Top 5 Yield Farming protocols on Solana - 2023

Dive into the world of Solana's yield farming, exploring unique single-sided liquidity pools, CLMM, PMM models, and more. Discover the future of DeFi!

Introduction

As you would have read in the title of this blog, we'll be covering the top-yield farming platforms on Solana. If you're new to our blogs, we've covered what Yield Farming is in a blog that you can check out here.

To explain it in brief, Yield Farming is a process of using your funds on different platforms to receive rewards in return for providing liquidity into specific liquidity pools. The people involved in yield farming are called farmers and are rewarded for offsetting any losses or risks associated with such practices.

If you haven’t checked our previous blog out here or are unsure of the terminology, do check out our previous blog as that would help in understanding this blog easily.

In this blog, we'll look at crowd favorites from Raydium and Tulip to Kamino and Lifinity and what we're offering at GooseFX.

So, without any further ado, let's jump right in!

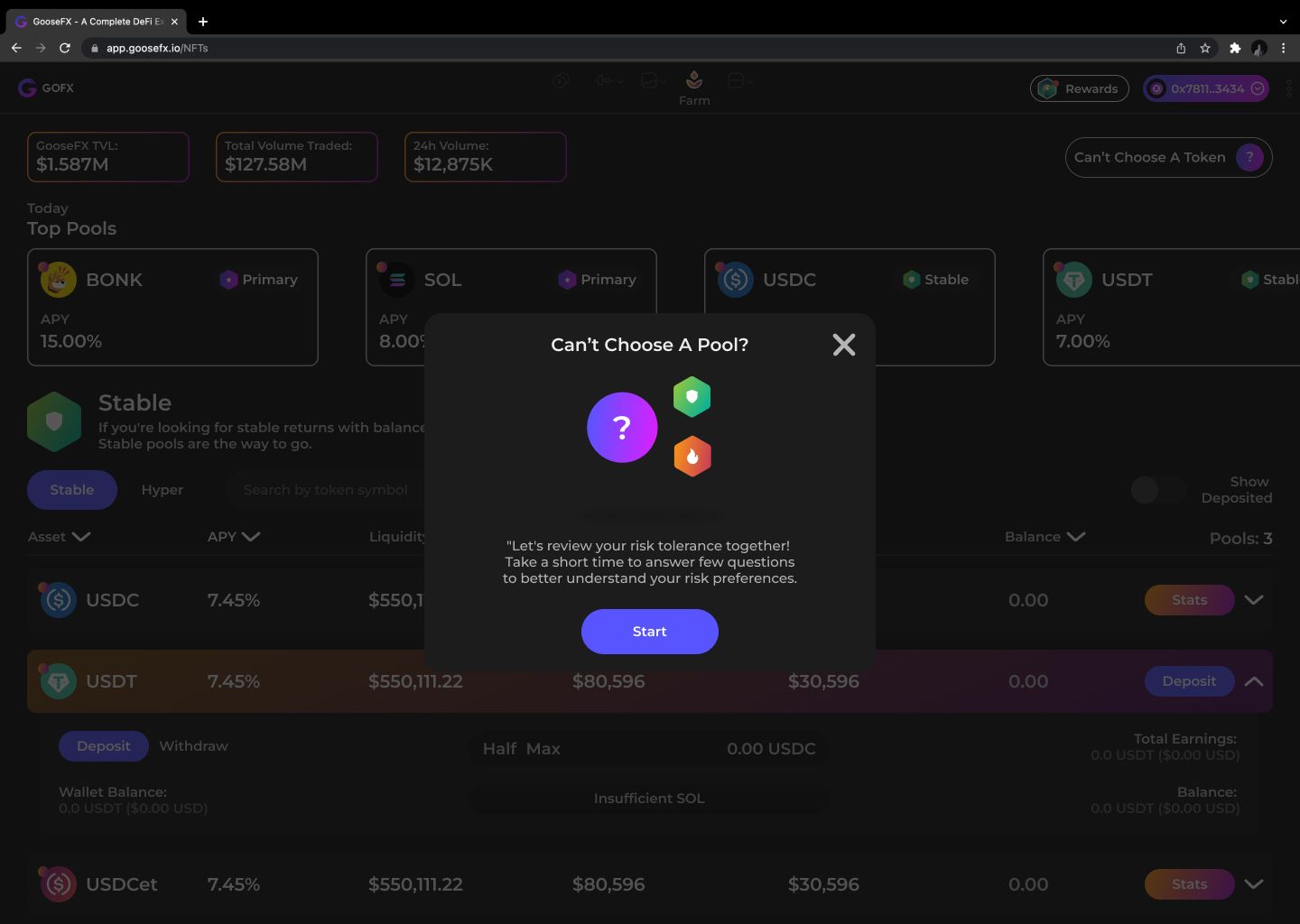

GooseFX

First up, we have GooseFX. GooseFX is bringing you their all-new v2 SSL or Single-Sided Liquidity Pools. For those that may not know, compared to traditional liquidity pools that require you to deposit two assets, SSL pools only require you to deposit a single asset, removing any risk of Impermanent Loss due to its single token nature.

