Leveraging NFT and SOL Perps

Unleash the power of NFT and Token perps on Sujiko and GooseFX. Dive into the world of perpetual trading, leverage, and delta-neutral strategies to earn a sustainable yield on Solana's cutting-edge platforms.

Introduction

Another blog, another strategy, eh? Welcome to another blog where we'll cover a process involving NFT Perps on Sujiko with SOL Perps on our DEX to create a delta-neutral plan for you to earn a yield on.

As discussed last time, Delta neutral is a type of strategy where a user aims to eliminate the directional risk of their portfolio by balancing positive and negative deltas, i.e. staying hedged, resulting in a position less sensitive to market or asset movements.

If you haven't already, make sure to check out that blog here

With that out, let's explore another arbitrage opportunity utilizing the unique Sujiko Protocol.

Understanding Sujiko and NFT Perps

Sujiko Protocol is revolutionizing the world of NFT trading by bringing perpetual futures markets to the Solana blockchain. This innovative protocol offers a secure and efficient platform for trading NFT-based perpetual contracts, providing traders new opportunities to engage with the vibrant NFT ecosystem. From native Solana NFTs like MadLads and SMBs to Ethereum-based NFTs like BAYC and Milady, you can go long or short on any of these NFTs and participate in the NFT markets without holding the NFTs themselves.

Like token perps, NFT perps are futures derivatives contracts based on the underlying security (NFTs in this case), which has no fixed expiry date.

Currently, the maximum leverage that can be used on Sujiko is 2x for a few markets like DeGods perps, while for others, it is 1x.

Sujiko Protocol charges fees for trades settled in USDC based on the filled notional size. Market and taker limit orders have a fixed base fee of 1% and a dynamic fee tied to the oracle-mark price divergence. Maker limit orders earn a fixed rebate of 0.1% with a similar dynamic fee structure. The costs generated are distributed to various pools, including insurance, adjustments, funding rate, PNL, and R&D.

You can check out their dynamic fee structure here

Sujiko protocol incorporates multiple measures and guardrails to help mitigate risk. Let's have a look at each one of them and understand how they work:

At its core, the Sujiko protocol hosts a Clearing House that manages all actions and ensures risk mitigation. It tracks deployment stages, maintains perpetual futures markets, and monitors USDC collateral. These built-in guardrails provide a safe and reliable trading environment.

Each perpetual futures market operates independently with its vAMMs, limit order book, and dedicated pools for fees, funding, PNL, and insurance. This isolation safeguards market performance and contributes to a self-sustaining ecosystem.

You can read more about their dual liquidity model mechanism here

Sujiko implements asymmetric funding based on mark and oracle price divergence to maintain stability. It utilizes a smart pricing algorithm to generate on-chain price data for NFT collections, mitigating the impact of wash trading on floor prices.

PnL settlements on Sujiko are handled through isolated pools for each market, preventing cross-market impact. Sujiko also features a sophisticated liquidation engine that promptly addresses positions breaching margin requirements, avoiding bad debt. An auto-deleveraging mechanism closes ranks for users with high leverage and PNL when a market is unstable.

Now that we've understood the working of Sujiko and the basics of what NFT perps are let's dive into how you can utilize this along with our Perps Dex to stay Delta neutral.

How does the strategy work?

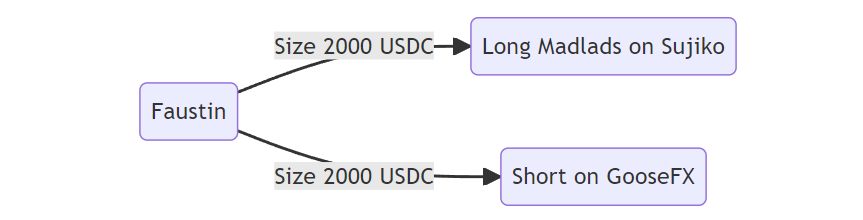

Imagine Faustin Edora (Definitely, not a real person 👀). While Faustin is bullish on MadLads, he doesn't want to buy a MadLads NFT, for the asset will decrease in value if the price of SOL goes down. Hence, being the caring man he is, he is trying to minimize his risk in case MadLad's value goes down due to the SOL price going down.

So, what does he do?

He goes to Sujiko and longs MadLads-Perp there with a notional size of 2000 USDC.

Since the Max Leverage allowed on Sujiko for MadLads-Perp is 1x, the collateral Faustin has to deposit is 2000 USDC for this trade.

