GooseFX Synthetic Asset Trading Guide (Alpha Devnet Launch)

GooseFX is a full suite DeFi platform built on the Solana blockchain and Serum DEX, offering a variety of unique decentralized peer-to-peer…

GooseFX is a full suite DeFi platform built on the Solana blockchain and Serum DEX, offering a variety of unique decentralized peer-to-peer financial products.

The first of these synthetic products are tokenized crypto stocks. These pools will allow global users 24/7/365 access to any synthetic asset with corresponding pools. This guide was designed to help our users understand expected behavior and to assist with testing the alpha release of synthetic asset pools.

What are financial derivatives?

Derivatives are contracts between two parties where both parties are placing a bet on the price movements. These contracts are zero-sum meaning that one party will be long and the other party will be short the underlying asset.

How are Synthetic Assets created?

Synthetic assets are created by the protocol acting as the counterparty. In order for the assets to have value they must be backed by collateral. Thus, when a user mints a gToken they must deposit GOFX as collateral and are able to borrow up to 50% of their collateral value. When a user mints a gToken they are borrowing that synthetic asset from the pool and must repay that debt before they can remove their collateral.

For example, if GOFX is trading at $1 and you have deposited 100 GOFX, you then have $100 in collateral value which you may mint up to $50 worth of gTokens. Thus the collateral ratio (C-Ratio) requirement to mint synthetic assets on the protocol is 200%. Once a user’s C-ratio falls below 200% they can burn their debt or deposit more GOFX to increase their C-ratio. Users will be liquidated once the C-ratio falls below 120%.

Synthetic Assets use decentralized oracles in order to deliver real-time price feeds. As a result, users will experience zero slippage trading no matter how large the trading size is. In detail, users always buy and sell at the oracle price, and thus no need to worry about other users trading against you in a central limit order book (CLOB). A consistent price oracle feed of the tokenized asset is used for trading.

Let’s walk through an example using the GooseFX platform.

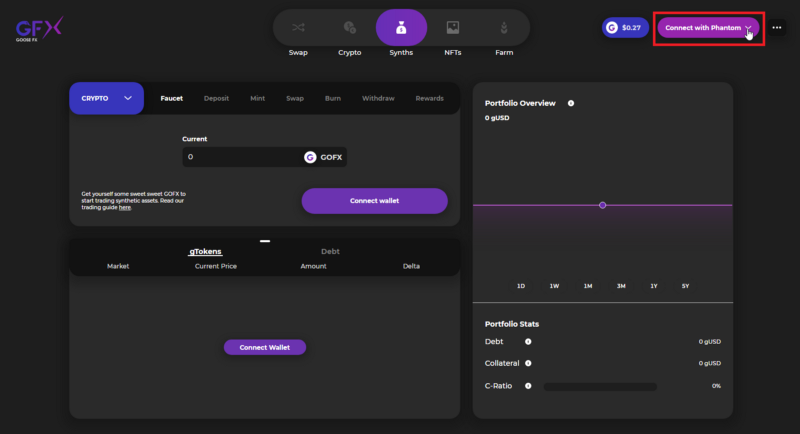

- Start by connecting your wallet. (we’ve tested with Phantom and Sollet but Solflare, Ledger, MathWallet, Solong, Slope and Torus should also work). After selecting the wallet of your choice please click “Connect…” again to connect.

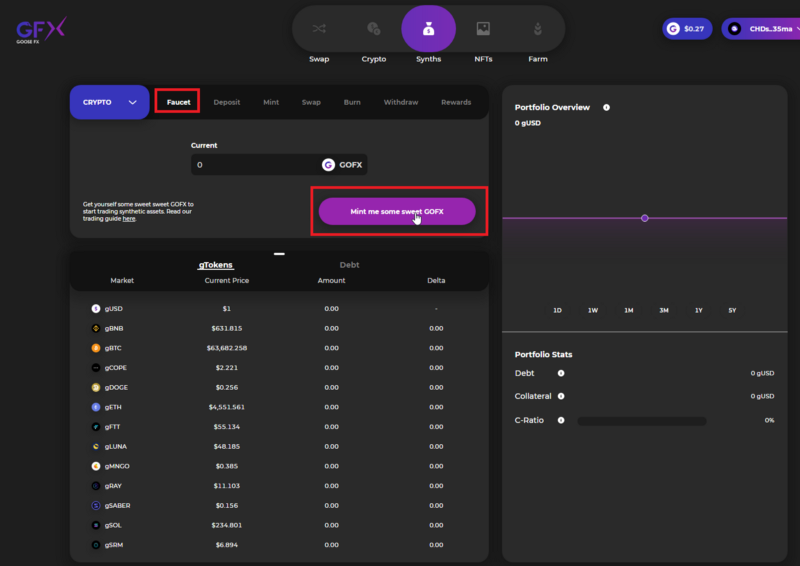

2. If you have not used the faucet before you can claim some DevNet GOFX token for testing. (reach out in discord if you cant use faucet.)

