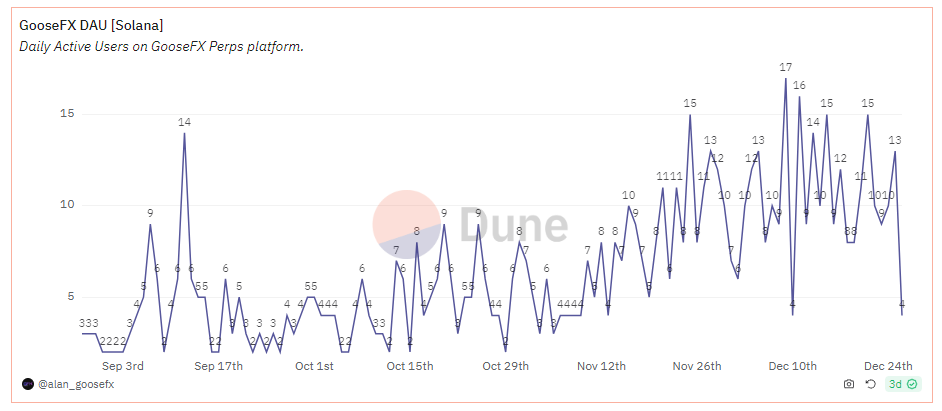

GooseFX Perps DEX Key Stats

- Cumulative Trading Volume: 1.8M

- Cumulative Users: 288

- Total Value Locked (TVL): $42,000

- Supported Markets: SOL

- Collateral Assets Supported: USDC

GooseFX Perps DEX Dune - https://dune.com/alan_goosefx/goosefx-perps-dex

How to trade on GooseFX Perps?

- Visit GooseFX Perps https://app.goosefx.io/trade

- Click connect wallet

- Choose your desired Solana Wallet

- Bonus tip: Make sure to have more than 0.2 SOL in your wallet

- Click Deposit / Withdraw

- Add your desired amount of USDC and click Deposit

- Place a limit order / market order (menu at the right hand side)

- Confirm trade details with the trade popup

- Click Click Long/Short to execute the trade

- Voila!