If you don't know what Impermanent Loss is, check out our blog here, highlighting it with an easy example

The SSL Pools are categorized into three sections: Stable, Primary, and Hyper pools. Each category has a specific nature depending on the user's risk-taking ability and their current holdings.

While SSL pools do remove the risk of Impermanent Loss, a potential risk is price inventory vulnerability, a challenge commonly encountered by market makers. This risk emerges when the value of the assets used for market-making drops significantly, surpassing the fees earned from the activity.

Note: The Beta launch of GooseFX's v2 SSL Pools goes live on Tuesday, 5th September 2023 at 9 AM EST! Get your Beta passes while you still can.

Welcome to GooseFX, the only super-app on @solana ♾️

— GooseFX (@GooseFX1) August 29, 2023

We're thrilled to announce that our Single-Sided Liquidity Pools v2 is live. This is how YOU can request access to our Beta

→ Follow @SSLbyGooseFX

→ Like this thread

→ Comment #GooseList

→ and DM us your Wallet Address pic.twitter.com/lkRhqlbX14

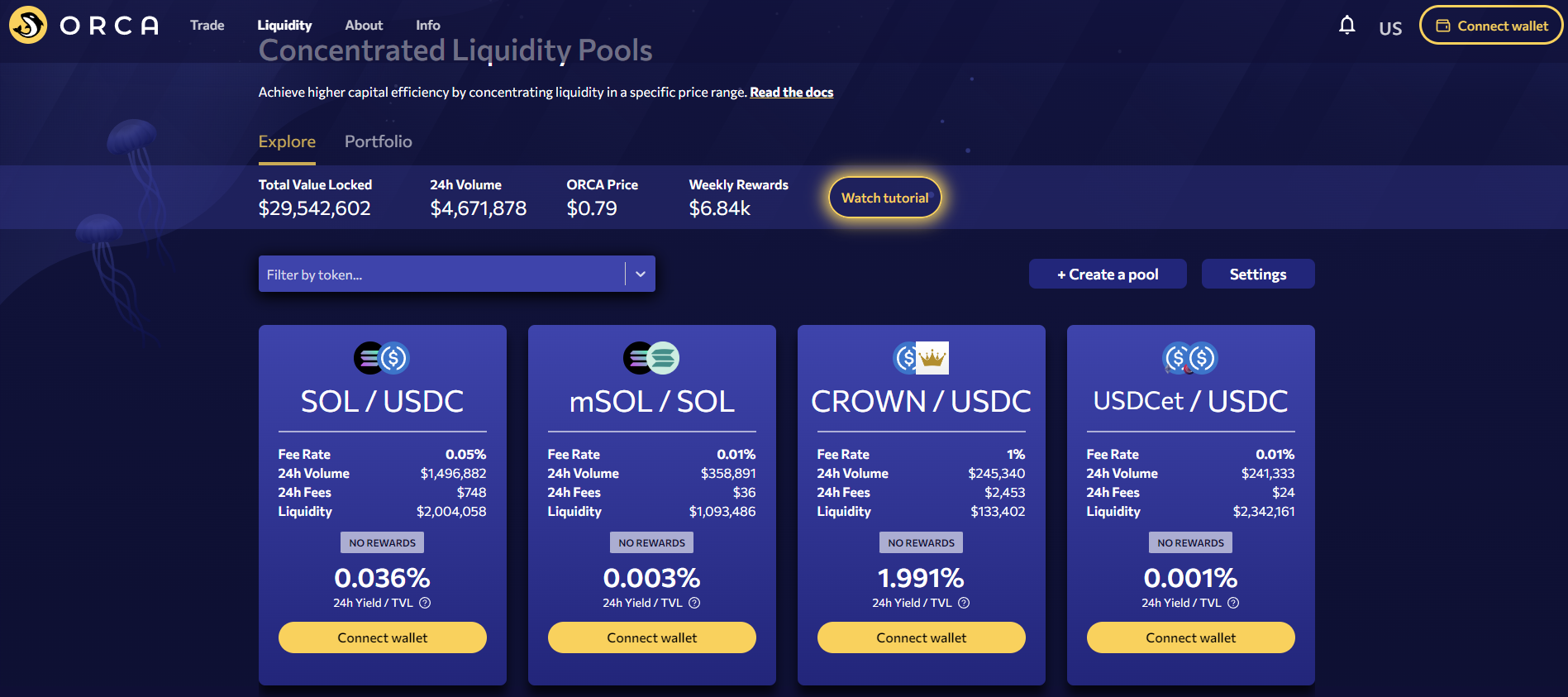

Orca

Orca is a decentralized exchange built on the Concentrated Liquidity Market Maker or CLMM model. Currently, Orca is sitting at a TVL of $37 Million across all of its pools.

You can check out different types of AMMs and what CLMM exactly is in our blog here.

The useful thing with CLMM pools is the ability to specify the price range in which the user would like to provide liquidity. While this involves the user staying active and keeping his price range in check, it provides additional control to the user so that he can optimize it according to his needs.