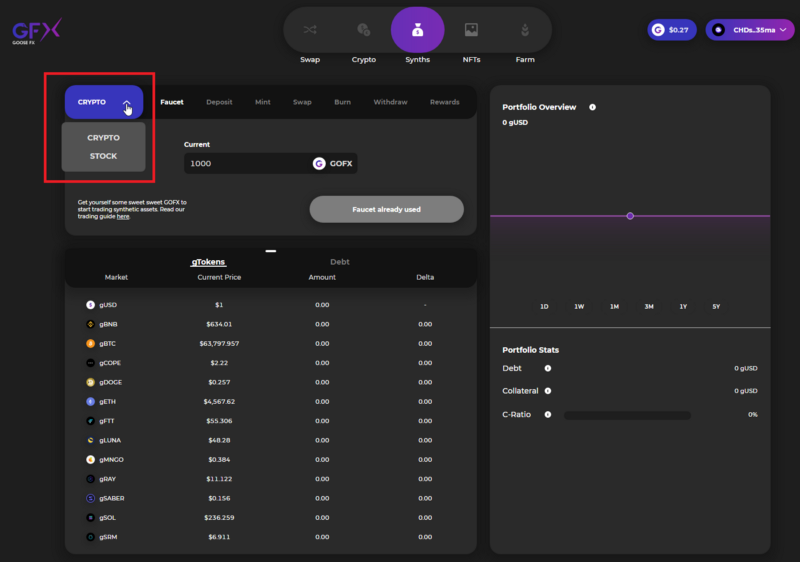

3. Use the pool selector drop down to select the pool you wish to interact with.

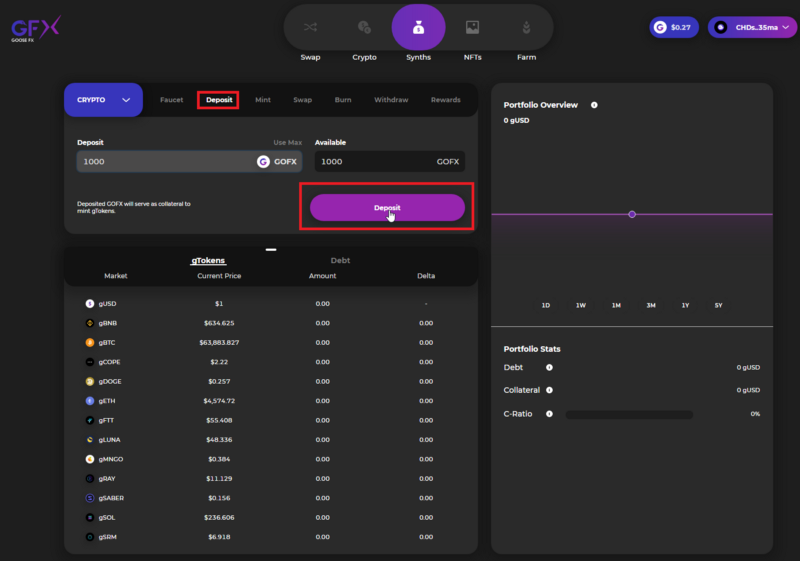

4. Select the deposit tab and enter an amount of GOFX tokens to deposit as collateral in your selected pool.

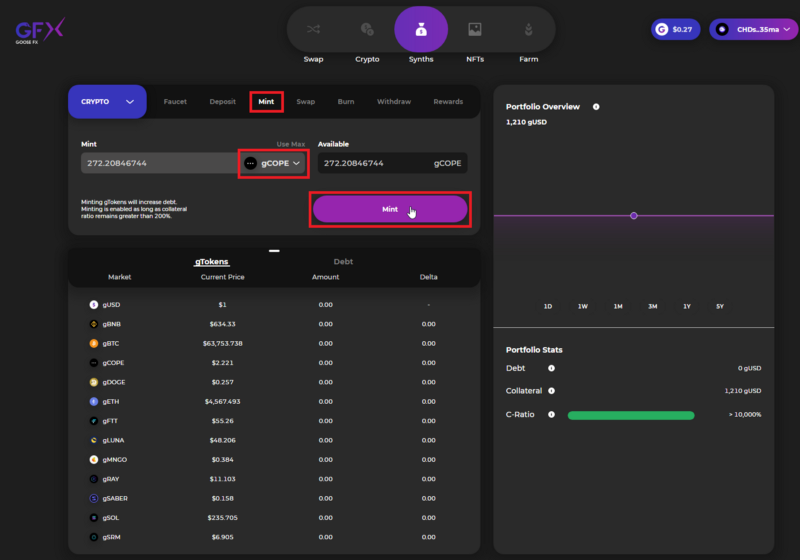

5. You can now Mint your gToken of choice in the Mint tab. Remember you must maintain a 200% C-Ratio on your positions.

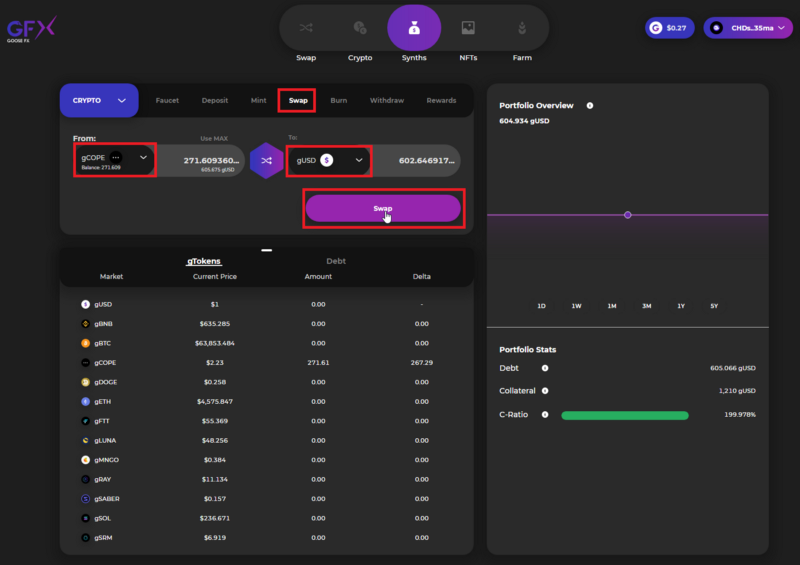

6. Navigate to the Swap tab to Swap pool assets directly, this way you can change positions without leaving and re-entering the pool.