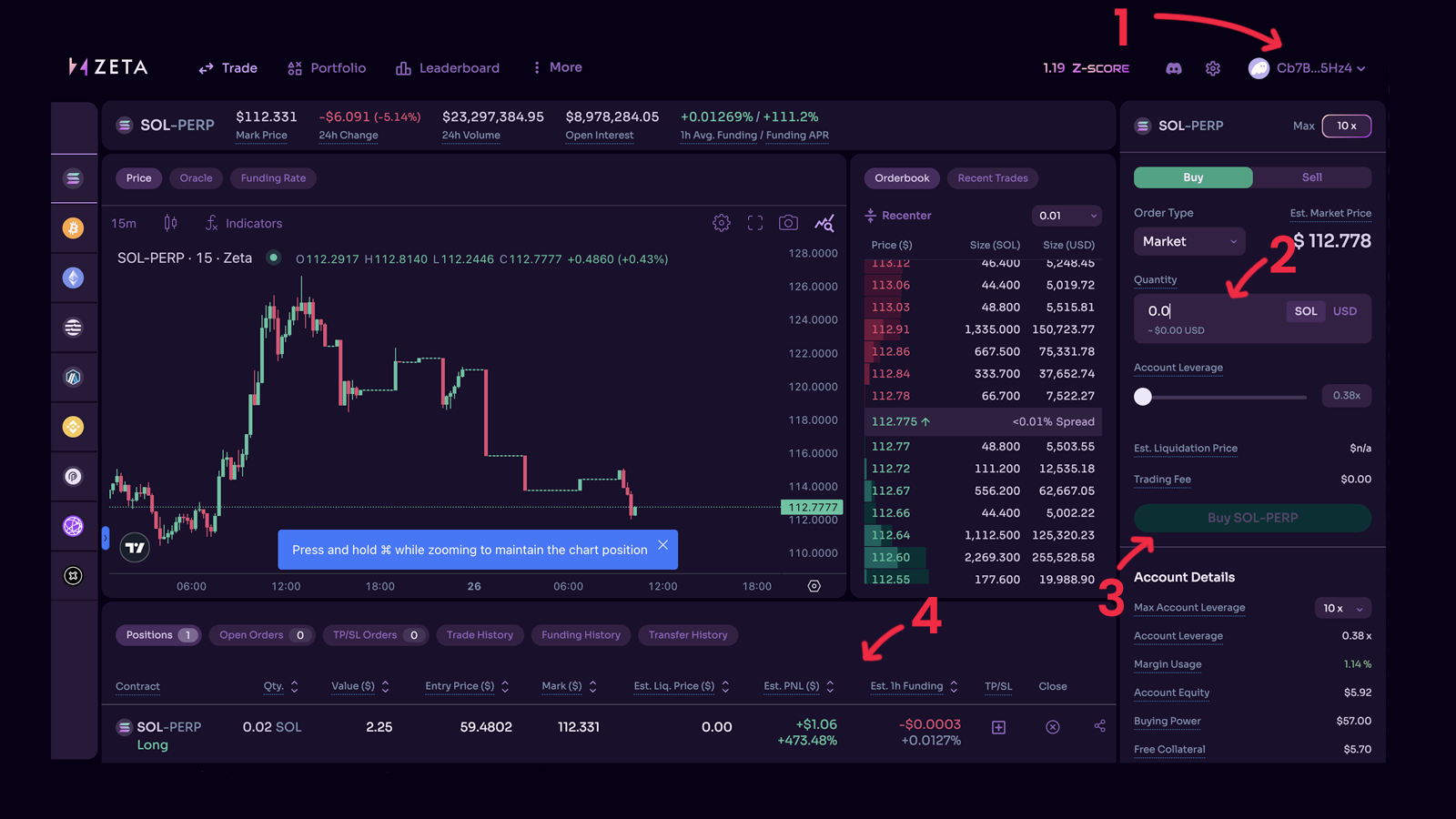

Zeta Markets Perps DEX

Zeta Markets is another DEX on Solana offering users a platform to trade perpetual futures from 4x up to 10x leverage. You can trade on their platform to earn Z-Score and you might be eligible for their token airdrop.

Why use Zeta Markets?

- Leverage: Trade perpetual swaps with up to 10x leverage for major pairs while up to 4x on highly volatile pairs with cross-margin functionality.

- Asset Security: Complete control over your assets, with USDC collateral.

- Decentralized Price Discovery: Experience fully on-chain limit orderbook (CLOB) for transparent pricing.

- Engagement and Rewards: Enjoy gamification elements, including leaderboards, referrals, and trading incentives.

Earn Z-Score: Trade on Zeta to earn Z-Score and stand eligible for their token airdrop.

Zeta Market Stats

- Cumulative Trading Volume: 1.45B

- Cumulative Users: 26k

- Supported Markets: BTC, ETH, SOL, BONK, PYTH and more

- Collateral Assets Supported: USDC

Zeta Market Perps DEX Flipside - https://flipsidecrypto.xyz/marqu/solana-perps-drift-v-2-zeta-markets-solana-perps-drift-v-2-zeta-markets-odMk9g

How to trade on Zeta Markets Perps?

- Visit Zeta Market Perps https://dex.zeta.markets/trade

- Click connect wallet

- Choose your desired Solana Wallet

- Bonus tip: Make sure to have more than 0.2 SOL in your wallet

- Add your desired amount of USDC and click Deposit

- Place a limit order / market order (menu at the right hand side)

- Click Click Long/Short to execute the trade

- Voila!

