What are CLMMs? [ Concentrated Liquidity Market Makers ]

Discover how CLMMs revolutionize liquidity provision, compare them to traditional AMMs, and get a step-by-step tutorial for Raydium's CLMM Pools.

![What are CLMMs?

[ Concentrated Liquidity Market Makers ]](/content/images/size/w1200/2023/09/CLMM-GooseFX.png)

Table of content

Introduction

You might have seen this term "CLMM" thrown around quite a bit recently with Kamino Finance taking it one step further by introducing their Creator Vaults to provide even more freedom for LPs when providing liquidity.

DeFi's liquidity landscape needs a change

— Kamino Finance (@Kamino_Finance) August 24, 2023

Until now, LPs had to choose between complex, manual position management - or automated LP solutions that allow 0 user freedom

Today, we launch Kamino Creator Vaults: a permissionless liquidity management primitive for @solana🧵 pic.twitter.com/WUD5NYLsSS

In this blog, we'll be diving into the basics of AMMs, understand what CLMMs are, how are they better than traditional AMMs and much more!

Let's jump straight into it!

What are Automated Market Makers?

In simple language, Automated Market Makers or AMMs for short are the models that help match buyers to sellers on a decentralized exchange. They are smart contracts allowing users to swap tokens on decentralized exchanges without any intermediary.

Unlike centralized exchanges like Binance, DEXs don't run on CLOB or Orderbook Model where the exchange acts as the middleman to match buyers and sellers. Rather. users trade against a liquidity pool which is facilitated via AMMs.

Liquidity Pools are, well, pools of liquidity formed by LPs or Liquidity Providers depositing a pair of assets like SOL-USDC. They are the foundation of any AMM. A big liquidity pool is crucial for any DEX as it helps reduce slippage. Slippage is price deviation in AMMs caused by low liquidity, resulting in unfavorable trade execution

Check out our older blog where we cover all the basics of AMMs

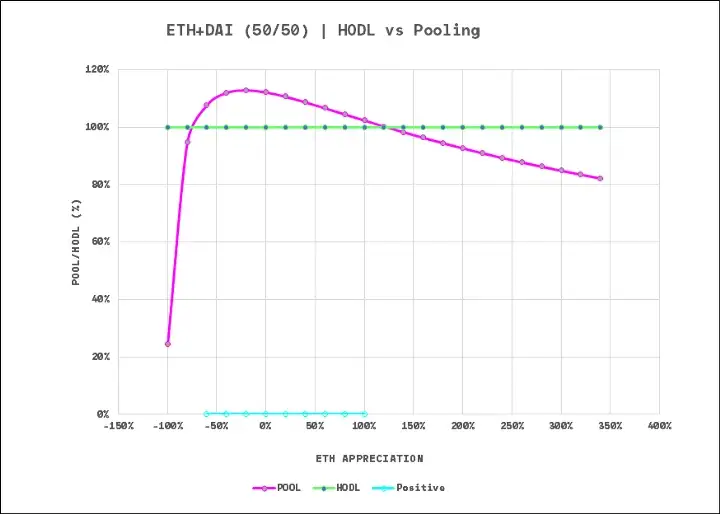

For providing liquidity, LPs are rewarded a fraction of fees per trade and this process is known as Yield Farming. However, sometimes this isn't enough to outweigh the losses due to Impermanent Loss which is the primary risk associated with providing liquidity.

Check out our blog to learn more about Impermanent Loss

Solution to the problem: CLMMs

To tackle the issue of Impermanent Losses and Slippage, new models popped up including Hybrid AMMs, dAMMs, PMMs and many more, one of which is CLMM introduced by Uniswap in their v3.

Let's understand what it is and how does it work.

Curious about traditional AMM models and how they function? Click the link to know more!

Concentrated Liquidity Market Maker or CLMMs as stated were introduced by Uniswap that allowed a user to set a specific price range in which they would like to provide liquidity. This meant that the tokens are provided in tighter ranges at or around the current market price thereby increasing capital efficiency as opposed to traditional AMM models. It also meant that LPs can now earn more on their liquidity than before thereby reducing capital risk for them.

A CLMM model breaks a price range into ticks and distributes the capital evenly across all the ticks in the price range mentioned. A tick is the smallest unit of price change.

If for example, SOL-USDC is trading at 19.84, then 1 tick would be equal to 0.01 USDC as that is the smallest possible price change either side for SOL-USDC.

While CLMMs does help improve the capital efficiency, it also comes with it's own set of cons. Providing liquidity in CLMMs requires you to constantly manage your position which could be an intensive task for an average user who'd simply like to earn yield on his assets.

