Beta Assets and Portfolio Diversification

Beta assets track underlying assets, reducing risk & increasing returns by diversifying portfolios. Consider stability, liquidity, returns, & regulations when investing in beta assets to minimize risk & maximize long-term returns.

Table of Content

- Introduction

- What are Beta Assets

- How can Beta help in diversifying your portfolio?

- Factors to keep in mind when diversifying your portfolio

- Conclusion

Introduction

Trading can be a thrilling journey, but it also involves some risk and uncertainty. To minimize your risk, one of the best ways is diversification.

In this blog, we'll explore the concept of beta assets and how they can help you achieve a well-balanced portfolio. We'll provide an overview of a Beta asset, how it behaves compared to the market, and why it matters in your investment strategy. By the end of this blog, you'll have a better understanding of how beta assets can add value to your portfolio and help you make informed decisions.

So buckle up and get ready to learn about the power of beta assets and how they can help you diversify your portfolio.

What are Beta Assets?

Beta assets are currencies or tokens designed to track the price movements of a particular underlying token. The term "beta" refers to the volatility of an asset relative to the overall market. In other words, Beta assets aim to capture an underlying asset's performance while reducing the investment's overall risk.

You must have heard multiple times that if Bitcoin or BTC pumps, ETH follows. It makes ETH a Beta asset for BTC. There are times when ETH has more volatility compared to BTC, and there are also times when ETH has less volatility compared to BTC. It is indicated by the number known as Beta (β).

Beta or β can have any value and is generally segregated under four columns.

- If β = 0, then it means that the asset is not correlated to the benchmark asset at all.

- If 0<β<=1, the asset is correlated to the benchmark asset. However, has less or equal volatility compared to the benchmark asset.

- If β>1, the asset has a higher degree of volatility than the benchmark asset.

- Finally, β can also assume a negative value implying that it is inversely correlated to the benchmark asset. If the asset's returns tend to move in the opposite direction of the market or the benchmark asset, its Beta will be negative. It means that when the market is down, the asset will likely go up, and vice versa. An example of this would be a leveraged token like BTCDOWN on Binance.

A leveraged token is a type of financial instrument that provides leveraged exposure to the price movements of an underlying asset. It uses leverage, to amplify the returns of the underlying asset. Examples of this include BTCUP and BTCDOWN on Binance as well as BTC3L or BTC3S tokens on Bybit implying a 3x leveraged long or short respectively on Bitcoin.

How to calculate Beta?

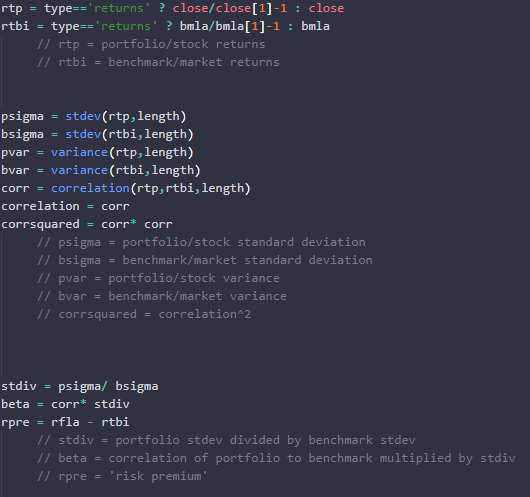

Taking the benchmark index as Bitcoin in this case, we can use the formula as:

Beta = Correlation (Token returns, Benchmark returns) * (Standard deviation of Benchmark returns) / (Standard deviation of Token returns)

Each of these variables can be found by finding the Token's returns and Bitcoin's returns over the same time period or length.

You can also see how you can calculate Beta on TradingView. This was personally used by Lil Goose (with different parameters)

How can Beta help in diversifying your portfolio?

Before we understand how it helps us diversify our portfolio, we must understand systematic and unsystematic risks.