However, if the price shifts beyond the designated price range, a position will cease to trade or generate fees actively, potentially causing a substantial impermanent loss for liquidity providers. Within a typical AMM pool, an increase in the price of a base token implies that users are swapping the quote token for the base token. Consequently, the pool and LPs will possess a higher quantity of the quote token and a decreased amount of the base token.

Raydium

Next on our list is Raydium. Raydium, an AMM or Automated Market Maker on Solana, also leverages a central limit order book or CLOB model for fast trades, incentivizing liquidity provision and earning yield.

To learn what AMMs are, check out our blog here.

To earn a yield on Raydium, you can deposit two assets into their liquidity pools, such as RAY-USDC, RAY-SOL, etc. You can also utilize their Concentrated pools, which are based on the CLMM model instead of your traditional AMM model.

The good thing about Raydium is that they provide all sorts of pools, from your basic LPs for almost any token on Solana to Concentrated Liquidity pools for users who want more control over their liquidity.

Currently, Raydium has a locked TVL of $30.2 Million sitting just below Orca.

Lifinity

Lifinity is the first Proactive Market Maker or PMM model-based exchange on Solana. Its innovative DEX approach combines concentrated and lazy liquidity, reducing impermanent loss with an oracle-based pricing mechanism. The protocol generates profit via delayed pool rebalancing.

To add to this, we have Lifinity's token and Flares incentivization model. Innovative tokenomics include continuous liquidity acquisition and an advanced veToken model. Collaboration with veLFNTY holders enables protocols to incentivize secure permanent liquidity dynamically. Lifinity also introduces Flares, a collection of 10,000 animated NFTs with dual artistic and financial value. Proceeds, fees, and royalties from Flares contribute to buybacks and reinvestment. Flares falling below 50% of mint price trigger repurchases, with 1% of LFNTY tokens reserved for Flare holders.

If you would like to get an in-depth knowledge about Lifinity and their Token and NFT model, check out this blog here

Tulip Protocol

Tulip or Tulip Protocol is the first yield aggregator built on Solana, taking advantage of its low-cost, high-speed transactions to provide auto-compounding vaults. It helps users to get a higher APY without any active management from their end.

Currently, Tulip offers three different types of products: Vaults. Lending and Leveraged Yield Farming or LYF. We won't look at Lending vaults in this blog as they are self-explanatory.

You have two different types of "Vaults" on Tulip. Auto Vaults auto-compounds into LP farms on other dApps. It means it swaps the rewards or emissions every 10 minutes into your existing LP position, helping the user get more APY due to its auto-compounding feature and a higher frequency of swapping the emissions.

Users could use Tulip's strategy vaults to deposit a single asset to gain exposure to multiple farming strategies across various dApps. Think of the vault as an organized repository capable of accommodating numerous yield strategies simultaneously.

Finally, we have Tulip's LYF or Leveraged Yield Farming. Leveraged Yield Farming, or LYF, as the name suggests, allows users to borrow up to 3x (hence the term "leverage") their capital to farm and thus generate more yield for themselves. While this does sound better because who doesn't want more yield, the user also places himself at risk of liquidation and an already existing pesky risk of Impermanent Loss.

Do note that new positions can't be created on LYF currently.

Kamino Finance

Kamino is an automated liquidity solution to help users earn a yield on their crypto holdings using CLMM-based pools across multiple dexes like Orca and Raydium. As mentioned, these CLMMs are more efficient than traditional automated market makers. Still, due to price volatility and manual management, their complexity often hinders users from fully benefiting.

Kamino Finance has just over $8 million in TVL and has seen steady growth since November last year.

Kamino automates the entire process of providing liquidity to a pool for the user, including automated position rebalancing, auto-compounding to optimize yield and auto-swap for single-sided deposits and withdrawals. Kamino also provides users using their protocol with tokens.

Tokens are, in a simpler language, receipt tokens that indicate your share of that Kamino vault. These SPL tokens can be used like any other token across DeFi on Solana. An example is the kUSDH-USDC pool on Hubble Protocol, which you get when you deposit into the USDH-USDC pool on Kamino.

Special Mention

Also, a special shoutout to OpenBook who has been the crux behind Solana ecosystem for the past few months post FTX-Saga! For those that do not know, Openbook is a community run dex which is a fork of Serum exchange v3.

You could check out all the details about Openbook in our blog here

Ending Thoughts

We've covered a range of protocols in Solana's yield farming, yet many more still need to be tapped. The diversity of options is striking, from Orca and Raydium's CLMM model to Lifinity's PMM approach, Tulip's yield aggregation, and GooseFX's unique single-sided liquidity pools.

As we move into the year's second half, we're thrilled to unveil innovative features for our v2 Pools and excited to witness the progress of other mentioned protocols. Solana's DeFi landscape is ever-evolving, promising an exciting journey ahead!

#OPOS Only Possible on Solana

Stay Tuned with #GooseAcademy

Website | Twitter | Telegram | Discord | Docs

Disclaimer: The statements, proposals, and details above are informational only, and subject to change. We are in early-stage development and may need to change dates, details, or the project as a whole based on the protocol, team, legal or regulatory needs, or due to developments of Solana/Serum. Nothing above should be construed as financial, legal, or investment advice.

Comments ()