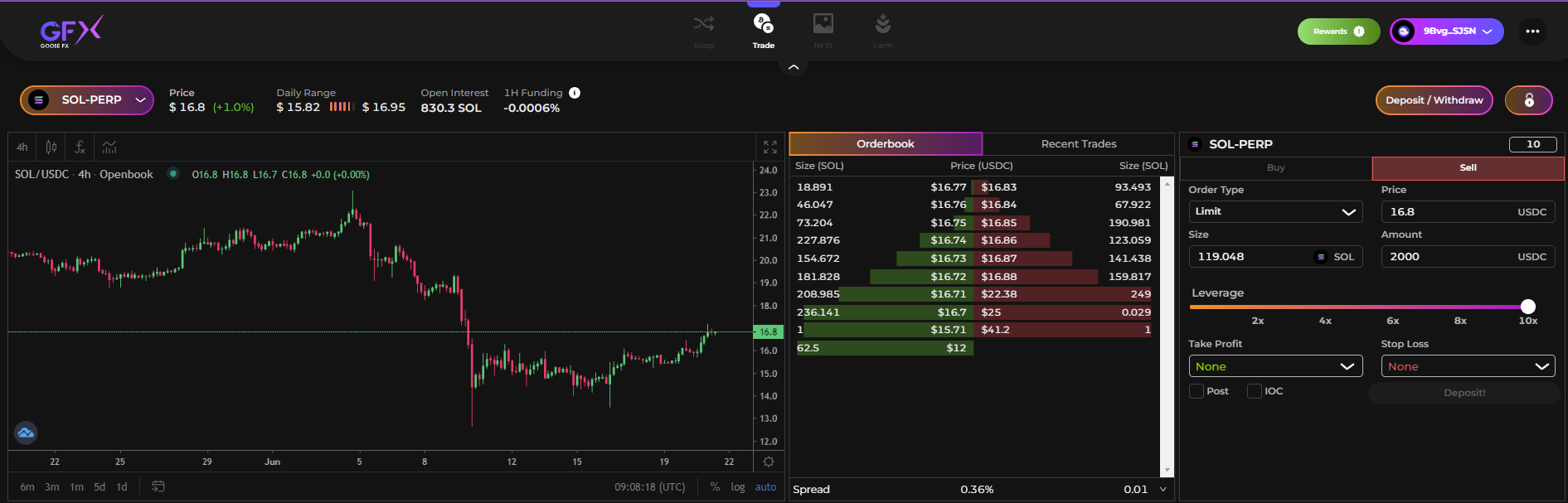

To fully hedge his long exposure and minimize risk, he will have to short SOL, i.e., bet on the probability that the SOL price goes down. To do that, he goes to GooseFX and shorts SOL.

If the price of SOL goes down, he makes a profit on his SOL short but loses on his MadLads long and vice versa if the SOL price goes up. Do note that, for a neutral delta hedge, the short SOL's notional size should equal the abstract size of his Long position, i.e., 2000 USDC.

Since GooseFX allows 10x leverage, the minimum collateral you can deposit is only 200 USDC for a 2000 USDC position. It helps Faustin (and you) preserve his capital.

Now, Faustin has created a delta-neutral hedge implying that the notional sizes of both his positions are same, but the question now arises; how would he earn a yield on it?

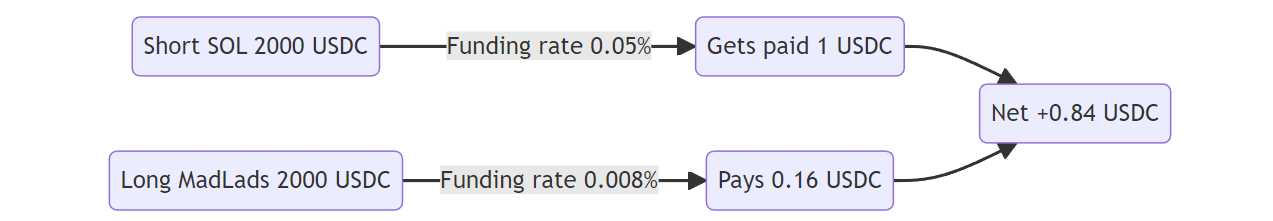

Faustin earns a yield on this position via Funding Rates. At the time of writing Hourly Funding Rate on SOL-Perp on GooseFX is at 0.050%, i.e. every hour, longs pay shorts, 0.05% of their position and hence in Faustin's case, it would be 0.05% * 2000 USDC = 1 USDC every hour. Thus, every day, he would earn 1 USDC*24 = 24 USDC.