Tutorial - How to deposit liquidity on Raydium

Adding Liquidity

Now that we've covered everything there is to CLMMs, in this section we'll be doing a step by step tutorial on how you can deposit liquidity into Raydium's CLMM Pools.

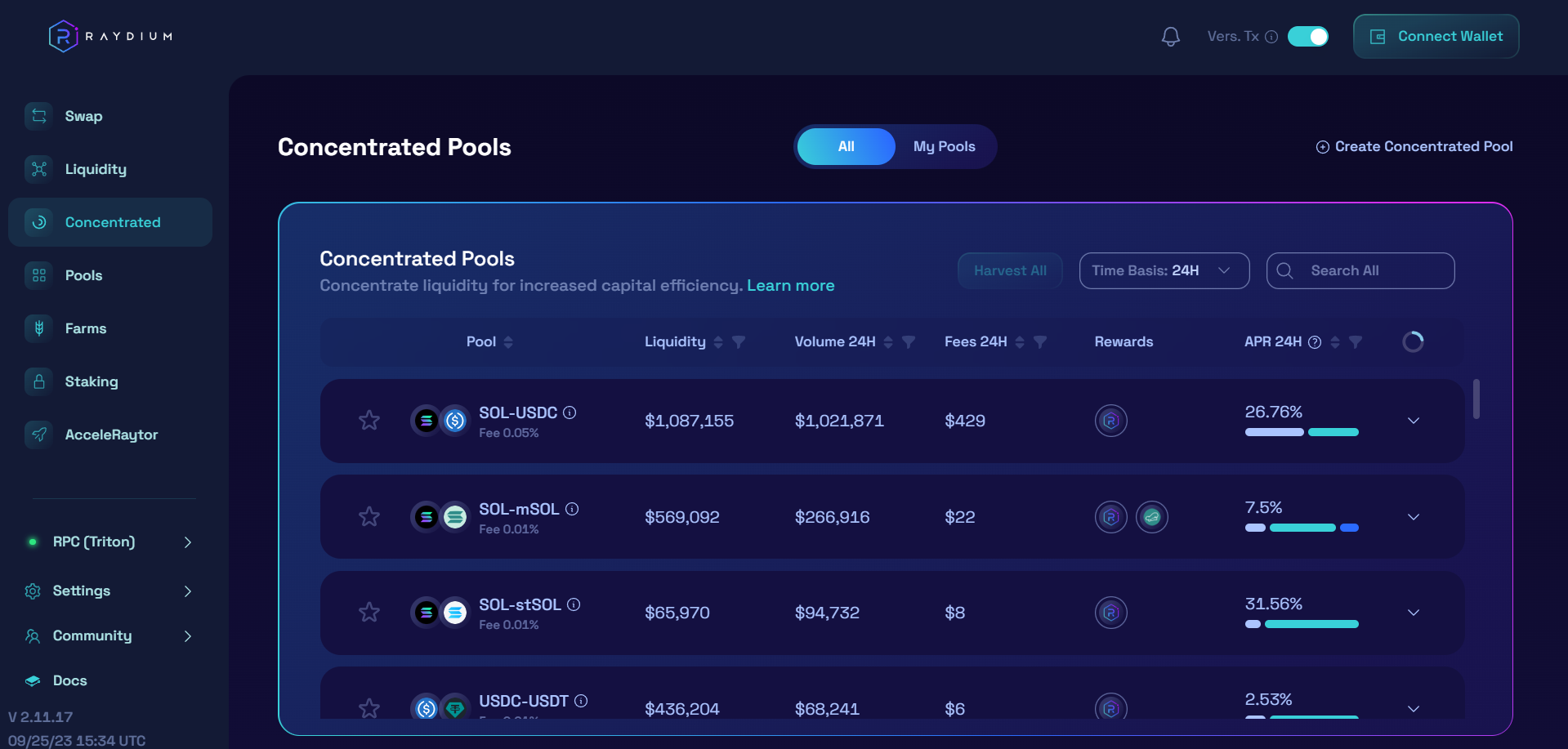

First, visit their website. Upon opening this link, you'll be greeted with this page.

Now, browse through their wide variety of pools and select which pool you'd like to provide liquidity on.