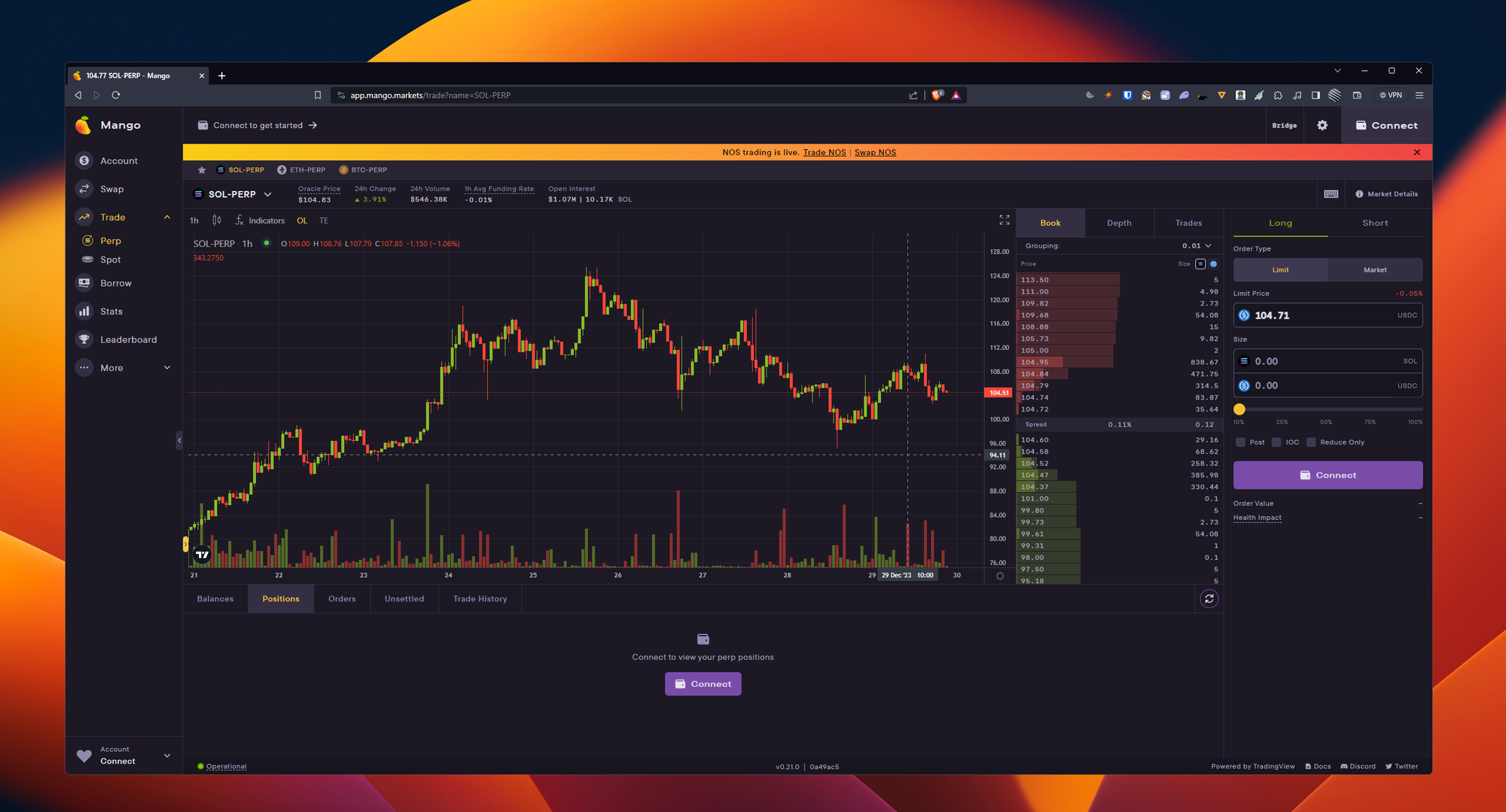

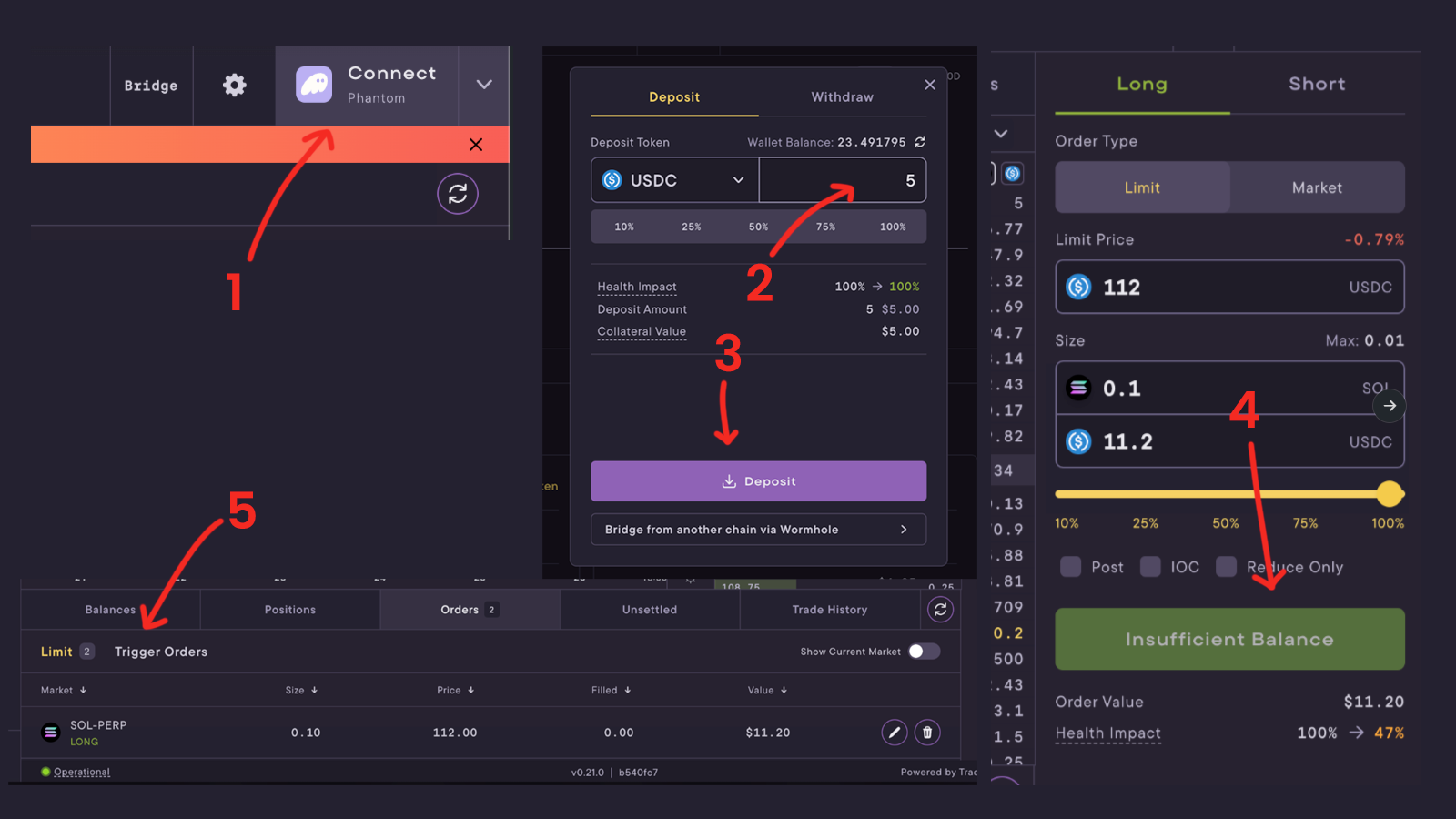

Mango Markets Perps DEX

Mango Markets provides a one-stop shop for users to swap, trade perps and borrow/lend their assets all in one place.

Why Use Mango Markets?

- Leverage: Trade perpetual futures with up to 10x leverage.

- CLOB based DEX: Utilize Mango’s fully on-chain orderbook style perps on Solana.

- Multi-Asset Collateral Support: Deposit collateral in SOL, MNGO, USDC and more.

- Borrow: Borrow assets like BONK, ETH, JLP and much more at a minimal APR

Mango Markets Stats

- Cumulative Users: 2.4k

- Total Value Locked (TVL): 15M

- Supported Markets: BTC, ETH, SOL

- Collateral Assets Supported: USDC, USDT, MNGO, ETH, SOL etc.

- Visit Mango Markets Perps https://app.mango.markets/

- Click connect wallet

- Choose your desired Solana Wallet

- Bonus tip: Make sure to have more than 0.2 SOL in your wallet

- Add your desired amount of USDC and click Deposit

- Place a limit order / market order (menu at the right hand side)

- Click Click Long/Short to execute the trade

- Voila!

