What is Fair Value Gap (FVG) Trading Strategy | GUIDE

Unlock the secret to Fair Value Gap (FVG) trading. Explore market inefficiencies, discover profit potential, and master risk management. Whether you're new to trading or a seasoned pro, FVG can be your path to exciting opportunities!

Welcome to the world of Fair Value Gaps or FVGs as they're commonly referred to, a concept that can help you improvise your trading prowess. In this blog, we will simplify FVG, making it easy to understand and use in your trading strategy.

Why is this important?

Trading can be challenging, and traders are always on the lookout for strategies or concepts that can help them trade these markets. FVG is one such concept that has gained popularity in recent years. It's a concept that helps traders identify market inefficiencies or imbalances and make use of them.

Upon reading this blog, you'll have a clear grasp of what FVG is, how it works, and how you can use it to your advantage in trading through some uncertain market conditions. So, let's dive in and demystify the concept of Fair Value Gaps.

What is Fair Value Gap (FVG)?

At its core, FVGs could be thought of as a price magnet. It's a concept that helps traders identify moments when the market is a bit out of balance, creating opportunities for profit.

Think of FVG as a temporary imbalance in the market, where buying and selling are not equal. This imbalance often occurs after a significant price move.

Illustrating the Concept

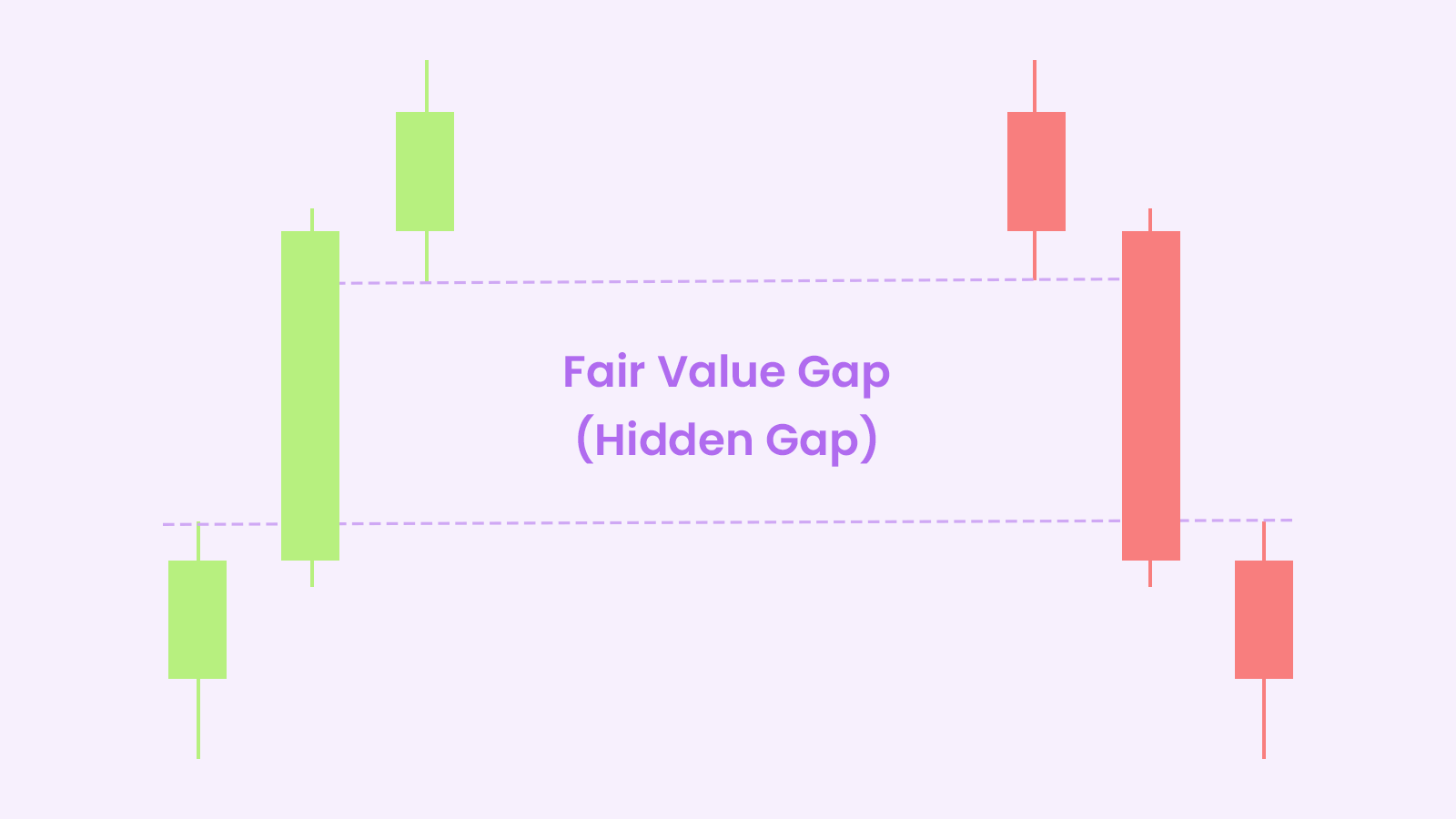

Let's visualize this with a simple diagram. Picture a candlestick chart representing a market's price movement. Suddenly, there's a big jump in price, creating a gap. This gap is the Fair Value Gap. It's the space between the candle prior to the impulse and the next candle after the said impulse.