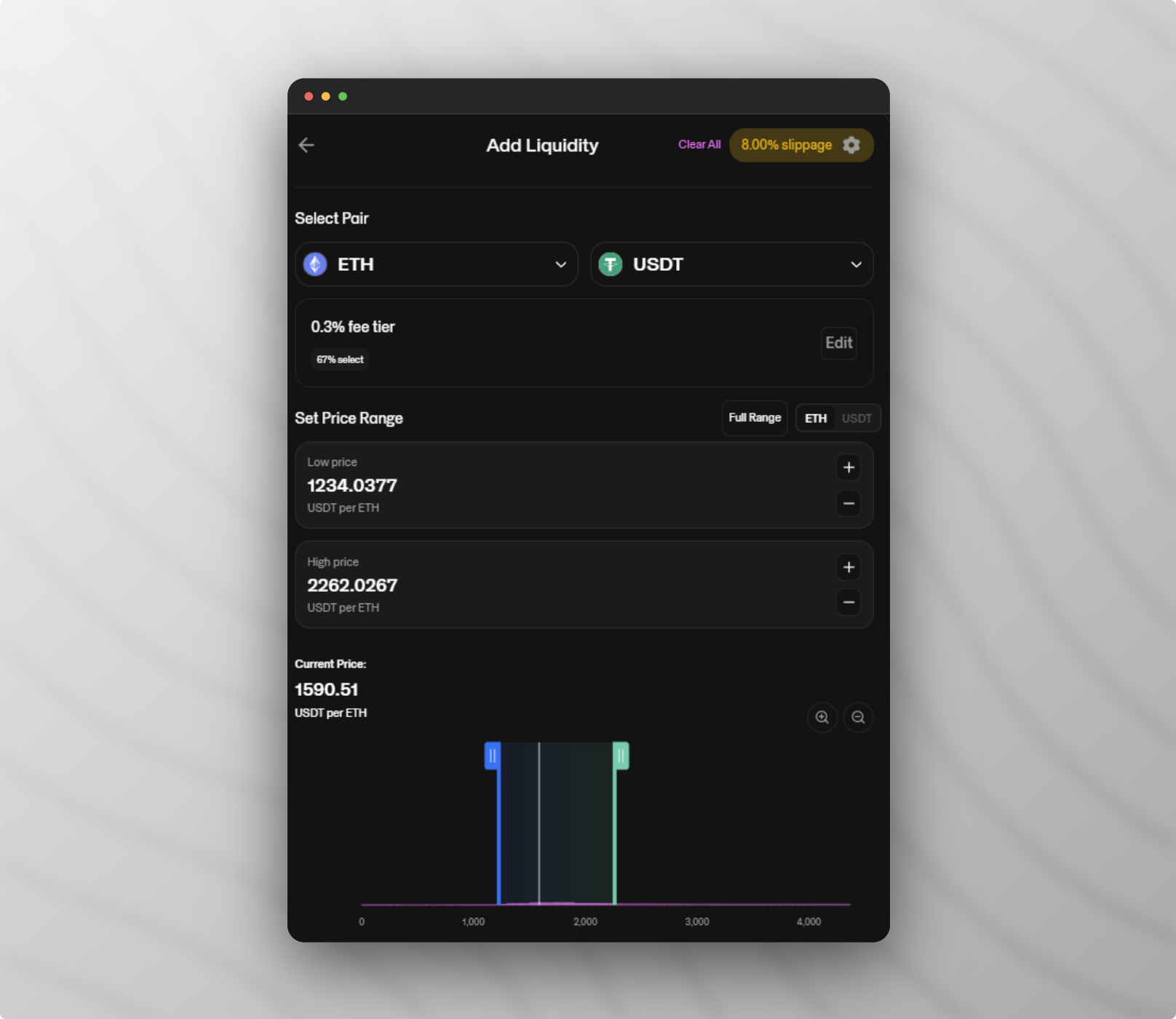

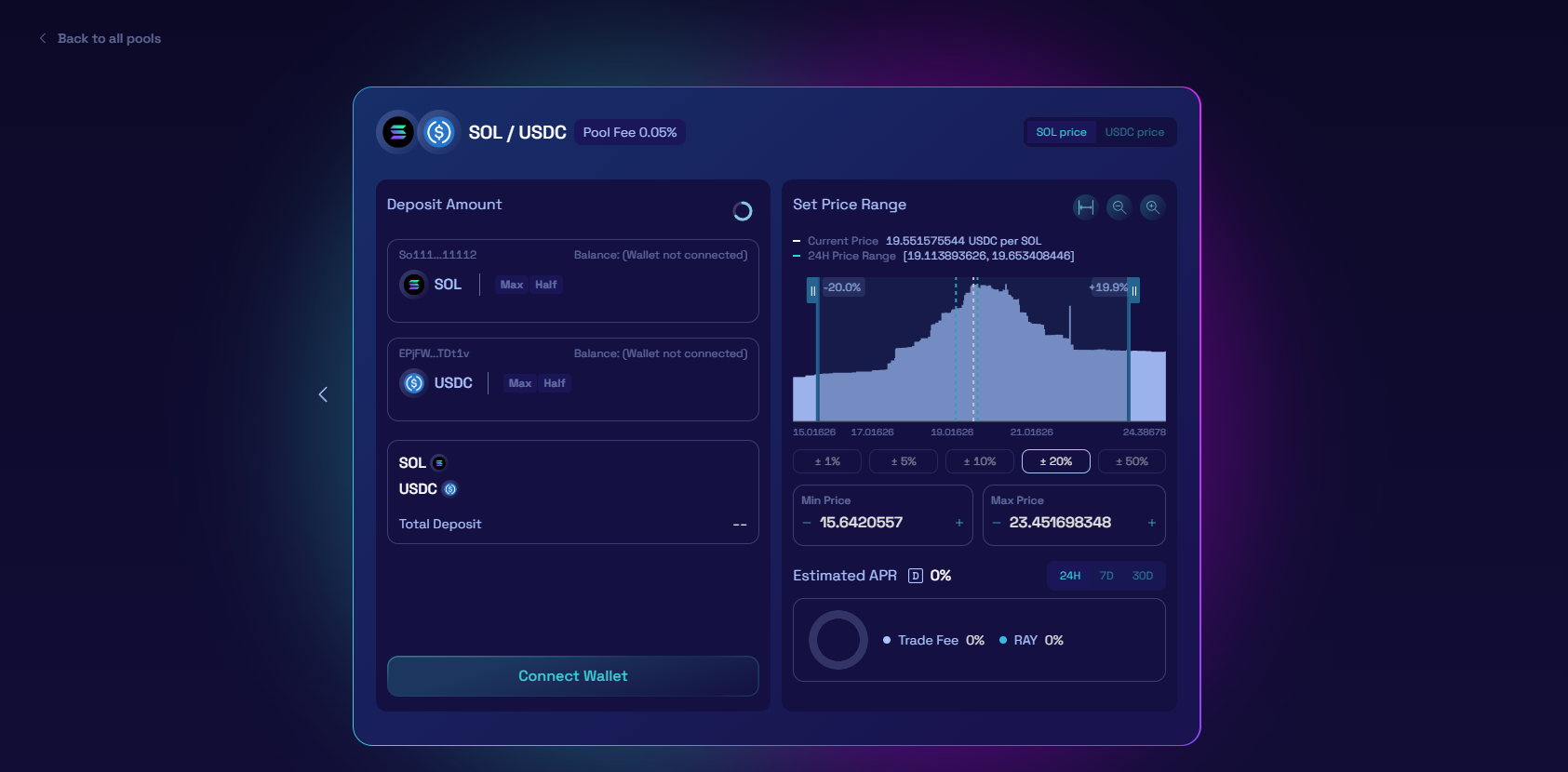

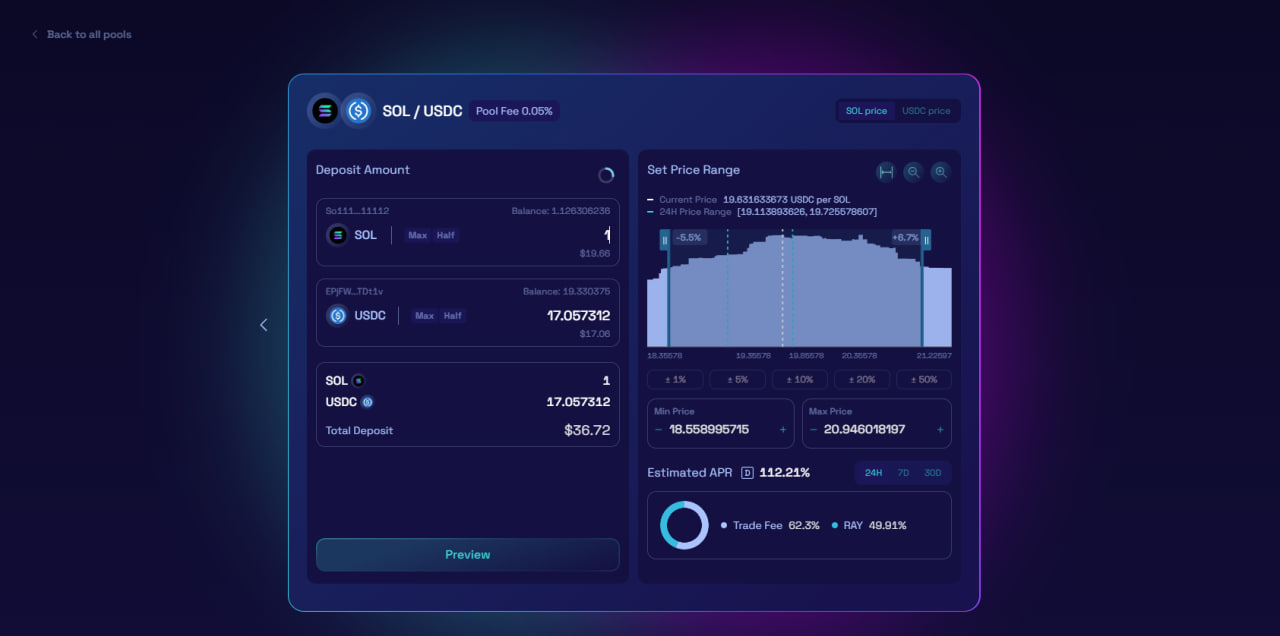

For this example, we'll be introducing a character called Mon (Definitely not Nom) who will be depositing liquidity in Raydium's SOL-USDC Pool. Once he clicks