Do note that MadLads-Perps on Sujiko also have a funding rate. At the time of writing, the MadLads-Perp has a funding rate of 0.00%. If the MadLads-Perp had positive hourly funding of 0.008%, Faustin's net profit would have dropped to (0.050-0.008)% * 2000 = 0.84 USDC every hour.

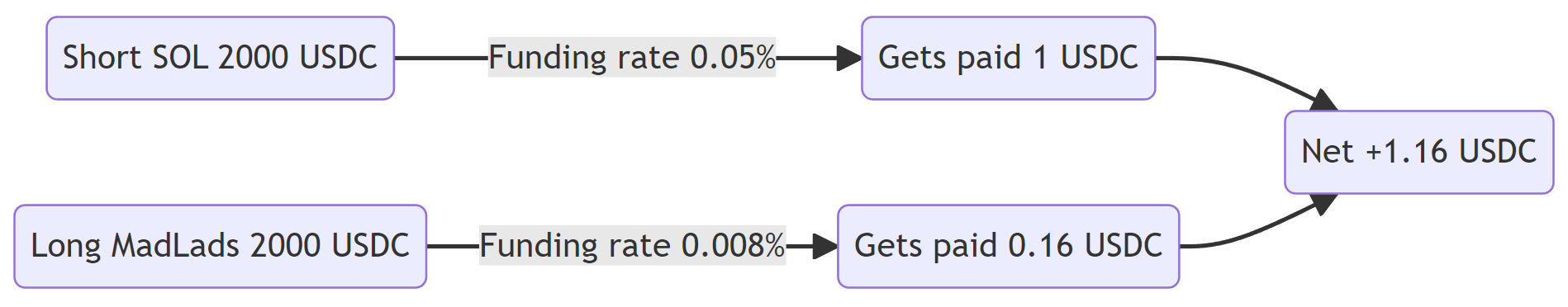

However, if MadLads-Perp had a negative funding of 0.008%, Faustin's net profit would have increased to (0.050+0.008)% * 2000 = 1.16 USDC.

Hence, Faustin (and you) should be aware of Funding Rates on both Dexes to evaluate the yield on this strategy carefully.

If it is so easy to earn a yield on this, then why isn't everyone doing it?

Well, Funding Rates can change over time as it is nothing but the difference between the Perpetual price and the Spot price of that asset. If SOL-Perps had negative funding, you would pay to short, decreasing your profit and/or even netting you a loss.

To learn more about Funding Rates and how they are calculated, check out our blog here.

Frequently Asked Questions (FAQs)

How does perpetual trading work?

Perpetual trading is a type of derivative trading where traders can speculate on the price movements of an asset without owning the asset itself. It involves trading perpetual contracts, which are contracts with no expiration date. Traders can open long or short positions, predict whether the price will rise or fall, and profit from the price difference. Perpetual trading allows traders to trade with leverage and offers the flexibility to enter and exit positions anytime.

What is the difference between futures and perpetual?

Futures contracts have a predetermined expiration date, while perpetual agreements do not expire. Perpetuals are designed to track the underlying asset's price closely and have a funding mechanism to keep the contract price in line with the spot price. Unlike futures, perpetual does not require the hassle of rolling over contracts, making them popular for continuous trading and hedging positions.

What is leverage?

Leverage is a trading tool that allows traders to amplify their market exposure and potential returns by borrowing funds to increase their trading position size. It enables traders to control a bigger position with less capital. However, it's important to note that leverage also magnifies potential losses, and traders should use it cautiously and implement proper risk management strategies.

What do you mean by going Long or Short on an asset?

Going long on an asset means buying the asset with the expectation that its price will increase, aiming to profit from the price appreciation. Traders going long want to benefit from the asset's value increasing over time. On the other hand, going short on an asset involves selling the asset without owning it, anticipating its price will decline. Traders go short and aim to profit from the asset's value decreasing. Short selling allows traders to profit in bearish markets by selling high and buying back at a lower price.

Stay Tuned with #GooseAcademy

Website | Twitter | Telegram | Discord | Docs

Disclaimer: The statements, proposals, and details above are informational only, and subject to change. We are in early-stage development and may need to change dates, details, or the project as a whole based on the protocol, team, legal or regulatory needs, or due to developments of Solana/Serum. Nothing above should be construed as financial, legal, or investment advice.

Comments ()