Meet Alice and Bob

To make it relatable, let's introduce Bob who's a passionate FVG trader. He opens his charts and sees a FVG on 1 Hour timeframe. He sets a long order at the end of the FVG and stops below the other end of the FVG as shown below.

He then waits patiently allowing price to retrace back to his pre-defined entry and he takes profits at some arbitrary region. Following a pre-defined entry and exits whether that's a Stop Loss or Take profit allows Bob to not seep any emotion into his trading ensuring proper risk management.

Be like Bob, anon. Risk management is much more important than where you enter - CryptoCred

How Does FVG Trading Work?

Now that we've grasped the basic idea of what FVG is, let's dive deeper into how FVG trading works.

- Market Inefficiencies and Imbalances

The trading world, inefficiencies and imbalances occur when there's an unequal distribution of buying and selling pressure. This can happen for various reasons, such as unexpected news, large institutional trades, or simply due to market psychology.

Identifying Fair Value Gaps

Now that we understand the principles behind Fair Value Gap (FVG) trading, it's crucial to know how to identify these gaps in the real world of trading. This section will walk you through the methods of spotting FVG, including both manual and indicator-based approaches.

How to Identify FVG

Identifying FVG is like having a treasure map and recognizing the "X marks the spot." Here's how traders can do it:

- Manual Method: Some traders prefer the hands-on approach. They scan through price charts, looking for a specific pattern called the "triple-candle pattern." This pattern involves a large candle with the previous and subsequent candles' highs and lows not fully overlapping the large candle. The space between these wicks is the Fair Value Gap. It's like searching for hidden clues in a puzzle.

- Indicator-Based Method: For those who prefer a more automated approach, there are FVG indicators available. These indicators are like having a treasure detector. They highlight Fair Value Gaps automatically on the trading chart, making them easier to spot. It's a bit like having a guide to point you in the right direction.

To make things even clearer, let's look at some real trading charts with actual Fair Value Gaps highlighted.

In this chart, we can see a Fair Value Gap highlighted between the wicks of the large candle via an FVG Indicator.

Identifying Fair Value Gaps is your first step in navigating the world of FVG trading. Once you've identified them, you can start planning your trading strategy to capitalize on these market imbalances.

FVG Trading Strategy

Now that we've learned how to identify FVGs, it's time to explore how to turn this knowledge into a successful trading strategy. In this section, we'll describe the basic steps involved in an effective FVG trading strategy, highlight the importance of discipline, and discuss essential risk management techniques.

Steps in FVG Trading Strategy

- Identification: Identify a Fair Value Gap on a trading chart, either manually or with the help of an FVG indicator.

- Observation: Once spotted, observe the market carefully. Pay attention to the direction of the prevailing trend.

- Wait Patiently: Wait for the price to revert back towards the Fair Value Gap, signaling the clearing of the imbalance.

- Entry: When the time is right, enter a trade. If the FVG is created during an upward move, consider a long position. If it forms during a downward move, think about a short position.

- Stop-Loss Orders: Set stop-loss orders to limit potential losses.

- Exit: When the market moves in the desired direction and the imbalance is cleared, exit the trade and take your profits.

Risk Management Techniques

- Setting Stop-Loss Orders: Think of these as your safety nets. They automatically sell your position if the market moves against you beyond a certain point, limiting your losses.

- Position Sizing: Determine the size of your trade relative to your overall capital.

- Risk-Reward Ratio: Assess the potential reward against the risk before entering a trade.

In the end, FVG trading is nothing without a proper risk management strategy and having an effective and sound exit plan. Having a well-defined strategy, the discipline to stick to it, and effective risk management techniques helps you to protect your capital.