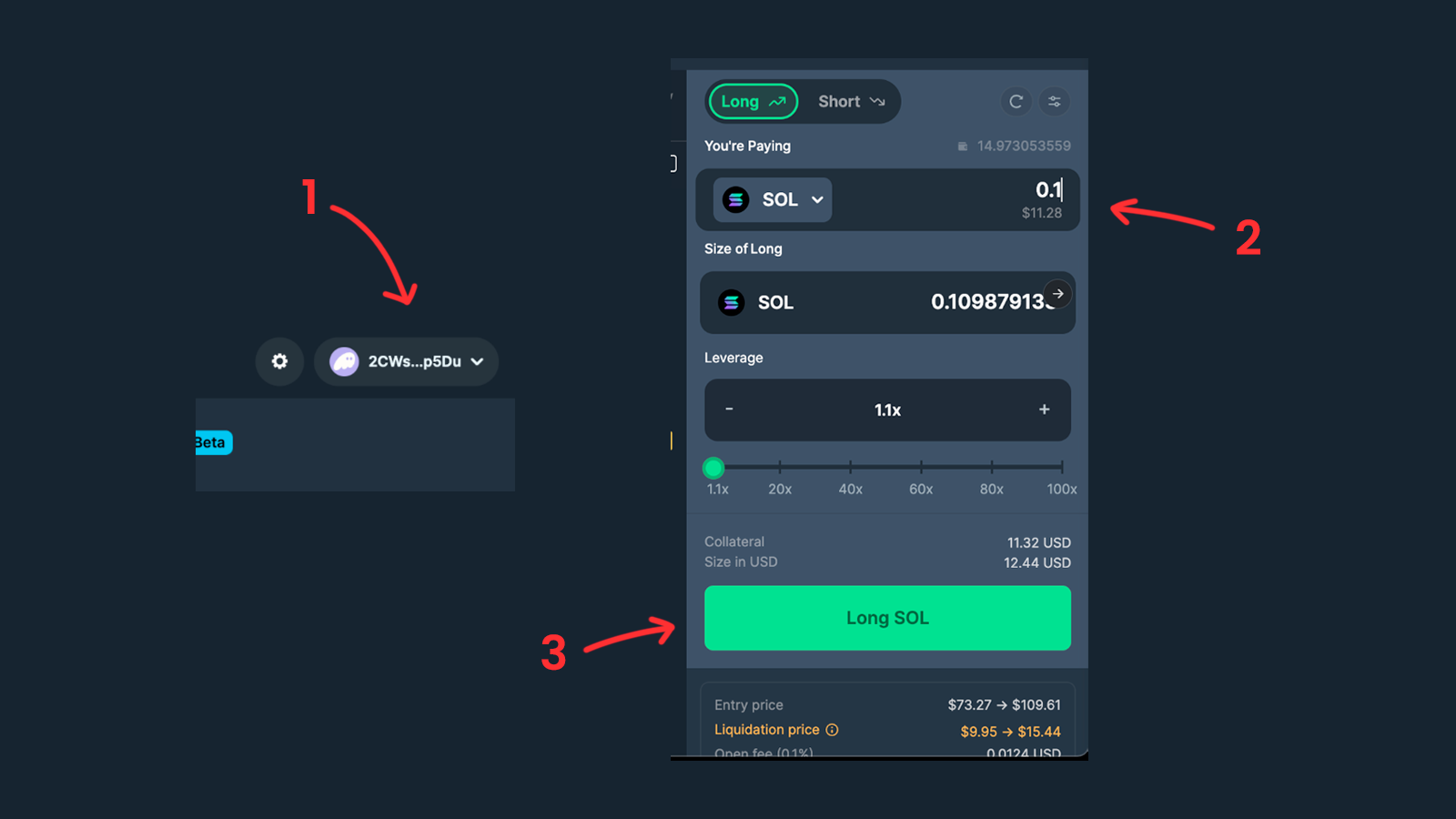

Jupiter Perps DEX

The leading DEX Aggregator on Solana has now launched their Perps protocol. Trade BTC, ETH, SOL on AMM Style perps with up to 100x leverage while also farming yield by depositing your assets and earning JLP tokens.

Why Use Jupiter?

- Leverage: Trade perpetual swaps with up to 100x leverage.

- AMM Style Perps: Experience fully on-chain AMM style perps on Solana.

- Multi-Asset Collateral Support: Utilize any token like BTC, ETH, SOL, BONK etc. as initial margin.

- Earn Yield: Deposit various assets from USDC,SOL,BTC etc. to earn yield generated by trading fees across the Perps DEX. Yield earned is in JLP tokens.

- Visit Jupiter Perps https://jup.ag/perps

- Click connect wallet

- Choose your desired Solana Wallet

- Bonus tip: Make sure to have more than 0.2 SOL in your wallet

- Add your desired amount of SOL or other assets

- Click Click Long/Short to execute the trade (menu at the right hand side)

- Voila!

Conclusion

In conclusion, Perpetual Decentralized Exchanges or Perps DEXs offer an alternative to traditional centralized exchanges. With lower fees, privacy-focused trading, and self-custody for users' funds, these platforms offer tonnes of advantage over there centralized counterpart.

Solana's fast transactions enable on-chain orderbooks, addressing key challenges faced by traditional DEXs. In this blog, we looked at the Top 5 Perpetual DEXs on Solana, including Drift Protocol, GooseFX, Zeta Markets, Mango Markets, and Jupiter Perps DEX, each offering unique features to its users.

We hope you enjoyed this small dive into the World of Perps DEXs on Solana and wish you a Happy New Year!

Stay Tuned with #GooseAcademy

Website | Twitter | Telegram | Discord | Docs

Disclaimer: The statements, proposals, and details above are informational only, and subject to change. We are in early-stage development and may need to change dates, details, or the project as a whole based on the protocol, team, legal or regulatory needs, or due to developments of Solana/Serum. Nothing above should be construed as financial, legal, or investment advice.

Comments ()