How to trade effectively with Jupiter on Solana [GUIDE]

Trade smarter, not harder with Jupiter Exchange. Aggregated liquidity and smart routing for efficient trades and minimal slippage on Solana. Try it now at https://jup.ag/

![How to trade effectively with Jupiter on Solana [GUIDE]](/content/images/size/w1200/2023/01/Jupiter-GooseFX-1.webp)

Table of contents

- Overview of Jupiter and its purpose

- How to Swap Tokens on Jupiter Exchange

- Understanding Price Info on Jupiter

- How to trade on Jupiter with Limit Orders

- Stats Page

- Conclusion

Overview of Jupiter and its purpose

Jupiter Exchange is a decentralized liquidity aggregator on Solana that offers the broadest range of tokens and the best route discovery between any token pair. Jupiter automatically lists new tokens and markets as they become available and allows users to swap tokens in a single transaction.

When trading on DEXs, liquidity pools determine the exchange rate based on the ratio of the two tokens in the pool. This can cause a difference between the price you expect from a trade and the price you get, known as slippage. This is especially problematic when trading illiquid tokens.

Jupiter solves this problem by aggregating liquidity from multiple DEXs and liquidity pools, e.g.: (Orca, Raydium & GooseFX), resulting in a larger pool of assets to trade from, which allows for more efficient trades and minimizes price impact and slippage.

In short, you need Jupiter for token swapping on Solana to maximize your price performance and minimize slippage. It provides a more efficient and effective way to trade tokens on decentralized exchanges.

Understanding the problem of slippage and price impact

When trading tokens on a DEX, you "swap" a token by transferring it into a liquidity pool and getting another token in exchange. In order to make this possible, the liquidity pool has to hold both assets, and it needs to continue to hold enough of both assets to be able to handle the next trade as well. To ensure that it maintains a balance of both assets, liquidity pools determine their exchange rate based on the ratio of the two tokens in the pool, which means that the more you change the ratio, the more you pay to exchange assets.

How Jupiter solves the problem of slippage and price impact

Jupiter solves this problem by aggregating liquidity from multiple DEXs and liquidity pools, resulting in a larger pool of assets to trade. This allows for more efficient trades and minimizes price impact and slippage. Additionally, Jupiter uses intelligent routing to find the best prices for token trades by comparing prices across different DEXes and even routing through intermediary tokens if it finds better prices. By using Jupiter, traders can maximize their price performance and minimize slippage.

How to swap tokens on Jupiter Exchange?

- Visit https://jup.ag/

- Connect your wallet by clicking the button in the upper right corner. Jupiter suports 45+ solana wallets like (xNFT Backpack, Glow Wallet, Solflare, Coin98).