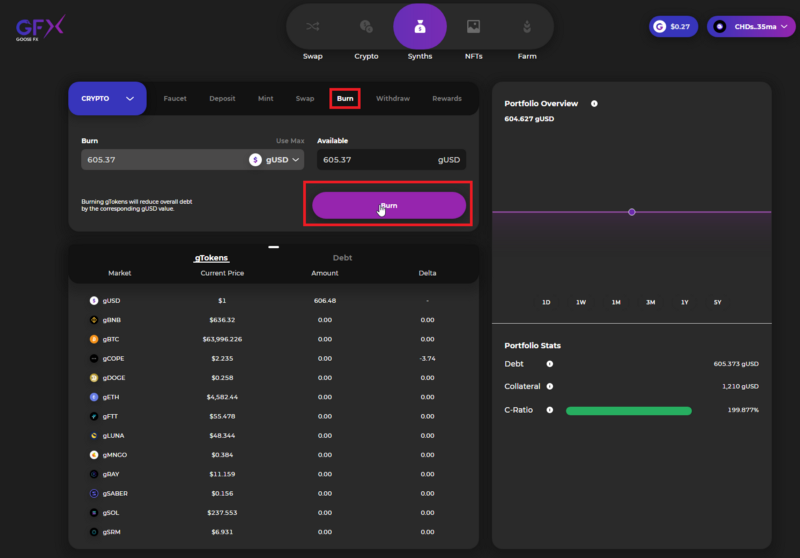

7. To withdraw your collateral from the pool you need to Burn the gTokens, settle any accrued debt, and then withdraw your collateral. If your C-Ratio has fallen below 200%, you can burn some of the gTokens to exit a portion of the position and increase the C-Ratio.

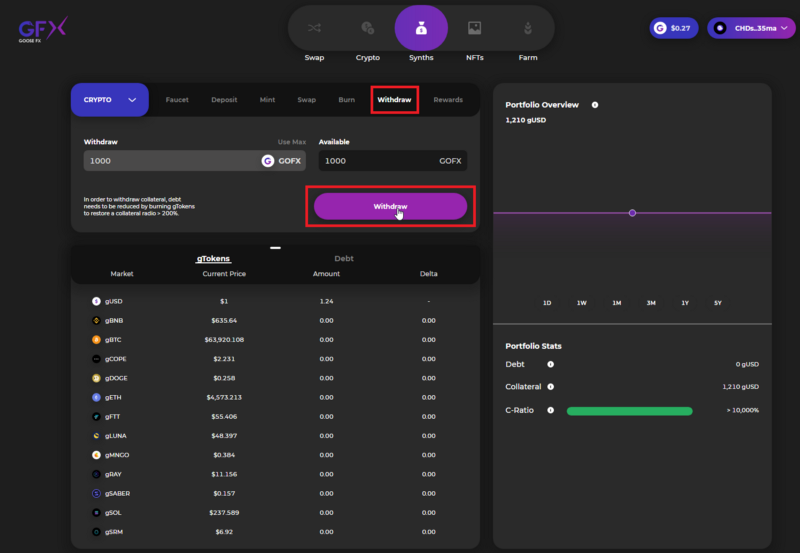

8. In order to withdraw your GOFX tokens, your C-Ratio must be above 200%. (Burn gTokens or deposit collateral to increase the C-Ratio)