Pros and Cons of FVG Trading

Understanding the advantages and disadvantages of Fair Value Gap (FVG) trading is crucial. Let's explore the pros and cons in a simple table format and discuss how these factors can influence traders' choices.

| Advantages (Pros) | Disadvantages (Cons) |

|---|---|

| 1. Profit Potential: When executed correctly, FVG trading can yield substantial profits. | 1. Risk of Misjudgment: FVG trading assumes that the market will reverse after filling the gap, but it doesn't always happen, leading to potential losses. |

| 2. Reduced Risk: FVG trading focuses on identifying market inefficiencies, making it less risky than other directional strategies. | 2. Market Volatility: Markets can be unpredictable, and even small price movements can result in significant losses for FVG traders. |

| 3. Flexibility: This strategy can be applied to various assets, including stocks, bonds, commodities, and crypto currencies. | 3. Limited Opportunities: FVG trading opportunities may be scarce in highly efficient markets. |

In summary, FVG trading offers both advantages and disadvantages. While it can be a profitable strategy when executed correctly, traders must be prepared for potential risks and challenges. Being informed about these pros and cons empowers traders to make well-informed decisions and adapt their strategies based on market conditions.

Scanning for Fair Value Gaps

In this section, we'll uncover the techniques traders can employ to scan for Fair Value Gaps (FVG) using price action criteria. We'll emphasize the significance of custom scans and provide a step-by-step guide or checklist to streamline your FVG scanning process.

How to Scan for FVG

- Price Action Criteria: Scanning for FVG begins with a keen eye for price action. Look for the telltale signs of a triple-candle pattern on your trading charts. Remember, this pattern consists of a large candle with the highs and lows of the preceding and succeeding candles failing to fully overlap the large candle. This is the first clue in your search.

- Custom Scans: To enhance your FVG scanning capabilities, consider employing custom scans or screeners. These tools can be like having a magnifying glass to pinpoint specific FVG setups in a vast sea of price data. Custom scans can be tailored to your preferred timeframes, asset classes, and trading strategies.

Step-by-Step Guide for Scanning FVG

Here's a simplified step-by-step guide or checklist to streamline your FVG scanning process:

- Select Your Assets: Determine the assets you want to trade and focus your scan on those markets. Whether it's stocks, crypto currencies, or commodities, clarity in your choices is key.

- Choose Timeframes: Decide on the timeframes you're comfortable with. Are you a day trader looking at shorter intervals, or do you prefer longer-term trends? Your choice will dictate your scan parameters.

- Identify the Triple-Candle Pattern: As you scan through price charts, keep an eye out for the triple-candle pattern. Remember, it's a large candle flanked by two smaller candles that don't fully overlap with it.

- Utilize Custom Scans: If available, use custom scans or screeners to narrow down your search. These tools can help you identify FVGs more efficiently.

- Verify FVGs: Once you've identified potential FVGs, verify them using additional technical analysis. Check for confirmation signals such as support and resistance levels, trend indicators, or other relevant chart patterns.

- Evaluate Risk-Reward: Before entering any trades based on FVGs, assess the risk-reward ratio. Ensure that the potential reward justifies the risk you're taking.

- Execute Your Strategy: If all criteria align, execute your FVG trading strategy. This may involve entering positions, setting stop-loss orders, and managing your trades according to your plan.

- Monitor and Adapt: Continuously monitor your positions and adapt as needed. FVGs may evolve over time, and market conditions can change, so staying vigilant is essential.

By following this step-by-step guide and incorporating custom scans into your trading routine, you can enhance your ability to spot FVGs efficiently and make well-informed trading decisions. Remember that practice and experience play a significant role in refining your scanning skills over time.

Conclusion

In conclusion, this journey through the world of Fair Value Gaps (FVG) trading has provided valuable insights into a strategy that can potentially unlock profitable opportunities in the financial markets. Let's recap the key takeaways and reiterate the importance of understanding FVG for trading success.

Key Takeaways

- Fair Value Gaps are market inefficiencies or imbalances that traders can identify on price charts, often appearing as a triple-candle pattern.

- FVG trading involves a step-by-step strategy, from identification and observation to entry and risk management.

- Traders can benefit from FVG trading's profit potential, reduced risk, and flexibility across various asset classes.

- However, it's essential to be aware of the risk of misjudgment, market volatility, and limited opportunities in some markets.

By understanding and mastering this strategy, you can uncover hidden opportunities, mitigate risks, and potentially achieve trading success. So, set sail on your FVG trading journey, and may your endeavors be as rewarding as a treasure hunt in uncharted waters.

Stay Tuned with #GooseAcademy

Website | Twitter | Telegram | Discord | Docs

Disclaimer: The statements, proposals, and details above are informational only, and subject to change. We are in early-stage development and may need to change dates, details, or the project as a whole based on the protocol, team, legal or regulatory needs, or due to developments of Solana/Serum. Nothing above should be construed as financial, legal, or investment advice.

![Top 6 Chart Patterns for Crypto Trading [Guide]](/content/images/size/w720/2024/07/Top-trading-patterns.png)

Comments ()