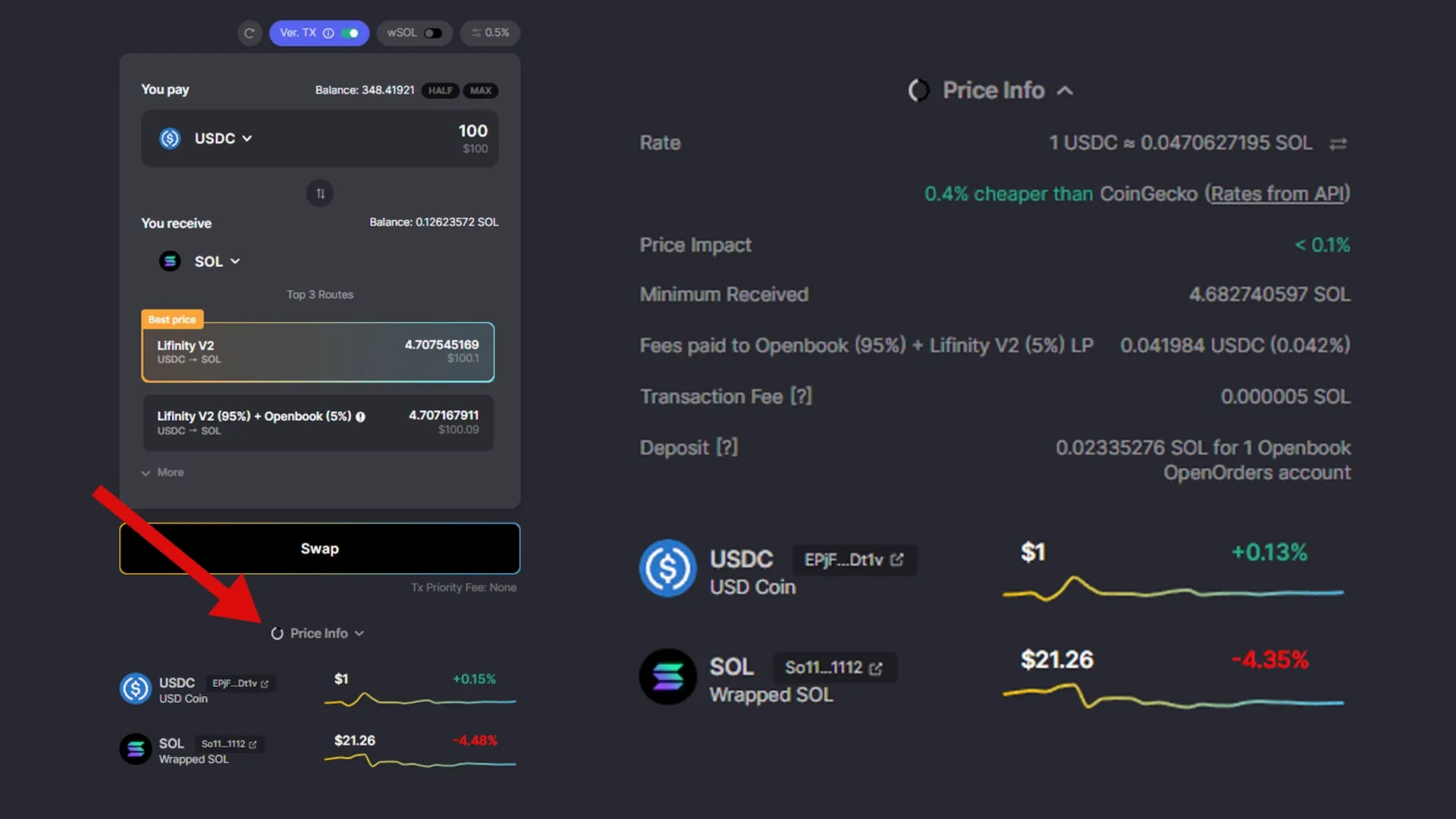

3. Once you connect your wallet to Jupiter, you can select the token pairs you want to swap. For example, you can swap 100 USDC for SOL. Jupiter will find the best-priced routes for your trade and automatically choose the one that will give you the most tokens. This way, you can ensure that you're getting the best possible price for your trade.

Jupiter aggregates liquidity from multiple DEXs, including Orca, Raydium, Mercurial, GooseFX, Lifinity, Step Finance, and many more. This means that the routes available for your trade can include a combination of any of these DEXs, providing you with the most options for finding the best prices.

Understanding Price Info

Rate: This tells you how much you will pay for the trade you selected. You can click to see the price.

x% cheaper/costly than CoinGecko: Jupiter will check if the rate you are getting is close to the market rate. If the price you will pay is 2% or greater than the price on CoinGecko jupiter will show you a warning.

Price impact: The size of your trade can also affect the rate that you get. Price impact measure how much the size of your trade is affecting your price. Jupiter will show a warning if it is 2% or greater.

Minimum Received: This is the minimum amount of tokens you are guaranteed to received and is based on your slippage settings but also has factored in all the fees.

Fees paid to xxx: These are the exchange fees paid and there is a fee paid per hop in a route.

Transaction Fee: This is the fee you will pay for the transaction regardless if the transaction is successful or not.

Deposit: This is the rent paid to create an ATA account that will hold your token data. Your deposit can be reclaimed by closing those accounts. You can use SonarWatch tool to reclaim them.

