World of DeFi: Single Sided Liquidity [SSL] Pools

![World of DeFi: Single Sided Liquidity [SSL] Pools](/content/images/size/w1200/2022/12/World-of-DeFi-Series-SSL-Pools.png)

Table of Contents

- Introduction: Single Sided Liquidity [SSL] Pools

- Problems with traditional liquidity provision

- GooseFX SSL v1

- Benefits of GooseFX Single Sided Liquidity Pool

- Conclusion

Introduction

Welcome to the fourth blog in our series on the World of DeFi! In the past blogs, we covered the basics of yield farming and its relation to automated market makers (AMMs) and liquidity pools. However, in this blog, we will dive deeper into a specific type of AMM known as single-sided liquidity (SSL) pools and how they provide a unique and sustainable way to earn yield on your assets, and the current problems with traditional AMMs and how GooseFX SSL v1 addresses these issues with its innovative design. We will also discuss the benefits of SSL pools for users, enhanced liquidity concentration, reduced slippage, and protection against impermanent loss.

What is Single Sided Liquidity Pool?

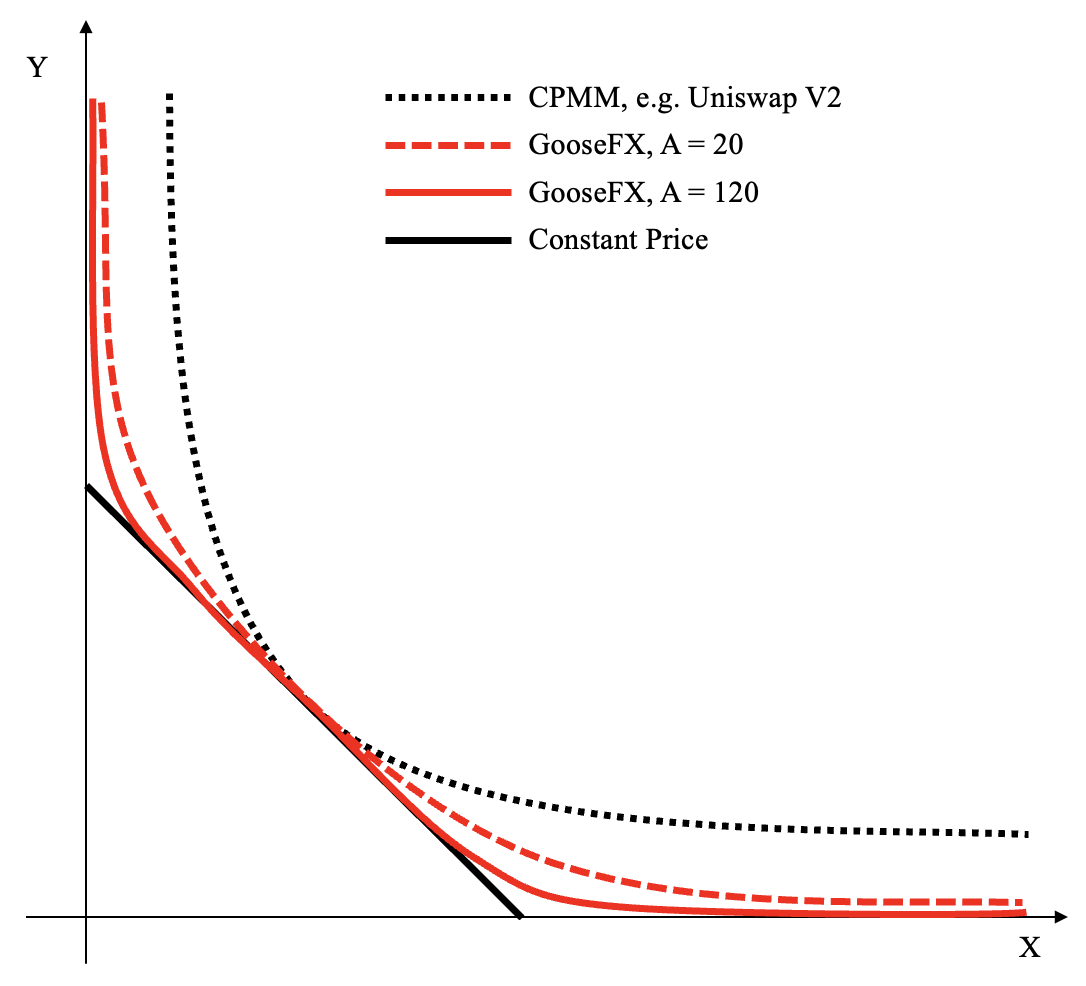

A single-sided liquidity (SSL) pool is an automated market maker (AMM) type that allows users to provide liquidity using a single asset in the pool pair. It is designed to address some issues with traditional liquidity provision methods, such as the need for a specific ratio of two or more tokens and the exposure of liquidity providers (LPs) to impermanent loss. SSL pools also aim to enhance liquidity concentration and reduce slippage by adjusting pool weights and constructing a curve that concentrates liquidity around the current oracle price. Additionally, SSL pools do not allow traders to trade more favourably than the current oracle price, further protecting LPs.