on this pool, he was asked to create a new position. Upon clicking, he was greeted with this interface.

Now, to proceed further, Mon types 1 SOL and the USDC amount automatically fills corresponding to his SOL amount given the asset ratio in the pool.

After selecting that, Mon plays around with the Price Range and sets this price range of 18.55 USDC to 20.9 USDC per SOL as where he would like to provide liquidity.

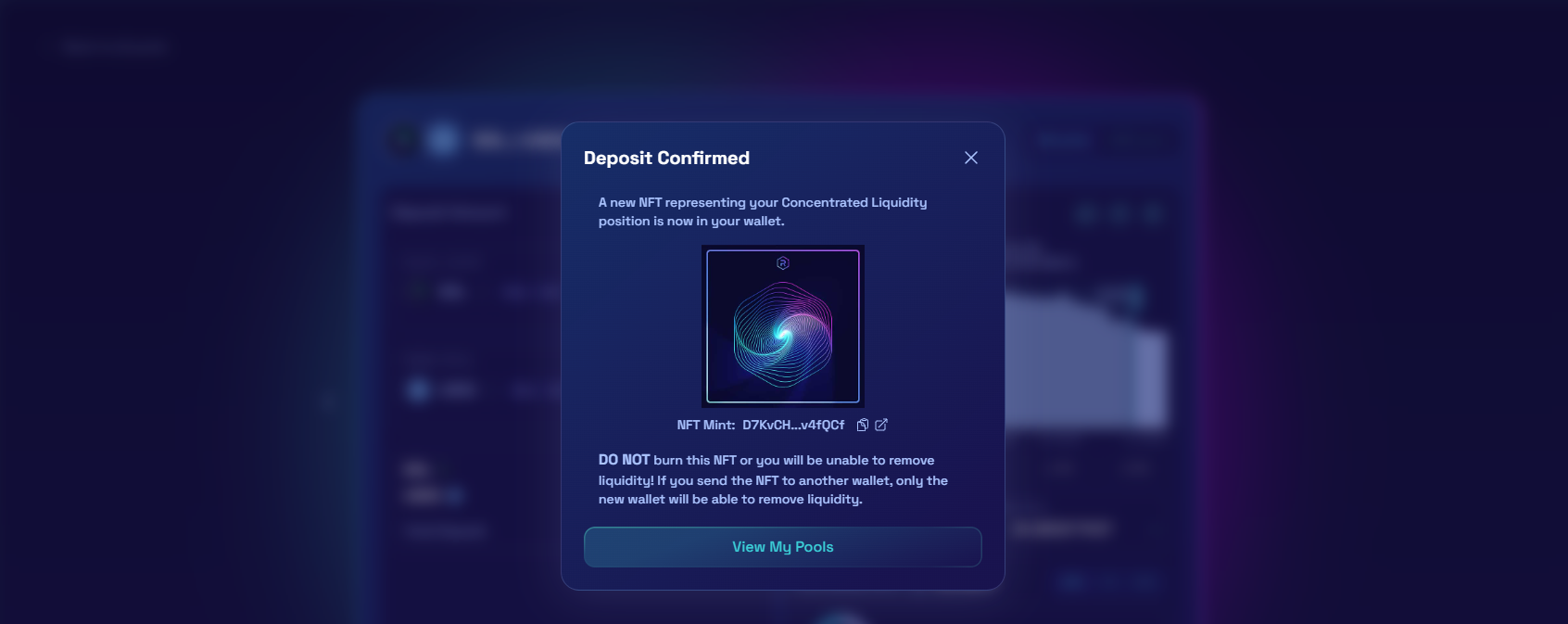

Upon previewing and confirming the transaction, Mon receives an NFT representing his position in this pool.