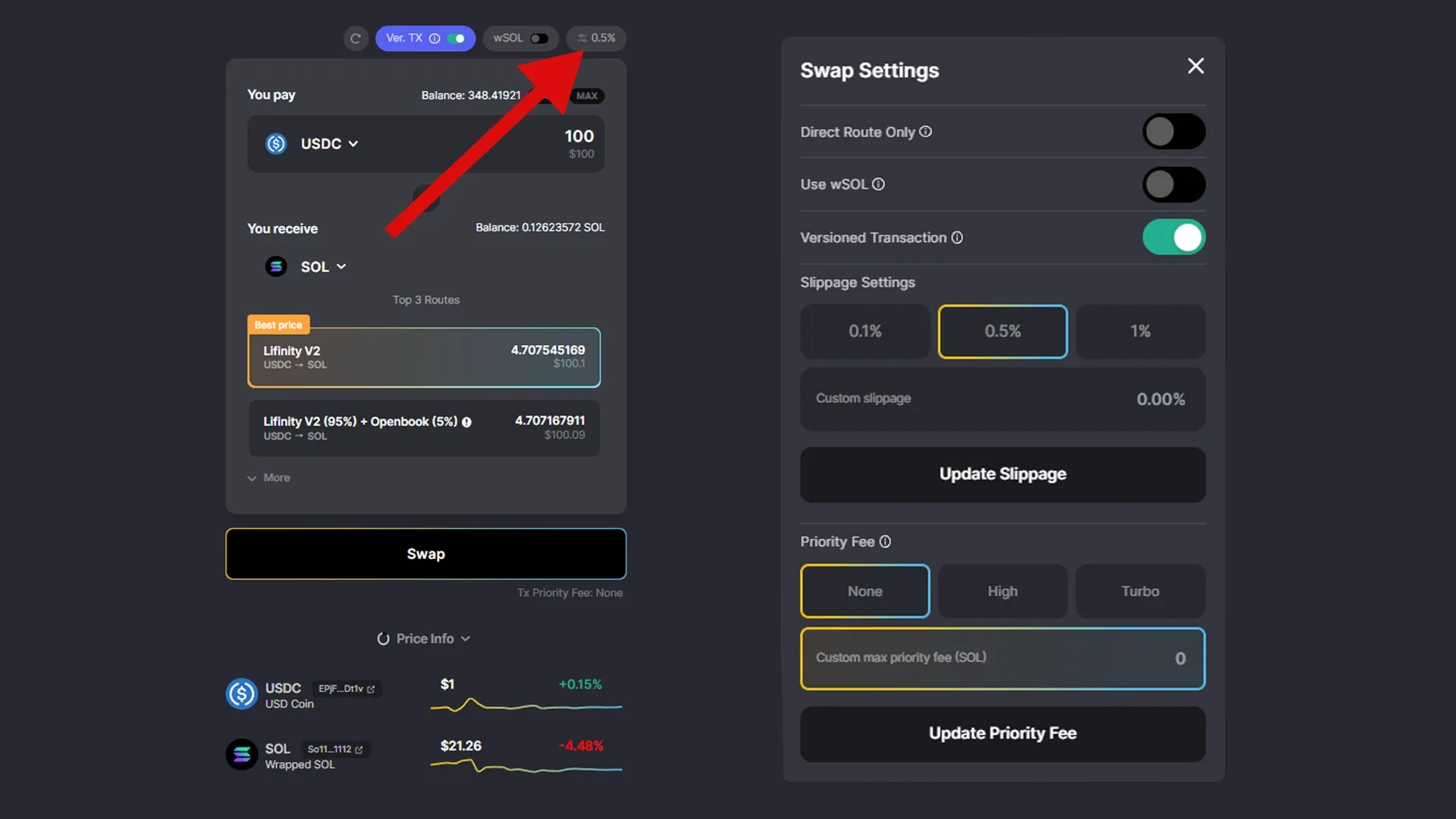

Slippage and Priority Fees

Before trading, you can choose how much the price can change by using the settings button. This is called the slippage rate. It's important because it tells Jupiter the least amount of tokens you want to receive. For example, if you set a 1% slippage rate, Jupiter will not complete the trade if the price changes more than 1% from your original quote.

What is slippage?

This is because between the time you get a quote and the time you execute the trade the price may change. If the price falls below your slippage rate, then the transaction will fail in order to prevent you from getting less tokens than you want.

Priority Fees

The priority fee is paid to the Solana network. This additional fee helps boost how a transaction is prioritized against others, resulting in faster transaction execution times.