Problems with traditional liquidity provision

In the world of decentralized finance (DeFi), liquidity pools have become a popular way for investors to earn a yield on their assets. However, traditional liquidity provision methods, such as automated market makers (AMMs) like Uniswap, have several fundamental problems that have led to the development of alternative methods, such as single-sided liquidity (SSL) pools.

Most AMMs require a specific ratio of two or more tokens, which can be difficult for users to provide if they do not have the exact amounts needed. This can lead to a less user-friendly experience for liquidity providers.

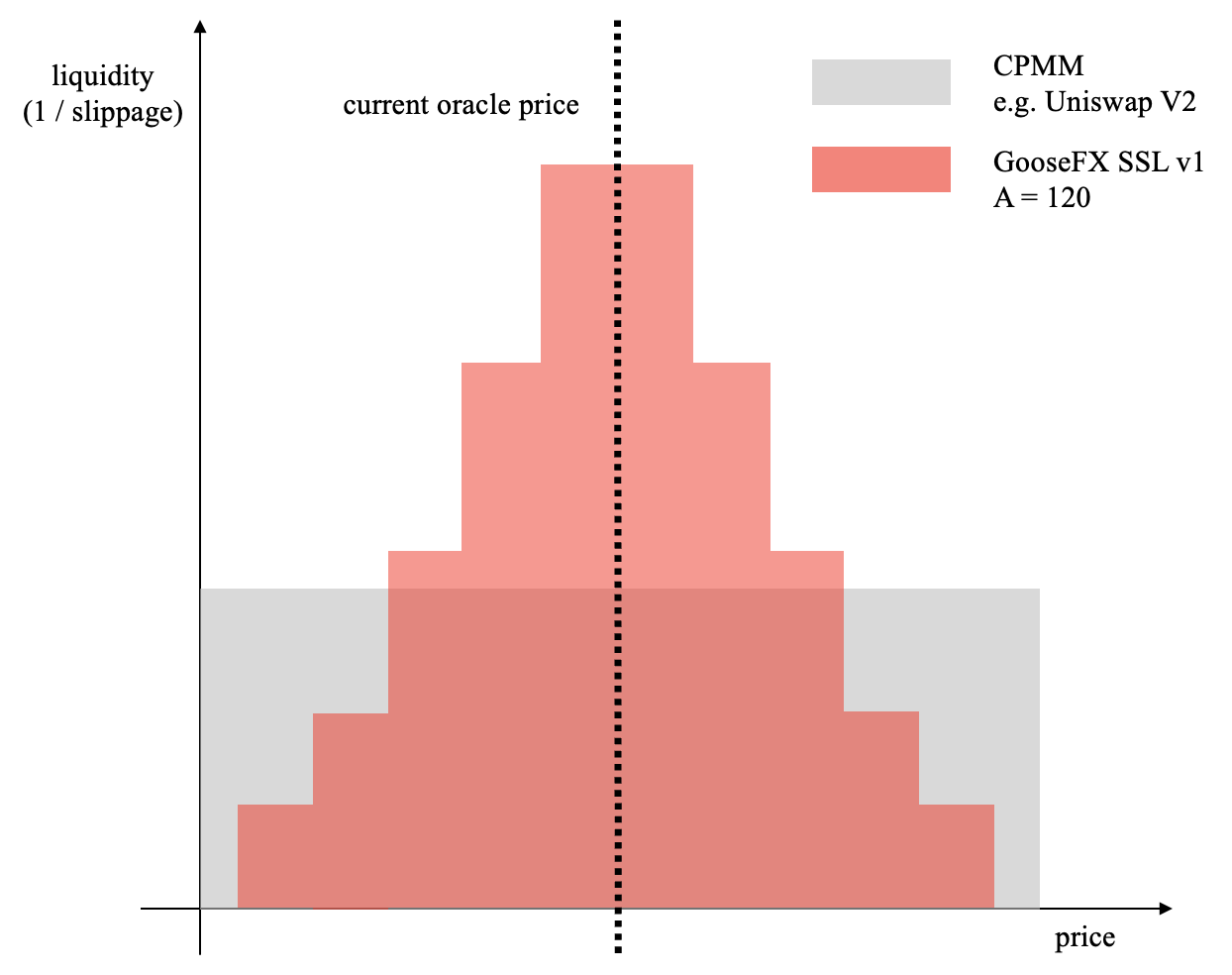

Additionally, traditional liquidity provision often leads to inefficiently scattered liquidity, resulting in high slippage for traders. AMMs like Uniswap distribute liquidity evenly across the entire price space, which can lead to wasted liquidity for prices that are not touched and constant slippage across the price range.

GooseFX SSL v1

GooseFX SSL v1 is a new AMM design that integrates single-sided liquidity pools with an innovative swap mechanism. In this design, each token corresponds to a single-sided liquidity pool. When a liquidity provider deposits a token into a pool (e.g., SOL), they receive a g-token (e.g., gSOL) in return. When a trader wants to demand liquidity, they must interact with two pools simultaneously and pay a transaction fee equal to their trading volume times a constant fee rate (currently at 0.40% but subject to change through governance). This fee goes to the pool where the trader withdraws tokens.

GooseFX SSL v1 addresses the issues with traditional liquidity provision in several ways:

- It enables simple single-sided liquidity provision, making it more user-friendly.

- It enhances liquidity concentration and reduces slippage by dynamically adjusting pool weights based on liquidity contribution and constructing a curve that concentrates most liquidity around the current oracle price.

- It protects LPs against impermanent loss by not allowing traders to trade more favourably than the current oracle price.

Benefits of GooseFX Single Sided Liquidity Pool

GooseFX SSL is a game-changing solution for DeFi users who want to earn a yield on their assets while minimizing risk. With traditional liquidity provision methods, users often face challenges such as complex liquidity ratios, high slippage, and exposure to impermanent loss. GooseFX SSL addresses these issues by offering a single-sided liquidity provision approach that allows users to contribute liquidity with a single asset.

