Learn about Meteora | Dynamic Pools, Vaults & AMMs

Explore Meteora, the composable yield layer on Solana, and learn how to create your own dynamic pool with just a few simple steps. Discover their dynamic vaults, AMM pools, and multi-token stable pools, offering various yield opportunities in DeFi!

Table of contents

- Introduction

- Mercurial to Meteora

- Dynamic Vaults

- Dynamic AMM Vaults

- Multi Token Stable pools

- Create your own dynamic pool on meteora

- Ending Thoughts

Introduction

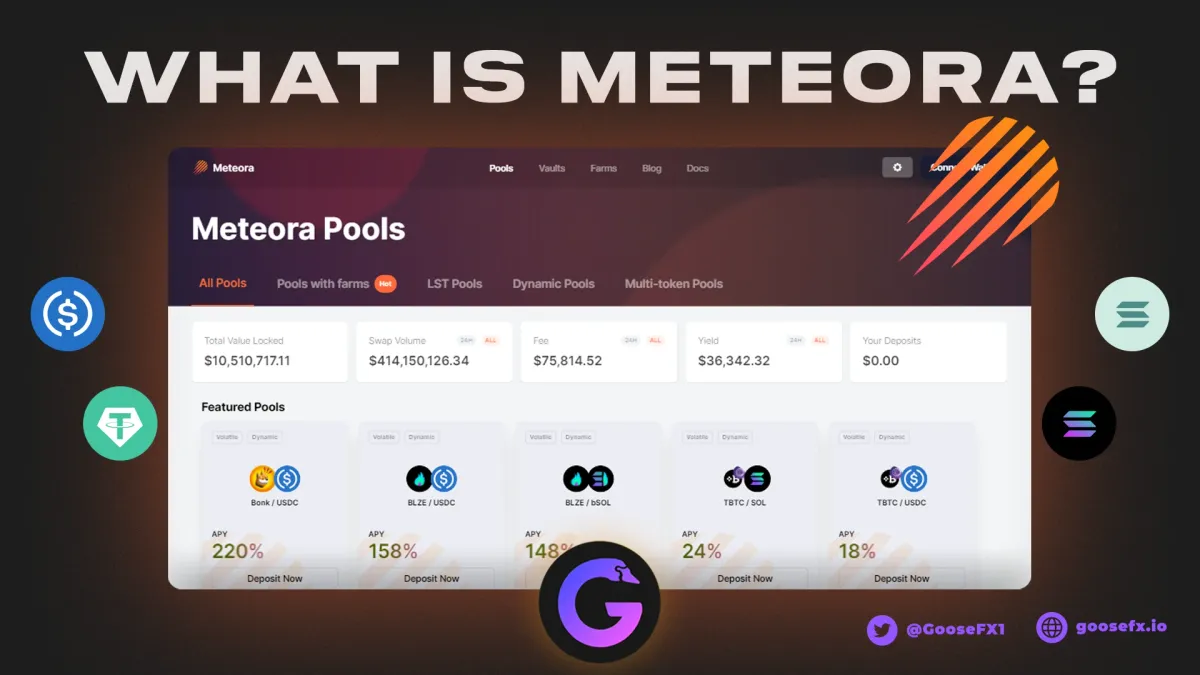

Recently, we tweeted about opening a new GOFX-USDC pool on Meteora and in this blog, Intern’s going to be taking you through what Meteora is all about, how you can create your own pool in just a few steps and much more!

We just made a new $GOFX / $USDC pool on @MeteoraAG

— GooseFX (@GooseFX1) October 10, 2023

Deposit now ➡️ https://t.co/9un8U6Z7QX

Wanna create your own pool? Intern got you.

Stay tuned!👀 pic.twitter.com/WQ1p5UlU1o

So, sit back, relax and enjoy this Series starter on Meteora!

Mercurial to Meteora - The Backstory

For those that don't know, Meteora is your friendly, secure and composable yield layer on Solana. It hosts a variety of yield farming opportunities including Meteora Pools, their dynamic vaults, LP farms to name a few.

Meteora emerged from Mercurial, a leading Solana DEX known for its stablecoin liquidity contributions. Following the challenges post FTX’s collapse, the team initiated the Meteora Plan, resetting tokenomics and technology for renewed user interest and market confidence.

The reasoning behind Meteora’s plan stemmed in their confidence in their past experience having built robust and battle-tested products in dynamic vaults/AMM. The backing of supportive investors has also been a crucial factor, enabling the project to pivot and evolve. Notably, the forthcoming Meteora token will be distinct from MER, featuring governance and value accrual mechanisms.