Systematic risk is the risk that affects all investments across the market due to macroeconomic factors. This type of risk is often beyond the control of individual investors and cannot be diversified away. On the other hand, unsystematic risk refers to the specific risk to a particular industry or investment and can be managed through diversification. By spreading investments across a range of assets, investors can reduce the impact of unsystematic risk on their portfolios.

Beta measures systematic risk. The market usually expects fund managers to reduce unsystematic risk. As a result, investors only expect to be compensated for systematic risk. It is why Beta is so important for portfolio management and investment decisions.

Thus, Beta can help diversify a portfolio by giving insight into the volatility of an investment compared to the market as a whole. By understanding the Beta of different tokens in your portfolio, you can make informed decisions about balancing your portfolio to include both aggressive and defensive investments. It can help you mitigate risk and potentially increase returns.

By diversifying your portfolio and not relying solely on investments with high beta values, you can smooth out the ups and downs of the market and potentially achieve a more stable overall return on investment.

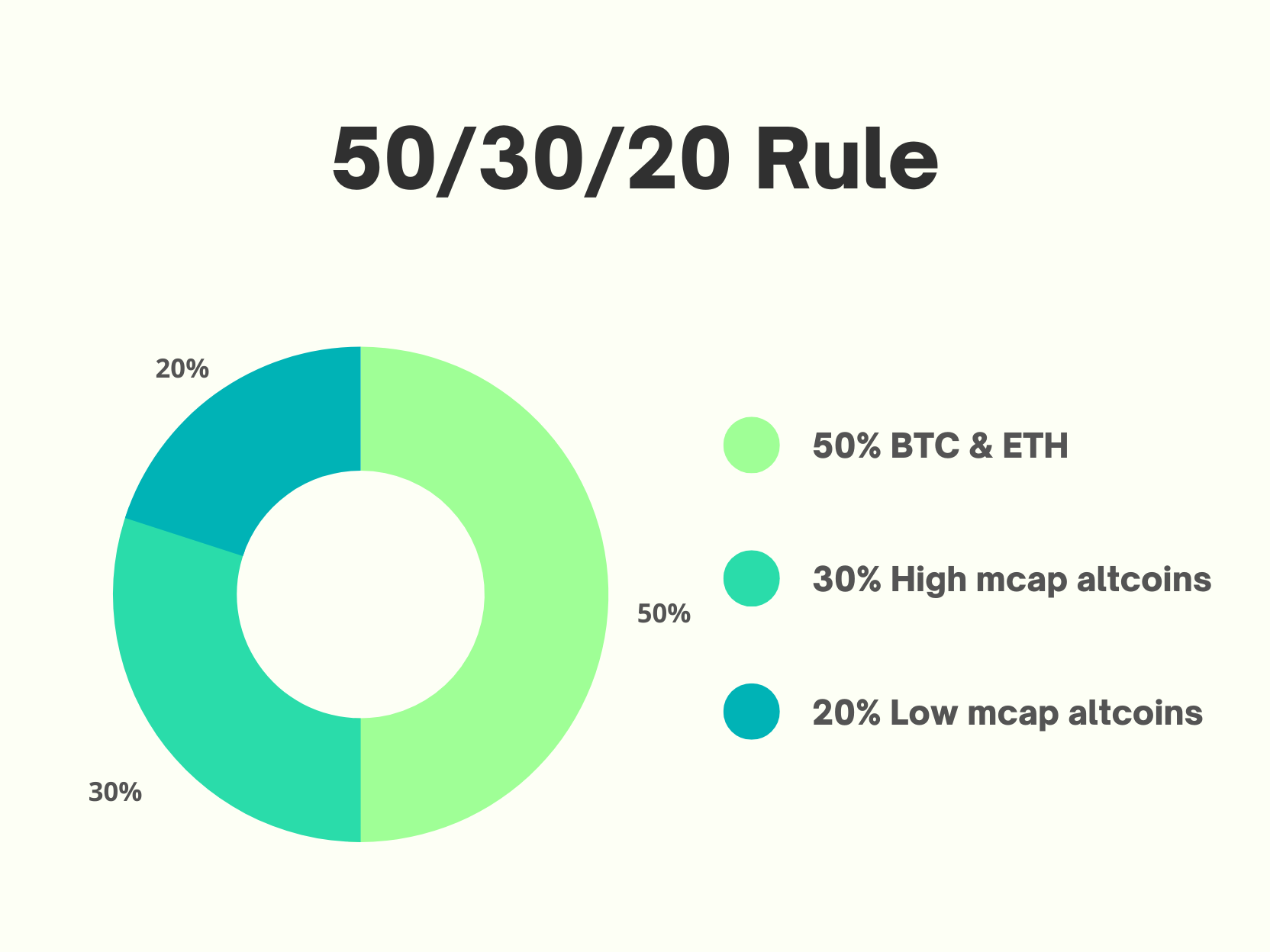

One of the most basic strategies people use is the 50/30/20 rule, where they allocate 50% to BTC and ETH, 30% too high market cap altcoins, and the rest 20% to riskier low market cap coins.

Regardless of your chosen strategy, it is essential to have a well-diversified portfolio that includes a mix of different assets to help minimize risk and maximize returns over the long term.

Factors to keep in mind when diversifying your portfolio

Investors must consider several key factors when selecting beta assets to ensure they make the most out of their investments.

- First, it's essential to consider the stability and security of the underlying asset. It means evaluating the overall health of the asset, its regulatory environment, and its track record of stability and growth.

- Second, it's essential to consider the liquidity of the asset, as well as its accessibility. It means looking at factors such as the size of its trading volume, the number of exchanges it is listed on, and the ease of buying and selling the asset.