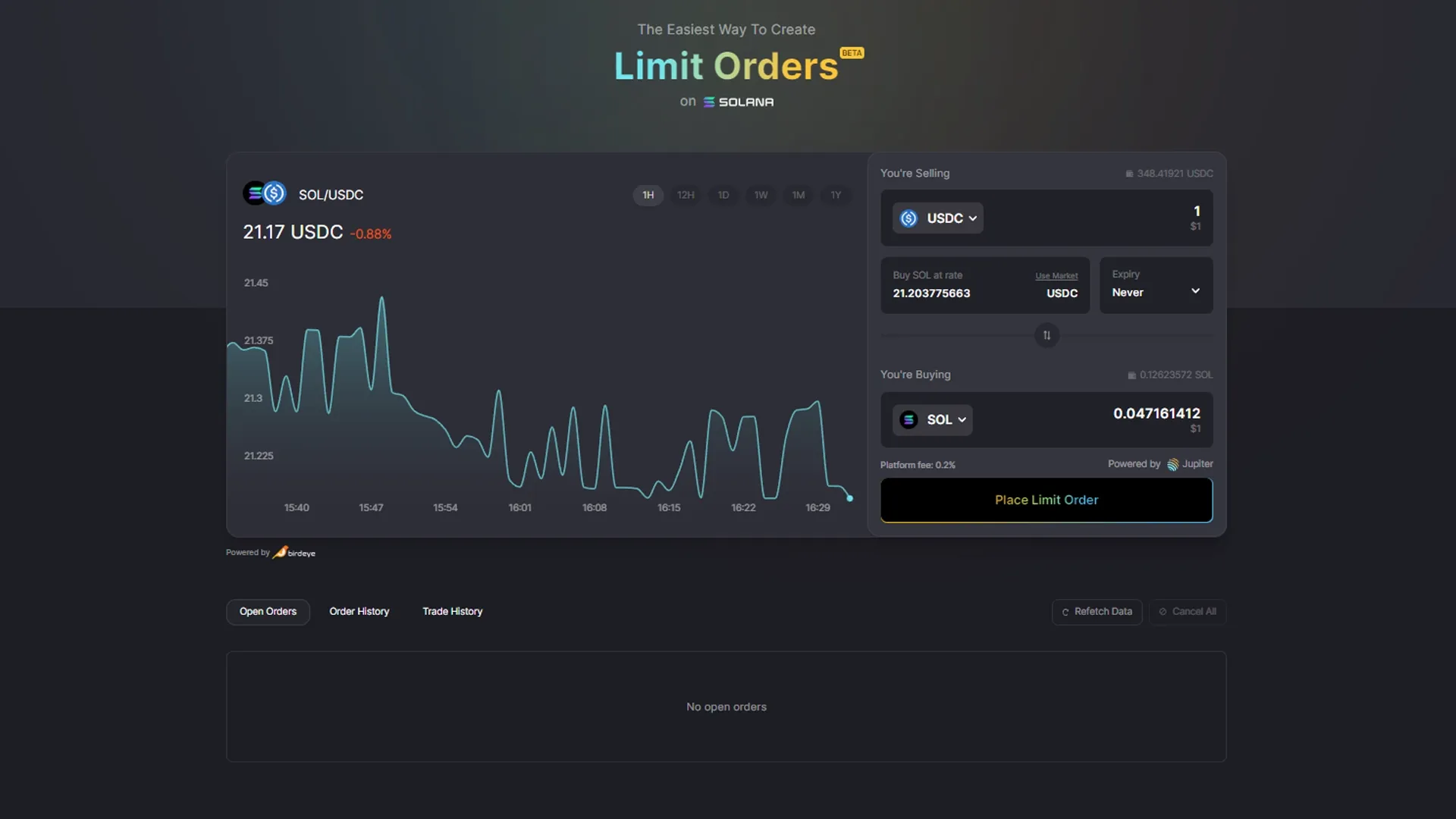

Limit Orders on Jupiter

In addition to standard swapping, Jupiter also allows users to set limit orders. These orders enable users to purchase tokens at a fixed, predetermined price. Additionally, limit orders can be utilized to automatically sell tokens at a higher price, eliminating the need for constant monitoring of market prices. This feature provides a convenient and efficient way for you to manage your token trades.

- To place a limit order on Jupiter, visit https://jup.ag/limit/USDC-SOL

- Select the token you wish to purchase and enter the desired amount. For example we are going to place a 100$ buy order of Solana at the price of 18$ for 1 Solana. Whereas the current marketprice is 21.18$ for 1 Solana.

- Expiry: You can also set an expiry for your limit order. This allows you to specify a time frame for your order to remain active. After the specified time, your limit order will be withdrawn.

Please note that the default expiry is set to "No expiry."