When re-launching, Meteora launched 3 platforms namely Dynamic Vaults, Dynamic AMMs and Multi-token Stable pools.

Before delving into each of their offerings, let’s take a step back to understand a bit about AMMs.

We’ve written quite a few blogs touching on this topic however to give a brief overview, AMMs short for Automated Market Makers are models that help match buyers to sellers on a dex (Decentralized Exchange). They are smart contracts allowing users to swap tokens on decentralized exchanges without any intermediary.

For an in-depth discussion, check out our full blog on AMMs

Coming back to Meteora, in the next section, we’ll be taking a look at their current offerings

Meteora's Arsenal

Dynamic Vaults

In the Meteora Dynamic Vaults system, users and protocols enjoy flexible asset deposits and withdrawals. These vaults engage in minute-by-minute rebalancing across multiple lending platforms to optimize yields guided by yield across different protocols and risk management while emphasizing user accessibility and much more!

Their dynamic vaults comprises of 2 major components:

- Vaults: Each infra layer vault holds single-token assets, e.g., USDC or SOL. The majority of assets are allocated to diverse lending protocols to generate yield. Common tokens used in each connecting protocol, AMM, or wallet are stored in a single vault. Users and protocols can easily deposit liquidity into each vault.

- Keeper - Hermes: An off-chain keeper, known as Hermes, is introduced to manage complex logic and operations, such as monitoring lending protocols and calculating optimal liquidity allocation across lending platforms.

Read more about Meteora's dynamic vaults

Dynamic AMM Vaults

The Dynamic AMM Pools operate atop the capital allocation layer, where assets are directly deposited into vaults within the yield layer. These assets are dynamically assigned to external lending protocols to generate yield and rewards, reducing dependence on liquidity mining for liquidity attraction.

This approach mitigates issues associated with over reliance on liquidity mining, like token inflation and short-term liquidity challenges when rewards expire.

The rewards generated by these pools are via multiple sources such as lending interest, AMM swap fees and any other incentives offered.

Check out their Docs for more information about their Dynamic AMM Vaults

Multi Token Stable pools

What started from Mercurial's inception as the pioneer of Solana's multi-token stable vault has still stayed the same when transitioning to Meteora. The multi-token stable pools enabled efficient liquidity pooling across multiple assets within a single pool.

Mercurial also pioneered DeFi's first non-pegged stable pools, utilizing innovative mechanisms leveraging on-chain oracles to maintain capital efficiency between two tokens in a pool, even as one token's value appreciates over time.

In the past year, these pools have become leading providers of stable liquidity in Solana, supporting crucial pairs such as allBridge, Wormhole, stSOL, native Solana, and USDC tokens.

aaand with that, we've covered Meteora's offerings! For more information, visit their website. In the next section, we'll be taking a look as to how YOU can make your own DYNAMIC POOL on Meteora!

Sounds cool right? Scroll down for the alpha!

Tutorial - How to create your dynamic pool on Meteora

As mentioned above, we recently created our own dynamic pool consisting of GOFX and USDC on Meteora and in this section, we’ll be taking you through how you can create your own pool comprising of two assets!

Step 1

Visit Meteora. Upon visiting the website, you’ll find a Create Pool button which will allow you to create your own dynamic pool.

Step 2

When you click the Create Pool button, you’ll be greeted with the below interface. Simply select the two tokens of which you’d like to create a pool of, select the fees that the pool will earn per trade out of the options mentioned and finally click on Create and Deposit and voila!

You’re all set!

It is this easy to create your own dynamic pool on Meteora!

So, what are you waiting for? Go to Meteora and create your Dynamic Pool today!

Ending Thoughts

With that, we come to the end of this brief blog folks! Intern hopes you learned something new today about Meteora and how their different offerings provide different yield opportunities for everyone in DeFi! We at GooseFX stand with Meteora in making DeFi easy and accessible to all crypto users and so if you haven't checked out our v2 SSL Pools, what are you even doing anon?

We're just tweaking a few things before we open up Public Deposits again. Trust us, you wouldn't want to miss out on this!

Sign up to our Beta Access, anon!

Until next time,

Intern.

Stay Tuned with #GooseAcademy

Website | Twitter | Telegram | Discord | Docs

Disclaimer: The statements, proposals, and details above are informational only, and subject to change. We are in early-stage development and may need to change dates, details, or the project as a whole based on the protocol, team, legal or regulatory needs, or due to developments of Solana/Serum. Nothing above should be construed as financial, legal, or investment advice.

![Top 6 Chart Patterns for Crypto Trading [Guide]](/content/images/size/w720/2024/07/Top-trading-patterns.png)

Comments ()