- Third, it's essential to consider the returns offered by the asset. It means evaluating the asset's historical returns, expected returns, and growth potential.

- Fourth, when evaluating beta assets for your crypto portfolio, staying up-to-date with market trends and news is crucial. It means regularly monitoring news sources, engaging with online communities, and considering experts' opinions in the field.

- Fifth is to keep an eye on market sentiment and news related to the beta assets you are interested in. Positive sentiment and news can boost the price of an asset, while negative sentiment and news can have the opposite effect.

- Lastly, Incorporate a risk management strategy when evaluating beta assets. Consider the level of risk you are willing to take and choose Beta assets that align with your risk tolerance.

By carefully considering these factors, you can effectively identify Beta Assets that are well-suited to your portfolio and help to diversify your holdings and minimize risk.

Conclusion

In conclusion, Beta assets can play an important role in diversifying and maximizing your investment portfolio. Beta assets are those currencies or tokens that aim to capture the price movements of a particular underlying token while reducing the overall risk of the investment.

The beta value of an asset indicates its volatility relative to the overall market, with a beta of 0 meaning no correlation to the benchmark asset, 0 < Beta <= 1 meaning less or equal volatility compared to the benchmark, β > 1 indicating higher volatility, and a negative beta imply inverse correlation to the benchmark.

Understanding the Beta of different tokens in your portfolio can help you make informed decisions about balancing your portfolio to include both aggressive and defensive investments. It is vital to have a well-diversified portfolio that includes a mix of different assets to help minimize risk and maximize returns over the long term.

Stay Tuned with #GooseAcademy

Website | Twitter | Telegram | Discord | Docs

Disclaimer: The statements, proposals, and details above are informational only, and subject to change. We are in early-stage development and may need to change dates, details, or the project as a whole based on the protocol, team, legal or regulatory needs, or due to developments of Solana/Serum. Nothing above should be construed as financial, legal, or investment advice.

![Top 6 Chart Patterns for Crypto Trading [Guide]](/content/images/size/w720/2024/07/Top-trading-patterns.png)

Comments ()