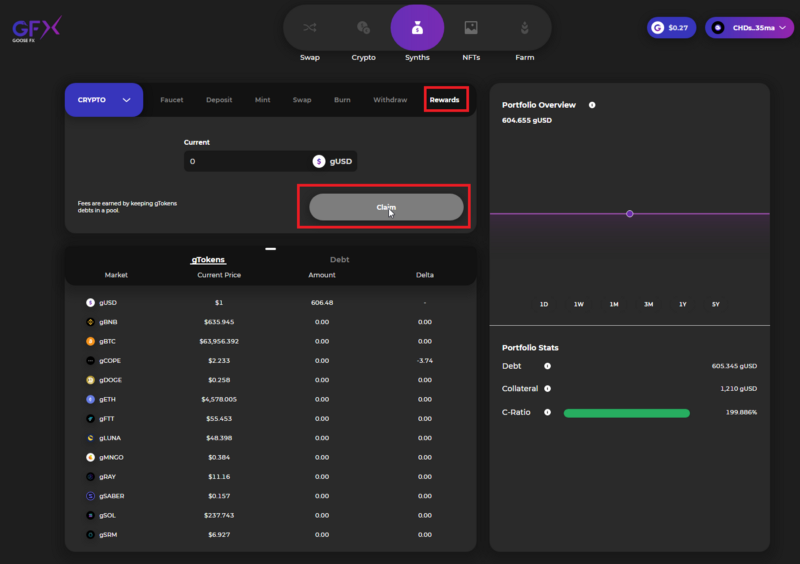

9. Users interacting with the pools will generate gUSD rewards for the pool participants. Collect your gUSD rewards in the rewards tab. Note that in this example there was no user activity between us entering and exiting our pool positions so there were no rewards accumulated.

Understanding Synthetics Trading: An Example

When you stake GOFX and mint gTokens, you take on debt reflecting the amount of gTokens that must be burned to un-stake your GOFX. This debt, which also represents a proportion of all the debt in the pool, is denominated in gUSD and increases and decreases in accordance with the supply of synthetic assets and their exchange rates. For example, if half of GooseFX’s synthetic assets were synthetic Apple (gAAPL) and the price of Apple doubled, the total debt and each staker’s debt would rise by one quarter.

Because the system’s total debt is distributed in this way, the stakers act as a “pooled counterparty” to trades. This means that you do not need counterparties when you trade synthetic assets. This system mitigates counterparty risks and slippage, and ensures that there is sufficient liquidity for trading.

Let’s work through an example with Bob. In this scenario, Bob is participating in a gAAPL/gUSD pool where the only two assets are gAAPL and gUSD.

- Bob is bullish on Apple and decides to mint 1 gAPPL at the current price of $100.

- Alice is bearish on Apple and thus chooses to mint 100 gUSD.

At this point, both Bob and Alice will be affected by the changes in price of gAPPL as well as any changes to the pool state such as minting or burning of assets. The pool debt also consists equally of both gAAPL and gUSD. The price of gAAPL in this scenario increases to $200;

- Bob decides to sell his gAAPL for 200 gUSD in order to exit his position.

When the price of gAAPL doubled it caused the total pool debt to increase by one-half due to gAAPL composing half of the debt in the pool. This also increases the share of debt owed by both Bob and Alice.

- Bob initially owed $100 gUSD debt from minting gAAPL but now he owes 150 gUSD.

- Alice on the other hand would owe 150 gUSD because she was effectively in a short position on gAAPL by minting and holding 100 gUSD in the gAAPL/gUSD pool.

Thus Bob would gain 50 gUSD and Alice who was bearish on gAAPL would lose 50 gUSD.

Golden Goose Community Updates

The GooseFX Synthetic Asset Alpha will be going live in the next few days and we are looking to our community to test it out and help us improve!

Please join the social channels and watch for the announcement in the next few days as we finish up our IDO/IEOs and begin exchange listings.

As always, follow our other social channels so you never miss an announcement.

Website | Twitter | Telegram | Discord | Docs

Disclaimer: The statements, proposals, and details contained above are informational only, and subject to change. We are in early stage development and may need to change dates, details, or the project as a whole based on the protocol, team, legal or regulatory needs, or due to developments of Solana/Serum. Nothing above should be construed as financial or legal advice.

Comments ()