And Voila! Mon was able to deposit liquidity in SOL-USDC CLMM Pools on Raydium!

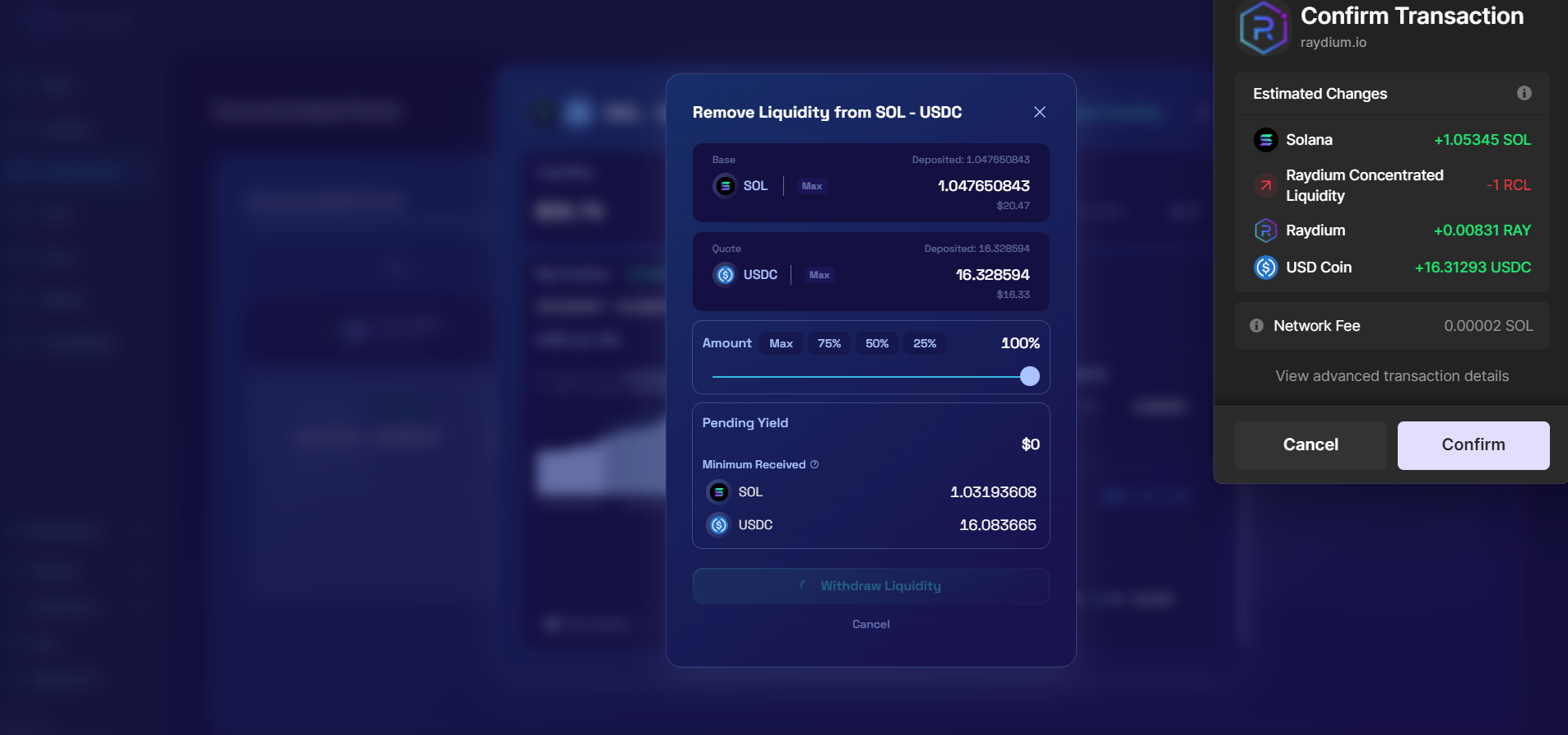

Removing Liquidity

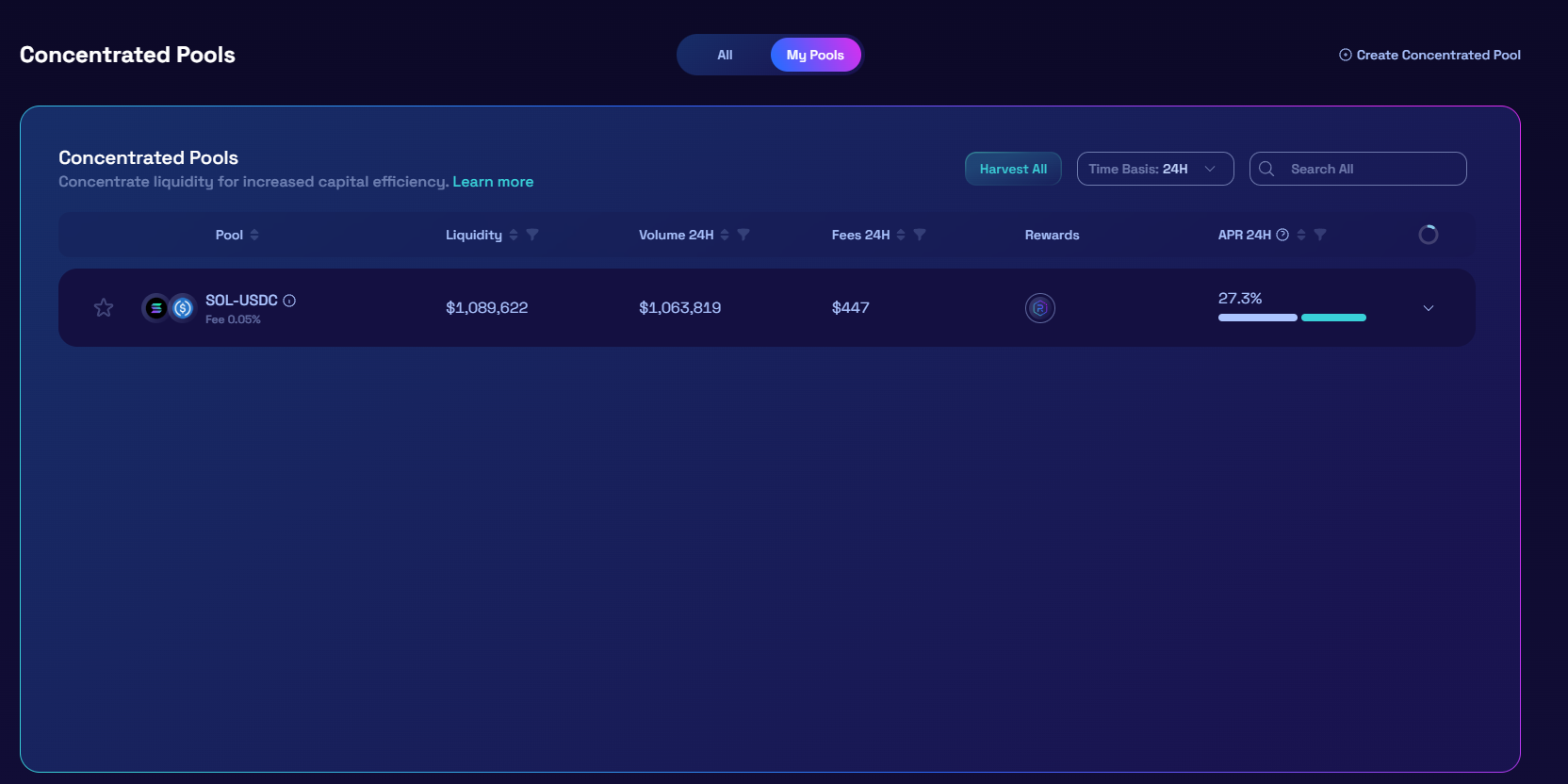

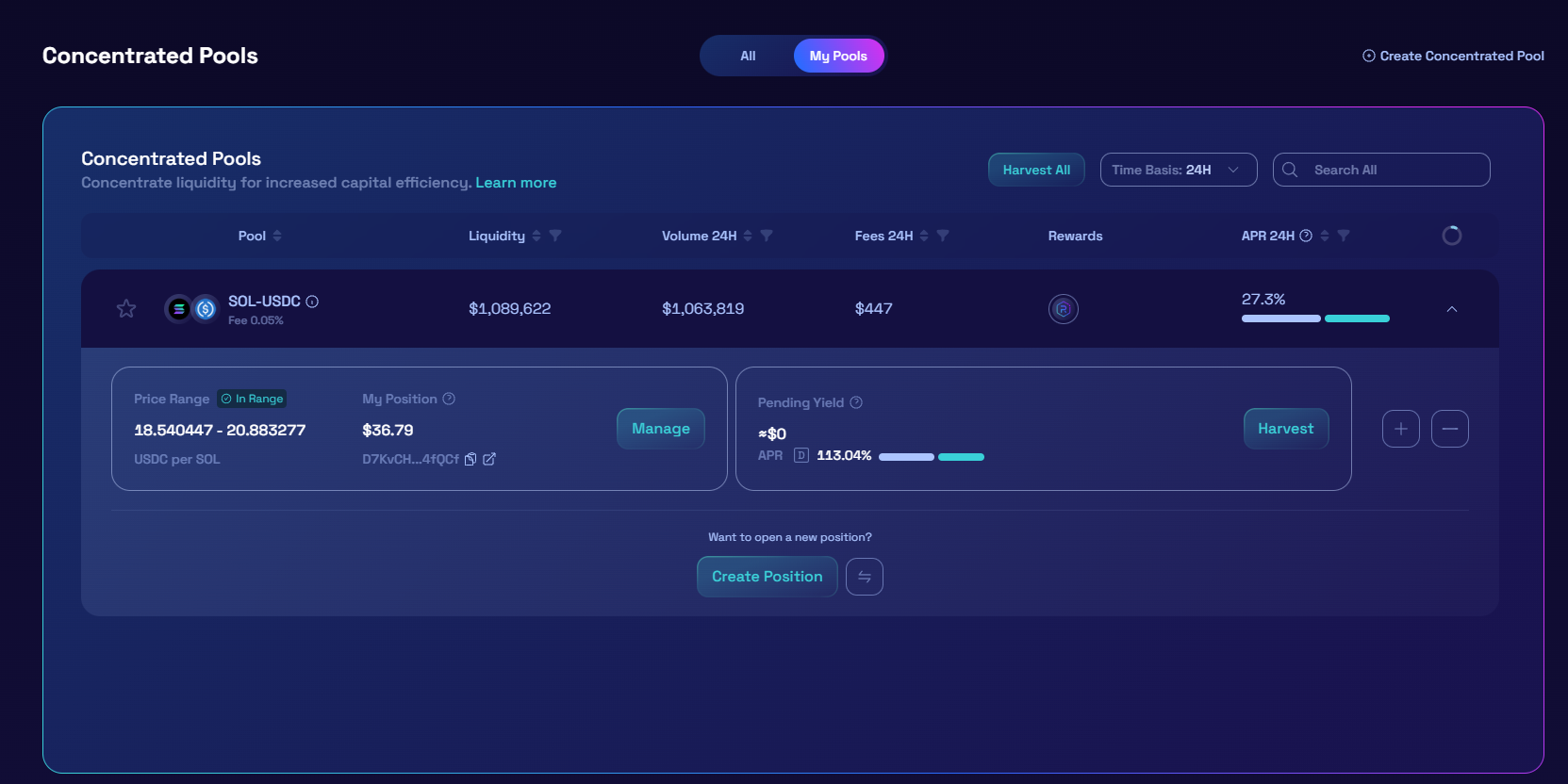

To remove liquidity, simply head over to My Pools section in the CLMM tab.

Click on the pool from which you'd like to withdraw. Head over to the Manage tab and you'll see an option to either Add or Remove liquidity on the top-right corner.

To withdraw, simply click on Remove liquidity, select how much amount you'd like to withdraw, approve the transaction in your wallet and Voila! You're all done!

Ending Thoughts

In this blog we saw how CLMMs are an innovative solution to challenges faced by traditional AMM Models as they offer tighter price range control for liquidity providers, increasing capital efficiency. We also looked at what slippages and Impermanent Losses are and how you can avoid them.

Finally, we went through a small tutorial about how you can add liquidity into Raydium's CLMM Pools.

You can also check out our previous blogs to learn more about the World of DeFi!

Till next time, Happy Farming!

Stay Tuned with #GooseAcademy

Website | Twitter | Telegram | Discord | Docs

Disclaimer: The statements, proposals, and details above are informational only, and subject to change. We are in early-stage development and may need to change dates, details, or the project as a whole based on the protocol, team, legal or regulatory needs, or due to developments of Solana/Serum. Nothing above should be construed as financial, legal, or investment advice.

Comments ()