Introduction to Liquid Staking

Delve into the world of Liquid Staking - Discover how LSTs offer liquidity and flexibility to your staked assets. Learn about the top liquid staking protocols on Solana.

Introduction

In the past few weeks, we've seen noticeable attention on Liquid Staking and how it can help propel DeFi forward.

What is liquid staking?

— 🔥🪂 SolBlaze.org | Stake with us! (@solblaze_org) July 27, 2023

Is it safe to liquid stake?

How does liquid staking interact with DeFi?

Why is it important to liquid stake?

Introducing... SolBlaze's Ultimate Guide to Solana Liquid Staking!

Read on to find answers to these common questions and a bonus at the end

1/33

Hence, that's what we're going to be looking at today! In this blog, we will delve into the world of LSTs, exploring what they are, how they work, their advantages, and potential risks.

So, without any further ado, let's jump right in!

What is Liquid Staking?

Let's rewind to the different blockchain networks and their consensus mechanism. In one of our previous blogs, we discussed how every blockchain network has a different consensus mechanism ranging from Proof of Work or PoW for Bitcoin to Proof of Stake or PoS for Ethereum and Solana to more hybrid and new mechanisms.

In the Proof of Stake or PoS mechanism, validators stake or lock their tokens to secure the network and verify transactions. Tokens are "put at stake" to validate new blockchain transactions, and any fraudulent behaviour can result in the tokens being "slashed" or taken away. For locking their tokens, the validators receive a reward proportional to their holdings concerning the total tokens staked, which generally has a relatively low APY due to their inherent low-risk nature.

However, while the tokens are staked, they cannot be traded, collateralized or used for any purpose. This illiquidity problem is what Liquid Staking set out to solve.

Liquid Staking is staking with a minor tweak. Liquid staking offers a smart solution, allowing users to stake directly on PoS networks like Ethereum. When staking, the protocol mints a liquid staking token (LST), granting liquidity to users. Hence, It is liquid because users can still access their funds.

Liquid staking lets users lock their assets while retaining access, enabling multiple revenue streams. They can use the liquid versions on DeFi protocols and earn more on their deposits. You can exchange your liquid staking tokens for the original token if you want to exit.

According to DeFiLlama, the TVL in Liquid Staking Protocols is over $21.5 Billion with just shy of $15 Billion locked in Lido. On Solana, leading the charge is Marinade Finance with over $159 Million locked on their dApp.

If you aren’t aware about Marinade Finance or mSOL, then check out our blog on them here

How exactly does Liquid Staking work?

When users opt to stake their tokens, they receive a representation of their staked assets known as "Liquid Stake Tokens" (LSTs) or "Liquid Stake Derivatives" (LSDs).

In essence, this process can be seen as "staking without actually staking." Instead of directly staking their tokens, users deposit their assets into a third-party dApp, which then handles the process of staking those tokens into a validator node. As users engage in liquid staking, these dApps perform all the necessary calculations to select the most suitable validators.

In return, users are rewarded with a representative token, such as mSOL or bSOL, mirroring their deposits.

Benefits of Liquid Staking

Liquid staking tokens offer a host of advantages over your normal staking. Users can maximize their yield and maintain flexibility by earning rewards from staking while retaining access to their assets. These liquid tokens provide enhanced liquidity and accessibility, eliminating the need for lock-up periods and allowing for easy fund access and seamless participation in trading and DeFi activities.

Moreover, the risk of slashing incidents is reduced as delegated staking through dApps ensures a secure staking process. The inclusivity of liquid staking also encourages more users to actively participate, leading to increased network participation and strengthened security.

Additionally, liquid staking tokens fuel the growth of DeFi innovations by integrating with other protocols, creating new opportunities for users to explore and optimize their financial strategies.