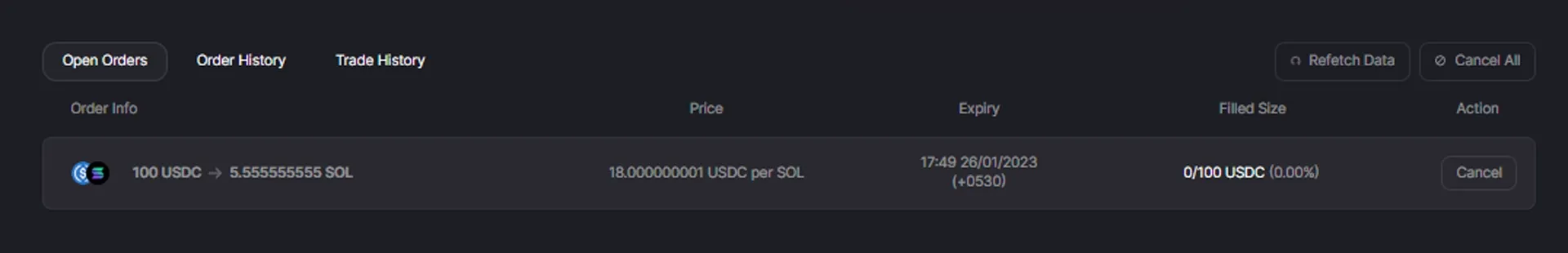

Open Orders

Once you have set your limit order, you can view details such as the price set for the order, the expiry time (if selected), and the filled size, which indicates the amount of your order that has been filled at any given moment. Additionally, you have the option to manually cancel the limit order from this same page.

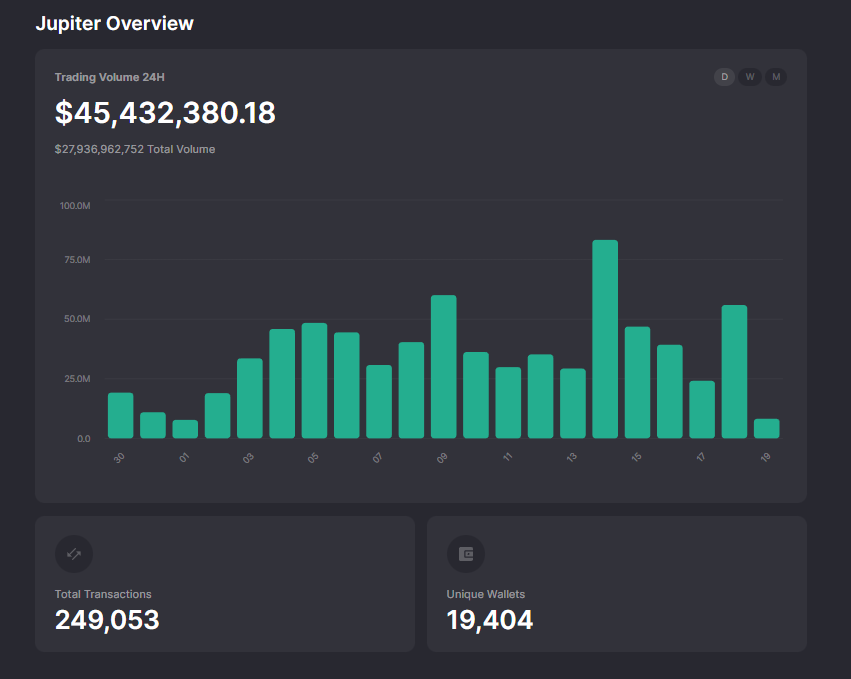

Stats

The statistics page on Jupiter provides valuable insights into the platform's trading activity. They also highlight the top tokens in terms of overall trading volume, as well as the top buys and sells. Users can also view the leading liquidity pool providers on Solana by their daily, weekly, and monthly trade volume. This feature allows for a comprehensive understanding of the platform's performance and activity.

Conclusion

Jupiter Exchange is a powerful tool for trading tokens on Solana. Its liquidity aggregation and intelligent routing capabilities allow for efficient trades, minimizing slippage and price impact. With Jupiter, traders can maximize their price performance and make the most of their token trades. Whether you're a seasoned trader or new to decentralized exchanges, Jupiter offers a seamless and user-friendly experience. We hope this guide has helped you understand how to use Jupiter and how it can benefit your trading strategy.

Stay Tuned with #GooseAcademy

Website | Twitter | Telegram | Discord | Docs

Disclaimer: The statements, proposals, and details above are informational only, and subject to change. We are in early-stage development and may need to change dates, details, or the project as a whole based on the protocol, team, legal or regulatory needs, or due to developments of Solana/Serum. Nothing above should be construed as financial, legal, or investment advice.

Comments ()