One of the critical benefits of GooseFX SSL is its user-friendliness. With traditional AMMs, users often need help to meet exact liquidity ratios and may end up depositing more than they intended. With GooseFX SSL, users can deposit their desired amount of a single asset and receive LP tokens in return. This simplicity is especially appealing to users new to DeFi, who may need to become more familiar with complex liquidity ratios.

In addition to its ease of use, GooseFX SSL enhances liquidity concentration and reduces slippage. By dynamically adjusting pool weights and constructing a curve that concentrates liquidity around the current oracle price, GooseFX SSL ensures that traders can make trades with minimal slippage. This is particularly important for users who want to trade efficiently and minimize transaction costs.

Finally, GooseFX SSL protects LPs against impermanent loss. By limiting losses to liquidity providers, especially when the market price can be accurately inferred, GooseFX SSL ensures that LPs can earn a yield on their assets without worrying about the risks associated with impermanent loss. This is a significant advantage for users who want to earn a yield on their assets in a sustainable and low-risk manner.

Overall, the benefits of GooseFX SSL are numerous, making it an appealing choice for users who want to earn a yield on their assets while minimizing risk. With its user-friendly approach, enhanced liquidity concentration, reduced slippage, and protection against impermanent loss, GooseFX SSL is a leading solution for DeFi users.

Conclusion

In conclusion, GooseFX SSL offers a revolutionary solution for liquidity provision in the DeFi space. Its single-sided liquidity pools allow users to easily contribute liquidity with only one asset, while its innovative swap mechanism enhances liquidity concentration and reduces slippage. Additionally, GooseFX SSL protects liquidity providers against impermanent loss, making it a sustainable and low-risk way to earn a yield on your assets. If you want to get involved in DeFi and earn passive income, check out GooseFX SSL and see how it can benefit you. With its top-notch design and user-friendly interface, GooseFX SSL is a game-changer in the world of DeFi. Take advantage of this fantastic opportunity to join the SSL revolution and earn with GooseFX today!

Stay Tuned with #GooseAcademy

Website | Twitter | Telegram | Discord | Docs

Disclaimer: The statements, proposals, and details above are informational only, and subject to change. We are in early-stage development and may need to change dates, details, or the project as a whole based on the protocol, team, legal or regulatory needs, or due to developments of Solana/Serum. Nothing above should be construed as financial, legal, or investment advice.

Comments ()