Top Solana Liquid Staking Protocols

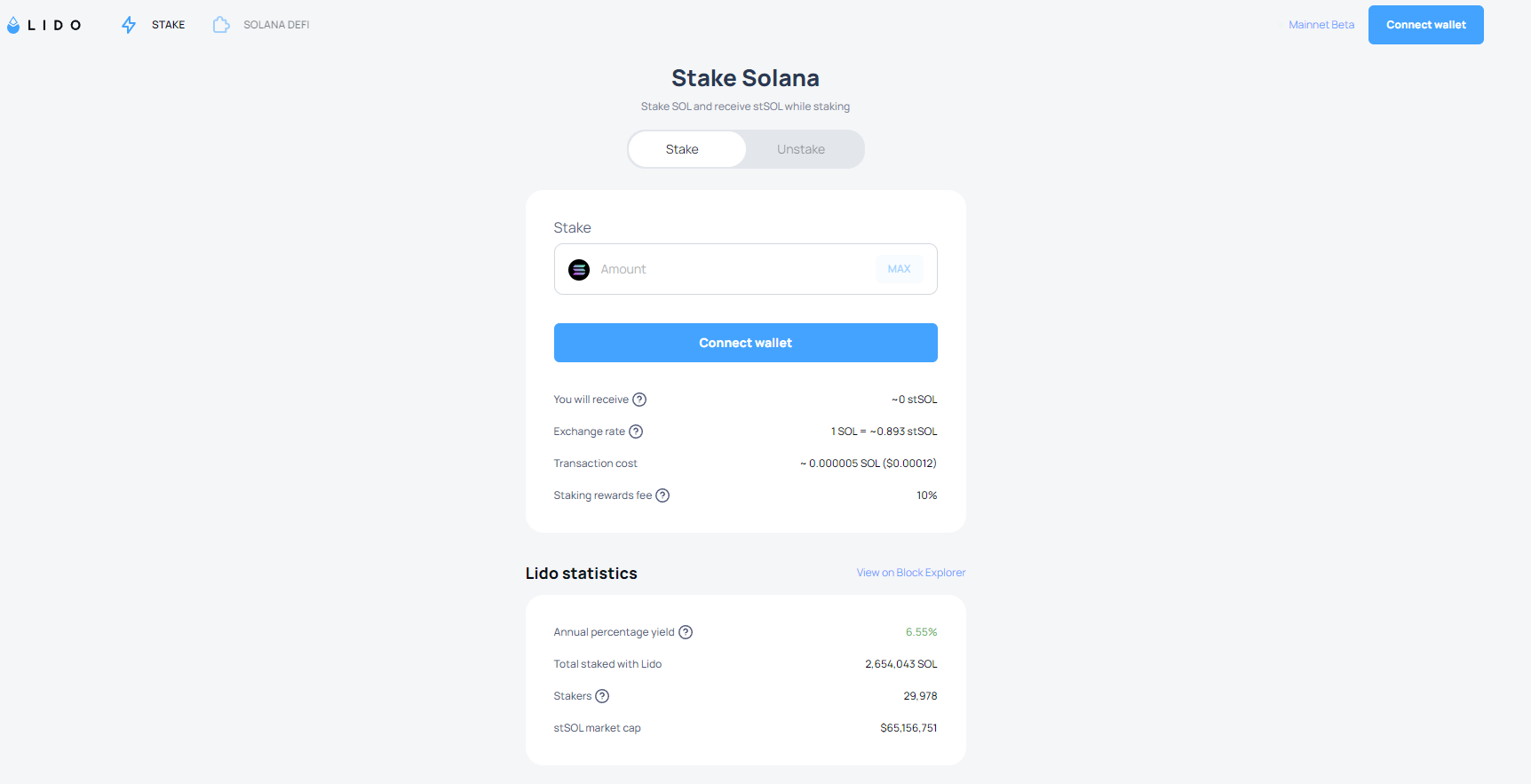

And with all that said about Liquid Staking Tokens or LSTs or LSDs, you must be wondering, where on Solana should I go for to get some Liquid Staking tokens. While, you can definitely swap your SOL or USDC to mSOL , bSOL etc., it’s more beneficial to the ecosystem if you stake your SOL to redeem the Liquid Staked Solana as it helps make Solana more secure. A few top Liquid Staking protocols are Marinade , Lido , Jito and finally SolBlaze.

While these protocols are among the top choices for liquid staking, users must conduct research and understand the associated risks before engaging with any dApps. Vigilance and due diligence are vital in DeFi and liquid staking ventures.

Frequently Asked Questions (FAQs)

What is liquid staking?

Liquid staking refers to the process of staking proof-of-stake or PoS tokens while still maintaining their liquidity. In PoS networks, participants lock up their tokens as collateral to support network security and consensus mechanisms. However, liquid staking allows token holders to access the benefits of staking, such as earning staking rewards, while also having the flexibility to trade or use their staked tokens without any waiting period or restrictions.

What is an example of liquid staking?

An example of liquid staking is when users stake their $SOL to secure the Solana blockchain. Instead of locking up their $SOL however, they can opt for a liquid staking solutions that provide them with wrapped or tokenized versions of their staked SOL like mSOL. These tokenized assets can be traded or used in DeFi protocols, offering liquidity and flexibility to users.

Is Liquid Staking good?

Liquid staking offers several advantages to token holders. It allows them to earn staking rewards while having access to the liquidity of their staked assets. This means that users can continue to participate in the broader crypto ecosystem, trade, or use their staked tokens without any hindrance. Liquid staking also mitigates the issue of "staking lock-up," making it an attractive option for those seeking both staking rewards and flexibility.

Is liquidity staking risky?

While liquid staking provides additional liquidity, it's essential to be aware of the potential risks involved. One of the primary risks is smart contract vulnerabilities in the liquid staking platforms, which could expose users to potential hacks or exploitation. Additionally, participating in liquid staking might involve counterparty risks if the staking provider is not adequately secured or reputable. It's crucial for users to research and choose reliable and secure liquid staking solutions to minimize potential risks.

Conclusion

In this blog, we explored the world of Liquid Staking Tokens (LSTs) or Liquid Staking Derivatives (LSDs) and how they have evolved the DeFi ecosystem. Liquid Staking offers a groundbreaking solution, allowing users to stake their tokens while maintaining liquidity and access to their assets. With increased yield opportunities and reduced slashing risks, Liquid Staking provides enhanced flexibility and participation in DeFi activities. Top protocols like Marinade , Lido , Jito and SolBlaze have become prominent choices for liquid staking on the Solana blockchain.

However, users must conduct thorough research and exercise caution when engaging with any dApps. As the crypto space continues to evolve, Liquid Staking holds the potential to unlock new opportunities and contribute to the growth of the DeFi ecosystem. Embrace the world of Liquid Staking because it is not going anytime soon.

Stay Tuned with #GooseAcademy

Website | Twitter | Telegram | Discord | Docs

Disclaimer: The statements, proposals, and details above are informational only, and subject to change. We are in early-stage development and may need to change dates, details, or the project as a whole based on the protocol, team, legal or regulatory needs, or due to developments of Solana/Serum. Nothing above should be construed as financial, legal, or investment advice.

![Top 6 Chart Patterns for Crypto Trading [Guide]](/content/images/size/w720/2024/07/Top-trading-patterns.png)

Comments ()